The ongoing money laundering investigation into Turkish fintech company Papara, in which its founder, Ahmet Faruk Karsli, and 10 others were arrested, has sparked regulatory concern in Pakistan, where the firm’s local subsidiary, SadaPay, is now facing increased oversight pressure.

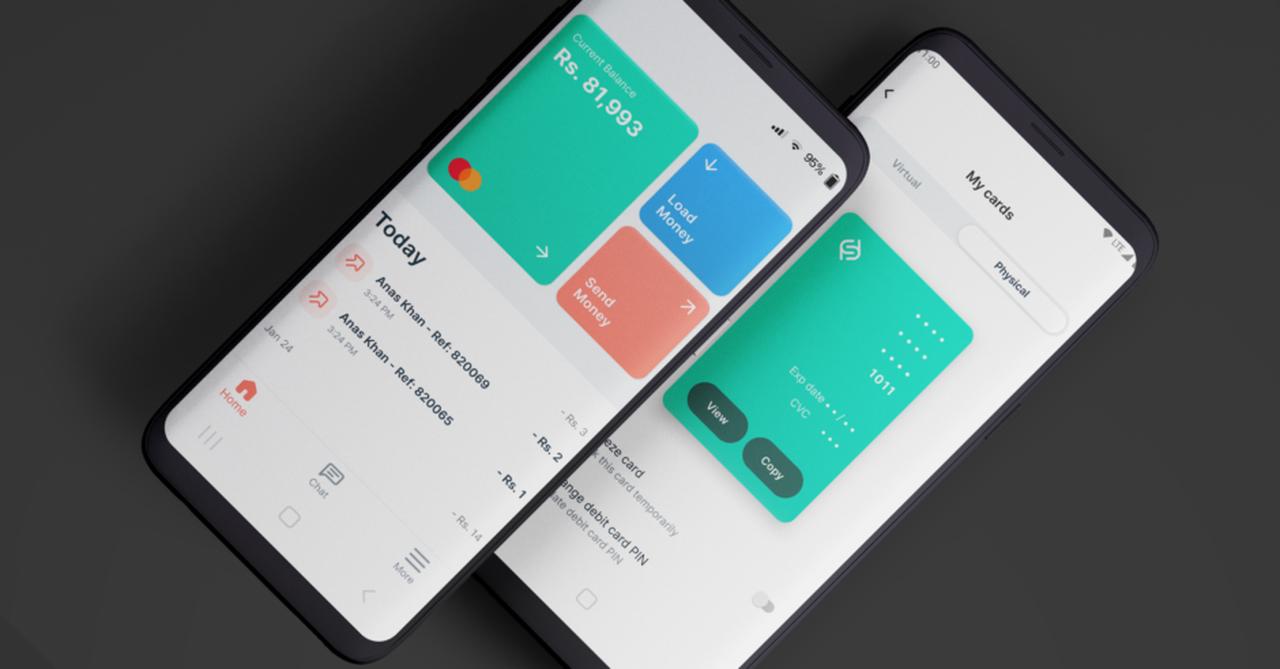

Papara, which acquired SadaPay in May 2024, is accused of facilitating illegal betting, money laundering, and other financial crimes in Türkiye.

The company, reportedly valued at over $2 billion and serving more than 21 million users, is currently the focus of a sweeping probe by Turkish authorities.

According to Pakistani news outlet tribune.com.pk, fintech analyst Muhammad Yasir urged the State Bank of Pakistan (SBP) to take proactive steps in reviewing oversight of foreign-backed digital payment platforms.

“This case highlights the need for enhanced regulatory oversight and continuous due diligence,” Yasir said.

“While the allegations pertain to activities in Türkiye, the reputational impact on SadaPay is inevitable. SBP must re-evaluate its existing electronic money institutions (EMIs) regulations and adopt a proactive approach to managing cross-border financial risks.”

He added that the increasing complexity of cyber-financial crime requires constant adaptation of Pakistan’s regulatory framework to ensure the stability of its financial system.

The investigation in Türkiye escalated on Tuesday when Papara’s founder and CEO, Ahmed Faruk Karsli, was detained along with 14 others during coordinated police raids in Istanbul.

The Istanbul Chief Public Prosecutor’s Office confirmed that 15 suspects have been taken into custody and that all related assets have been frozen.

Turkish authorities allege that Papara’s platform was used to process unauthorized financial activities, including high-volume illegal betting transactions.

Based on evidence from the Central Bank of the Republic of Türkiye (CBRT), the Financial Crimes Investigation Board (MASAK), and other regulatory bodies, officials claim that 102 user accounts operated through Papara were involved in routing funds via 274 bank accounts to 16 cryptocurrency wallets.

The total value of the illicit transactions is estimated at over ₺12.9 billion — roughly $330 million.

Turkish officials also seized assets, including multiple luxury properties, vehicles, yachts, crypto wallets, and eight businesses registered under Papara’s parent company, PPR Holding Inc.

While SadaPay continues to operate under its license from the State Bank of Pakistan, the company has not yet issued any statement regarding its parent company’s legal troubles.