Türkiye has maintained its position as Europe’s top housing market in terms of annual home sales and ranks second among member countries of the Organisation for Economic Co-operation and Development (OECD), following the United States, with 1.48 million units sold.

The figures show that Türkiye outpaced all 44 European countries, while only the U.S. recorded a higher number of home transactions at 4.06 million. The United Kingdom ranked next in Europe with 1.24 million, followed by France, Italy, Spain, the Netherlands, and Portugal, where sales ranged between 150,000 and 750,000 units.

In 2025, house sales in Türkiye rose by 19.2% to 1.12 million units in the January–September period and reached an annualized total of 1.43 million, despite exponentially increasing prices nationwide.

According to the Turkish central bank’s Residential Property Price Index (RPPI), house prices in Türkiye rose 32.2% year over year as of September; however, they showed signs of cooling as inflation-adjusted prices declined by 0.8%.

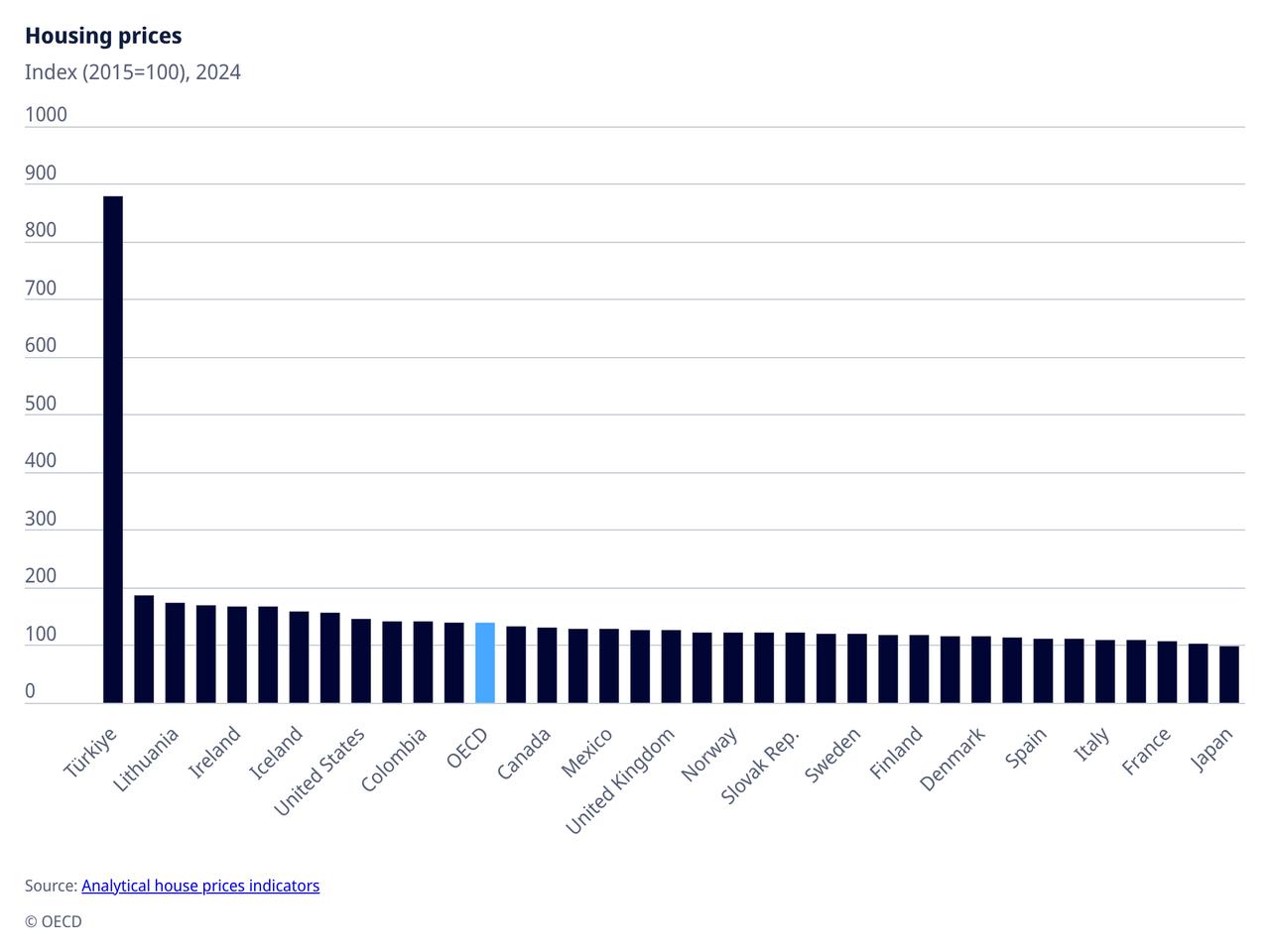

OECD’s Housing Price Index also indicates that Türkiye has experienced the fastest nominal housing price growth among member states since 2015, with prices rising 1,621.5% as of 2024 amid persistent double-digit inflation. Hungary ranked second with a 209.9% increase.

Rent prices in Türkiye also climbed sharply—up 779.8% over the same period—surpassing all other OECD countries.

In real terms, Türkiye ranks third in housing price growth, with a 75% increase since 2015, following Portugal at 80% and Hungary at 79.6%.

Commenting on the data, the Turkish Real Estate Investors Association (GYODER) Chair Nesecan Cekici said the strength of the housing market shows that real estate continues to serve as a core investment tool in Türkiye. Cekici added that strong sales volumes underscore both the sector’s dynamism and the need for balanced, long-term strategies.

"The housing sector’s size reveals why long-term policies are crucial to ensure sustainability and accessibility," she noted, emphasizing that "quality, urban transformation, and energy efficiency now matter as much as sales figures."

The Turkish Housing Developers and Investors Association (KONUTDER) Chair Ziya Yilmaz also pointed to the growing share of second-hand home sales, emphasizing the need to boost new housing supply. "Both public and private production capacities have proven their strength, but for sustainable growth, production conditions must become more accessible," he said.

Second-hand sales grew by 21.6% during the January-September period compared to the previous year to 786.086, constituting a 68.7% share of all house sales. On the other hand, the number of newly constructed housing units in Türkiye stood at 638,180 on an annualized basis as of June, according to occupancy permit data.

He added that lower interest rates and easier access to credit could stimulate demand and support both first-hand and mortgage-based transactions, as the share of mortgage sales contracted to 14.1% in September.

"High land costs and financing challenges remain the main obstacles. If the public sector supplies land under favorable terms, housing accessibility could rise by around 40%," he added.