Türkiye’s ongoing economic headwinds have led to a dramatic rise in distressed firms, with a significant portion of companies now operating as so-called “zombie companies,” according to a new report from the independent think tank, the Social Studies Institute.

At the same time, the country’s bankruptcy and enforcement courts are becoming increasingly overwhelmed, as the number of active cases has surged to record levels in recent years.

The study highlights how inflation, weakening credit conditions, and falling corporate profitability are placing mounting pressure on businesses, while the legal and financial systems struggle to keep up.

The report, authored by Dr. Yavuz Selim Gunay, highlights that a considerable share of companies in Türkiye are currently unable to sustain operations through regular earnings and instead rely on external support such as public subsidies, artificially low interest loans, or debt rollovers to survive.

These firms, known as zombie companies, have not officially declared bankruptcy but continue to operate at a bare minimum level.

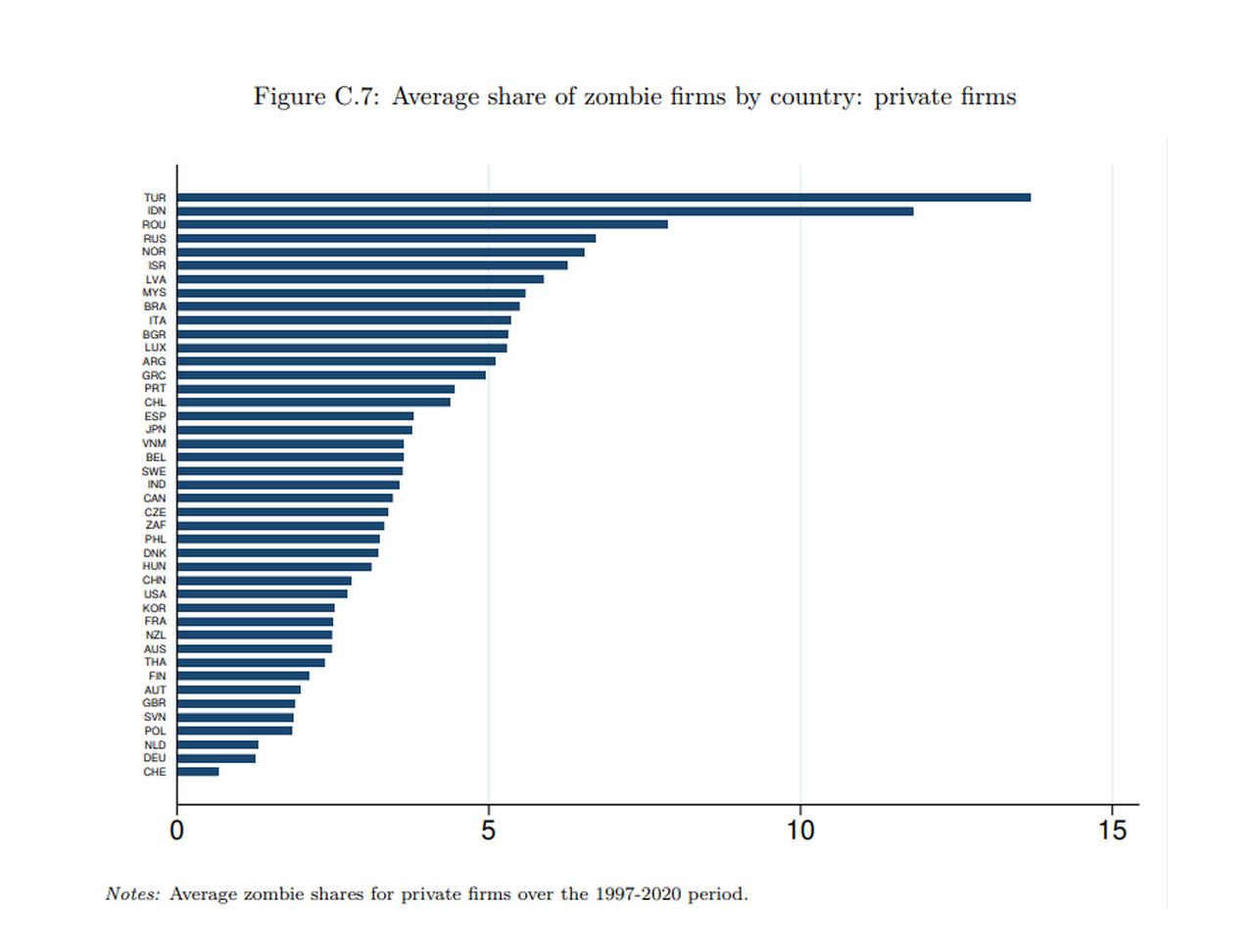

The prevalence of these firms is especially high among non-listed companies in Türkiye. According to the International Monetary Fund’s (IMF) 2023 report, The Rise of the Walking Dead: Zombie Firms Around the World, Türkiye leads globally in the share of zombie firms among private, non-publicly traded businesses, with a 13% share, higher than any other country surveyed.

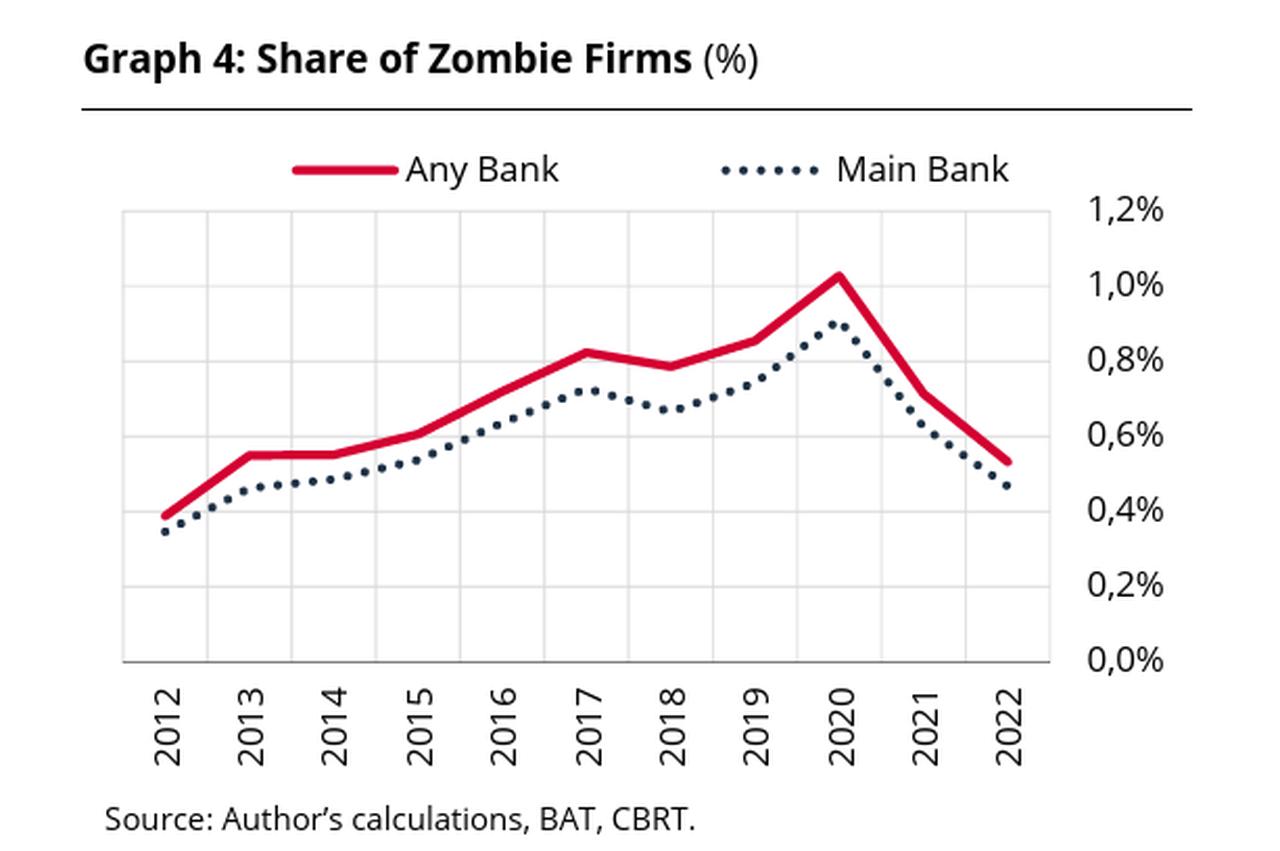

Research by the Central Bank of the Republic of Türkiye (CBRT), released in July 2024, shows that the share of zombie companies—those unable to service debt from operating profits—peaked at over 1% in 2020 before declining to around 0.6% by 2022.

On average, the zombie firm rate stood at roughly 0.7% over the full period, based on firm-level loan data and calculations using banking relationships with either the main creditor or any lending bank.

This narrower definition focuses specifically on credit-dependent firms, offering insight into financial system risks by identifying companies that are unable to meet their borrowing obligations through operational earnings.

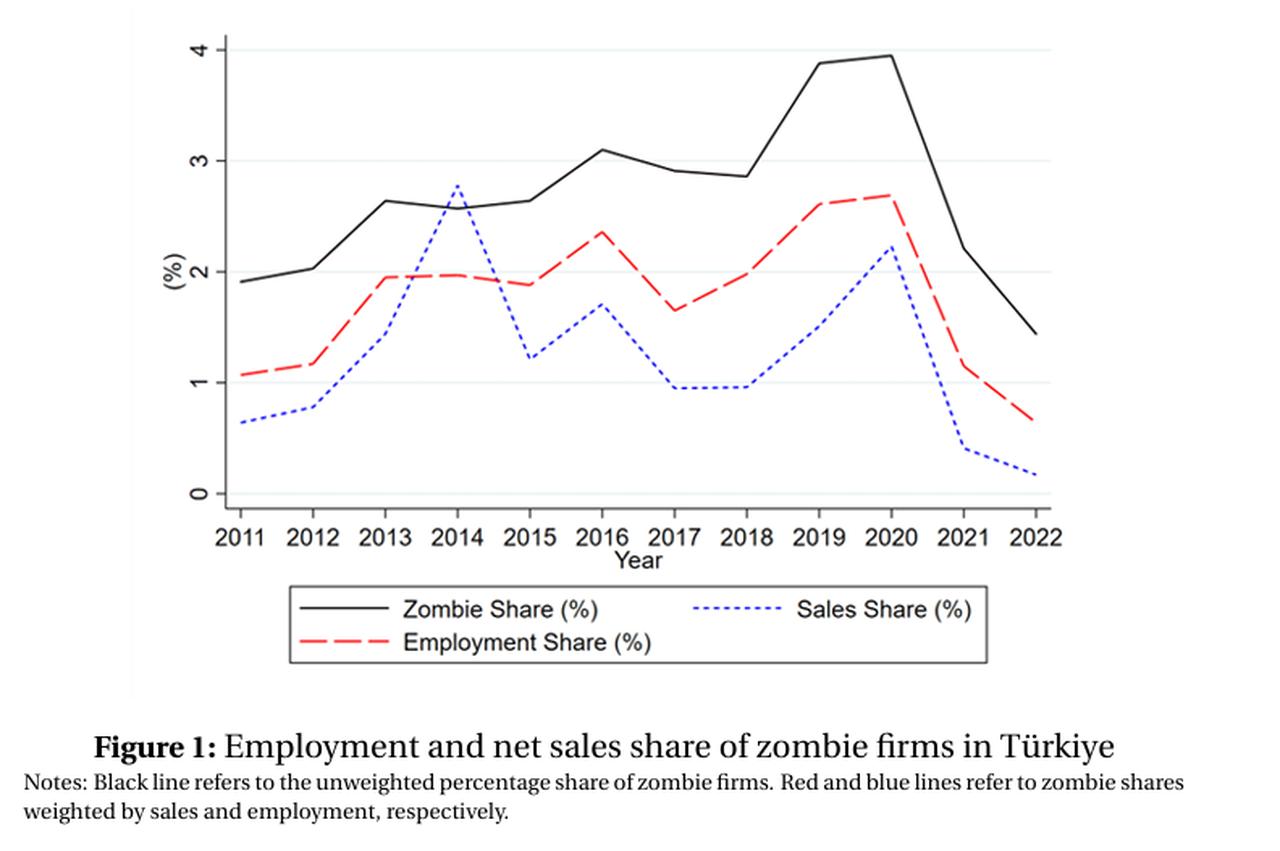

The broader findings released by the Central Bank of the Republic of Türkiye in December 2024 indicate higher figures, as the unweighted share of zombie companies—defined as firms unable to cover their interest expenses with operating income and including all firms regardless of size or borrowing activity—ranged between 2% and 3% from 2011 to 2022.

The Social Studies Institute’s report also sheds light on the challenges faced by Türkiye’s Small and Medium-Sized Enterprises (SMEs).

While SME loan volume has surged by about 120% between January 2023 and May 2025, the rise pales in comparison to cumulative inflation during the same period, which reached 240%.

As a result, although more SMEs may appear to be borrowing, the real value of the credit they receive has significantly diminished.

In practical terms, the report notes, average prices in Türkiye rose 3.4 times over that 2.5-year period, but SME lending only increased by 2.2 times—indicating a clear deterioration in actual purchasing power and investment capability for small businesses.

To keep companies pushed into technical bankruptcy by high interest rates and a strong exchange rate afloat, a provisional article was added to the implementation communique of the Turkish Commercial Code, published in the Official Gazette on Sept. 15, 2018.

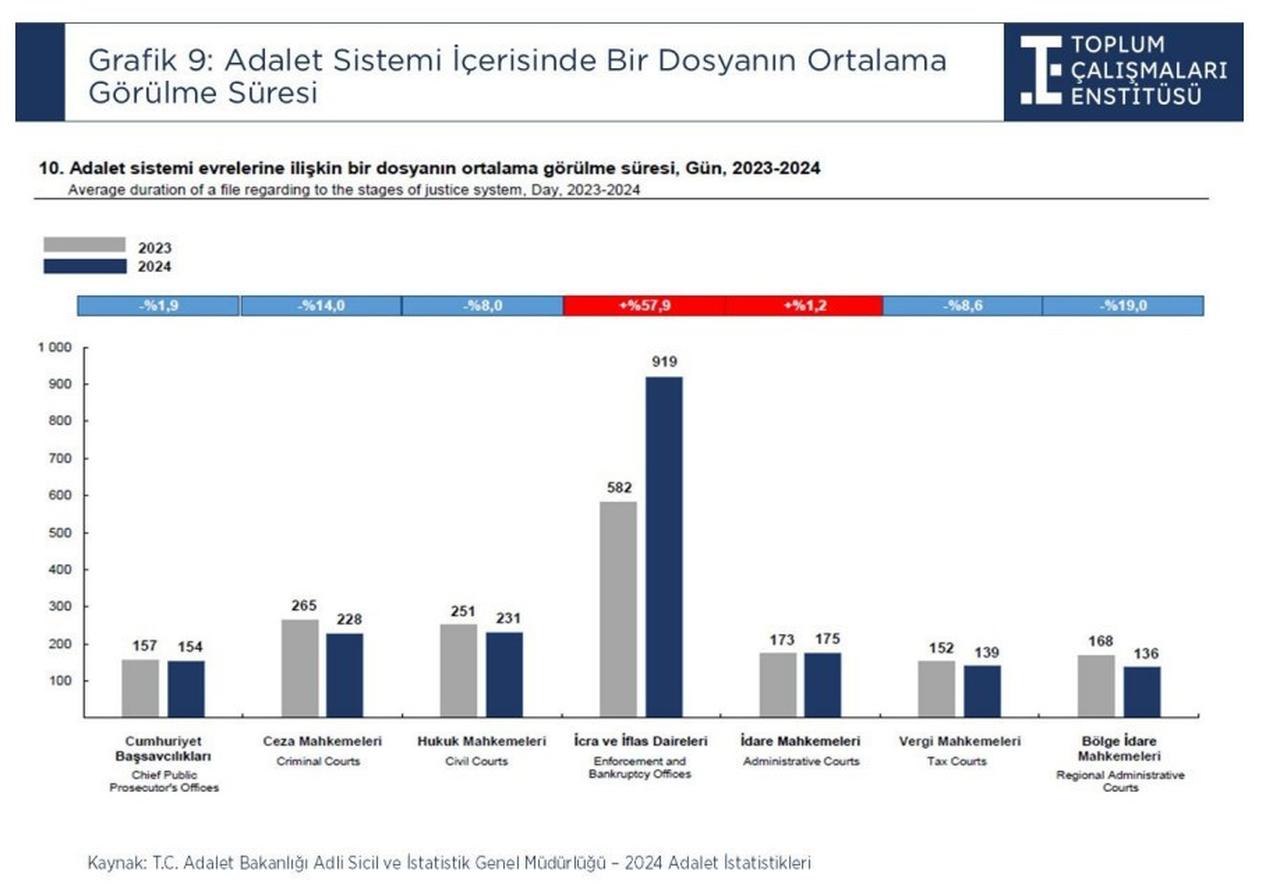

Data on enforcement and bankruptcy proceedings further underscores the strain on Türkiye’s economic infrastructure. The total number of cases filed with enforcement and bankruptcy offices reached a record 38.3 million in 2023, up from 26.2 million in 2015.

Although filings slightly declined to 32.7 million in 2024, the volume remains historically high. Compounding the issue is the growing backlog in the court system.

The average duration of enforcement cases ballooned from 582 days in 2023 to 918 days in 2024—a 57% increase in processing time, suggesting that the legal apparatus is struggling to cope with rising demand and complexity.

The report also draws attention to a surge in economic crimes, particularly offenses against property.

Based on data from Türkiye’s Ministry of Justice, the number of individuals investigated for property-related crimes climbed from roughly 5.8 million in 2022 to over 6 million in 2024.

During the same period, the number of related legal files rose from 4.7 million to 4.9 million, while the number of offenses recorded jumped from 8 million to nearly 9 million.

Taken together, the figures suggest that in 2024, approximately one in every 14 people in Türkiye was linked to an economic offense—highlighting a growing sense of desperation within segments of the population.

The report concludes that the rising number of zombie firms, coupled with weakened access to real credit and a spike in financial litigation, poses a serious threat to Türkiye’s overall financial stability.

In particular, it warns that current fiscal and monetary policy frameworks may be exacerbating structural weaknesses in the real economy, especially for small and medium-sized enterprises.