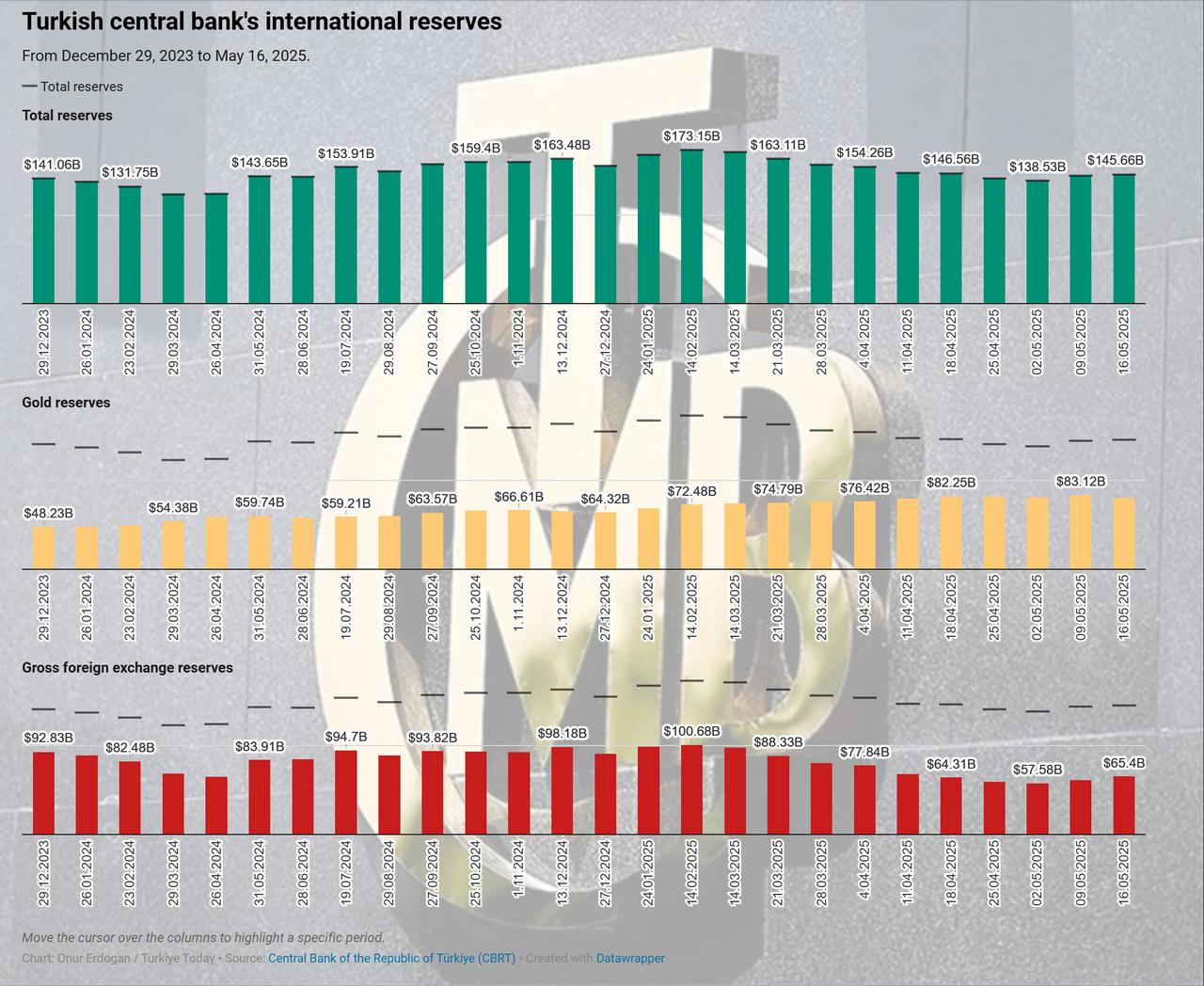

Türkiye’s central bank reported Thursday a continued rise in its international reserves for the third consecutive week, with total international reserves reaching $145.7 billion.

According to the “International Reserves and Foreign Currency Liquidity Developments” report published by the Central Bank of the Republic of Türkiye (CBRT), this marked a 0.9% increase from the previous week, driven primarily by a notable rebound in foreign currency assets.

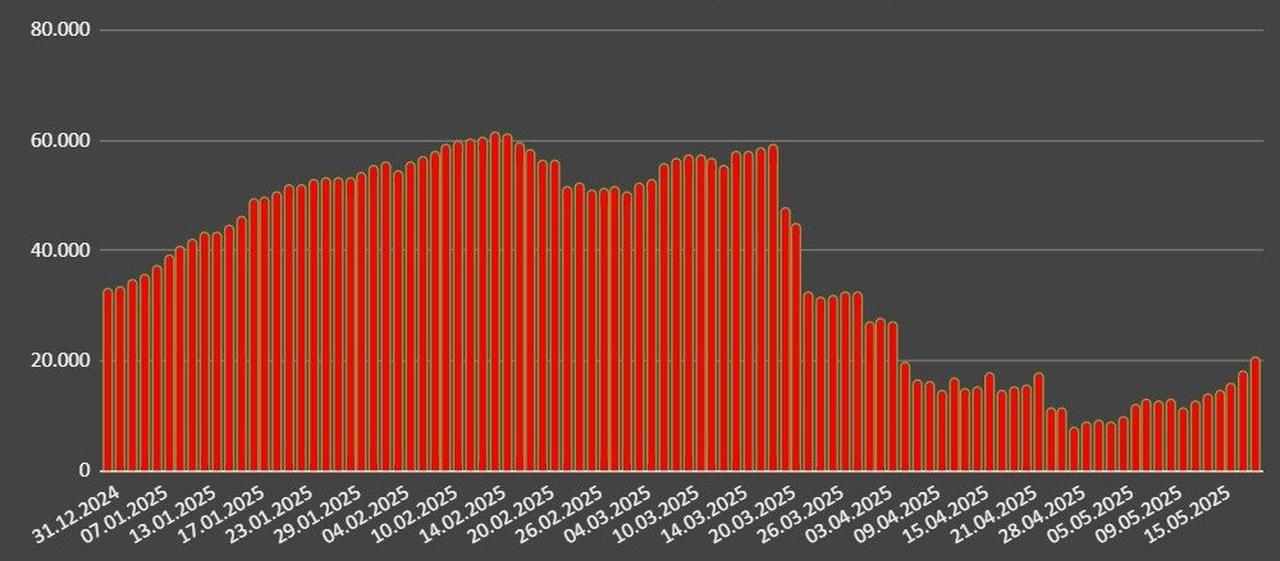

The central bank’s net international reserves rose by $2.4 billion over the same period, reaching their highest level since early April.

The increase is seen as a positive signal for Türkiye’s external financing capacity, reflecting a strengthened foreign exchange liquidity position.

The net reserve figure—often considered a critical indicator of a country’s short-term financial resilience—has been closely monitored in global financial circles amid Türkiye’s broader macroeconomic rebalancing.

Data in the report shows that foreign currency assets surged by 7.8% on the week, reaching $57.8 billion.

The CBRT’s role as a net buyer in recent foreign exchange market operations is cited as a primary driver behind this rise.

Analysts suggest that this strategic positioning has contributed significantly to the broader recovery in total reserves.

In contrast, gold reserves saw a modest contraction, declining by 3.4% to $80.3 billion.

While this fall partially offset the gains from foreign currency accumulation, the strength in FX holdings still allowed the overall reserves to post a net increase.