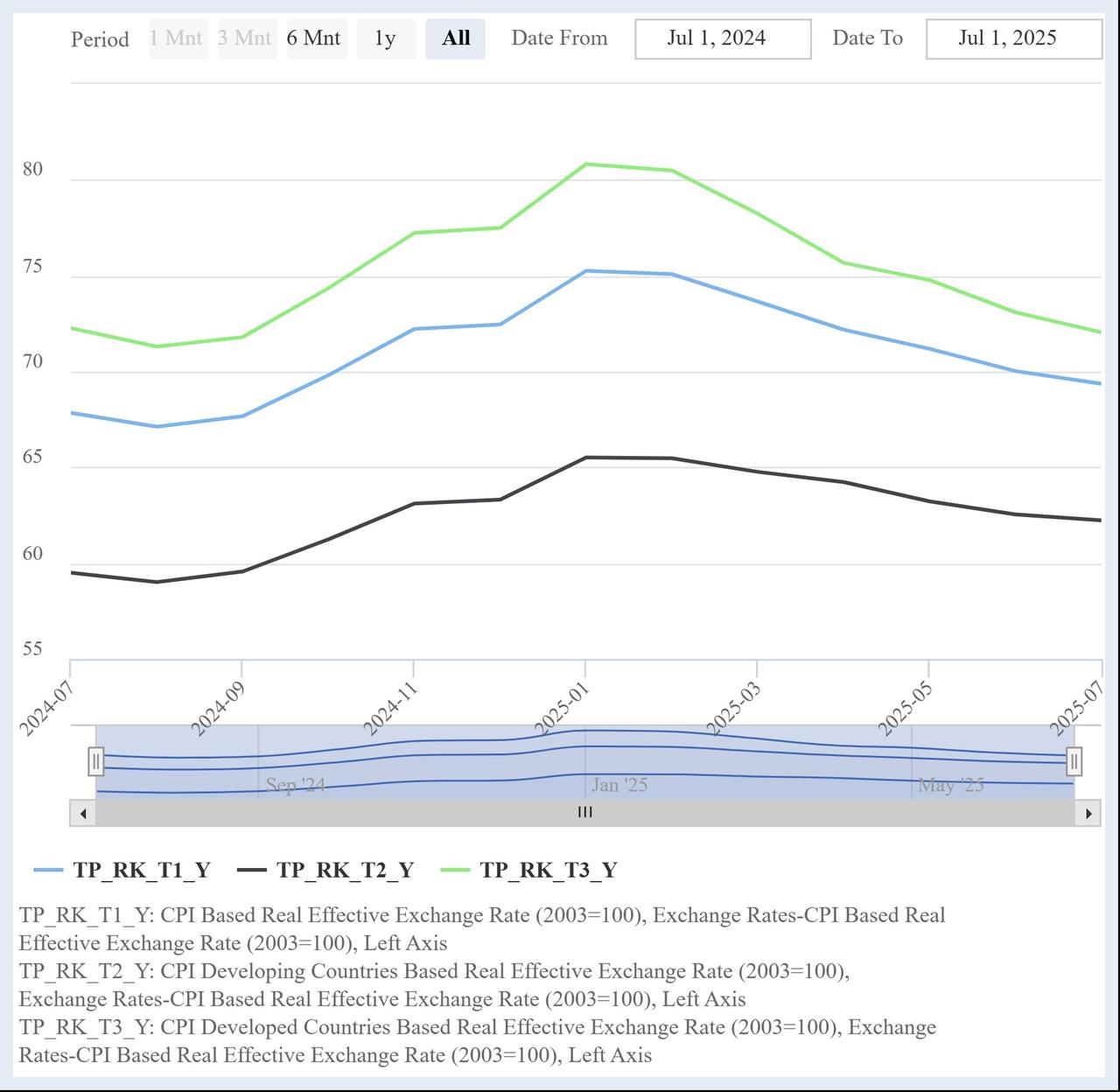

The Turkish lira’s international purchasing power, measured by its real effective exchange rate (REER), fell to a 10-month low in July 2025, the Central Bank of the Republic of Türkiye (CBRT) reported on Tuesday.

The central bank’s index measuring the lira’s inflation-adjusted value against a basket of foreign currencies dropped to 69.36 in July, down from 70.02 in June, representing the sixth consecutive month of decline.

The decline comes despite rising inflation within Türkiye, suggesting that the weakening of the currency on global markets has outpaced domestic price increases.

A similar index that adjusts for changes in domestic producer prices showed an even sharper fall. The lira’s value on this basis declined by 1.36 points to 91.92 in July from 93.28 in June. This was the lowest reading recorded since March 2024, extending a downward trend that began in February.

The central bank stated that the latest drop was driven by stronger movements in exchange rates relative to domestic inflation. In July, the U.S. dollar gained an average of 1.95% and the euro 3.65% against the lira compared to the previous month.

During the same period, Türkiye’s consumer price index (CPI) rose by 2.06% and the domestic producer price index (PPI) increased by 1.73%. While higher domestic prices typically support the index, they were not sufficient to offset the effects of the weaker exchange rate. The global inflation basket and exchange rate fluctuations contributed to the downward shift.

The inflation-adjusted exchange rate index reflects how much the Turkish lira can buy abroad compared to previous periods, factoring in both domestic and international inflation.

A declining index means that the lira has lost real value globally, even if nominal exchange rates remain stable. This trend can make imports more expensive and erode consumers' overseas purchasing power, though it may also improve export competitiveness.

The continued decline underscores the pressure on the lira amid broader macroeconomic challenges and currency volatility.