Türkiye’s fight against inflation is beginning to yield tangible results, according to Alvaro Pereira, Chief Economist of the Organization for Economic Cooperation and Development (OECD).

In a wide-ranging assessment following the release of the OECD’s latest Economic Outlook report on Tuesday, Pereira underlined that the policy shift in Türkiye—particularly the tightening of monetary and fiscal frameworks, is starting to deliver the intended macroeconomic correction. However, he emphasized that the continuation of this coordinated approach is vital to anchor expectations and secure long-term stability.

“We believe the tightening in monetary and fiscal policy is bearing fruit,” Pereira said, drawing attention to the declining inflation path projected for the country. Still, he cautioned against complacency, stressing that inflation, especially in services, tends to be more resistant to correction and could prolong the disinflation process.

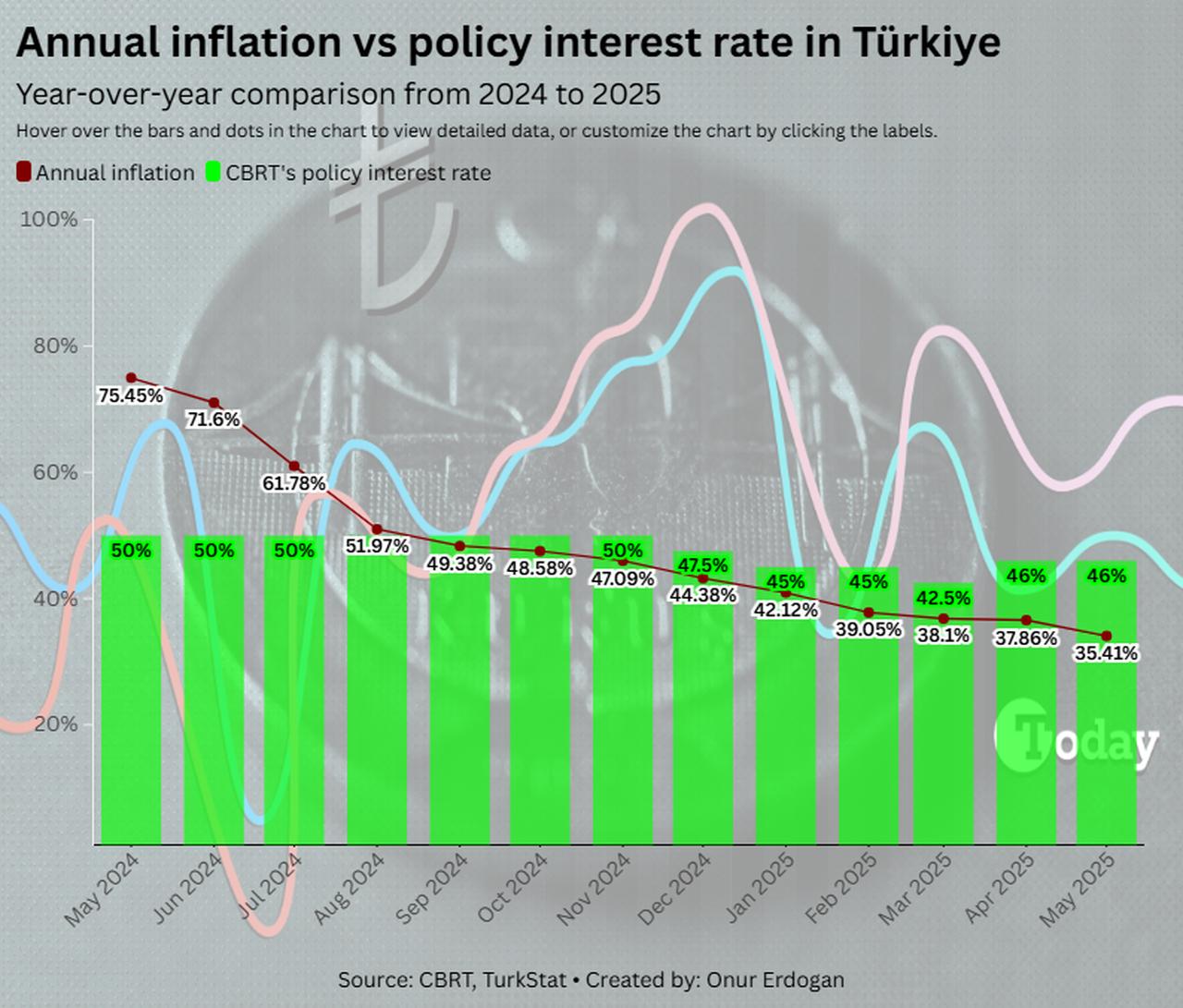

Türkiye has been pursuing a tight monetary policy to curb soaring inflation since 2021, with the central bank maintaining policy interest rates above 40% for nearly a year and a half. In its most recent monetary policy meeting in April, the bank unexpectedly raised the rate by 350 basis points to 46%.

As of May, Türkiye's inflation sharply dropped back to November 2021 levels at 35.41%, according to the official figures released on Tuesday.

Pereira explained that inflation in Türkiye continues to exert pressure on real incomes and overall consumption, making its reduction a top policy priority. He also acknowledged that while goods prices often respond relatively quickly to tighter financial conditions, the service sector displays greater rigidity.

“It’s not surprising to see some stickiness in inflation,” he said, suggesting that even with strong policy action, the full benefits may take time to materialize.

Beyond inflation management, Pereira strongly linked macroeconomic stability with Türkiye’s ability to attract long-term foreign direct investment (FDI). He pointed out that all countries that have succeeded in drawing sustained foreign capital flows have done so on the back of consistent policy discipline, credible institutions, and transparent economic governance. “This means reducing inflation, maintaining fiscal control, and fostering a more predictable environment for doing business,” he said.

Türkiye received $3 billion in FDI in the first quarter of 2025, up 89% from a year earlier, with capital investments rising 40% to $1.8 billion, according to central bank data.

While acknowledging the reform steps already taken in Türkiye, Pereira argued that more can—and should—be done to improve the investment climate. He encouraged the authorities to continue enhancing competitiveness in areas where Türkiye could perform more strongly in European markets, adding that these reforms would not only strengthen the country’s growth fundamentals but also help narrow its structural income gap with other OECD members.

The OECD’s recommendations include broadening the income tax base, making consumption taxes more efficient, increasing the effectiveness of social assistance, and promoting higher participation in the labor force. According to Pereira, reforms in these areas will improve fiscal sustainability and reduce economic vulnerabilities over the medium to long term.

In assessing external dynamics, Pereira also touched on Türkiye’s commercial relations with the United States. While he downplayed the direct impact of U.S. tariffs on the Turkish economy, he suggested that reducing bilateral trade barriers could be beneficial.

Türkiye is among the least-affected countries by the tariffs introduced by U.S. President Donald Trump in April, as the measures targeted countries with significant trade imbalances.

Since Türkiye does not have a particularly unbalanced trade relationship with the United States, it was subject only to the baseline tariff rate of 10%.

Pereira also identified specific sectors with potential for increased exports to the U.S., alongside the opportunity to attract more American tourists.

“Türkiye already attracts many visitors due to its culture and natural beauty, but there is further potential,” Pereira said. He noted that with a stable macroeconomic environment and a possible trade understanding with the U.S., the country could see both increased investment and tourism flows.

In 2024, Türkiye's tourism revenue surpassed $60 billion, accounting for approximately 4% of its gross domestic product (GDP).

OECD now projects global GDP growth at 2.9% for both 2025 and 2026, a downgrade from earlier estimates of 3.1% and 3%, respectively. The weaker outlook reflects heightened trade barriers, tighter financial conditions, and growing uncertainty around economic policy in major economies.

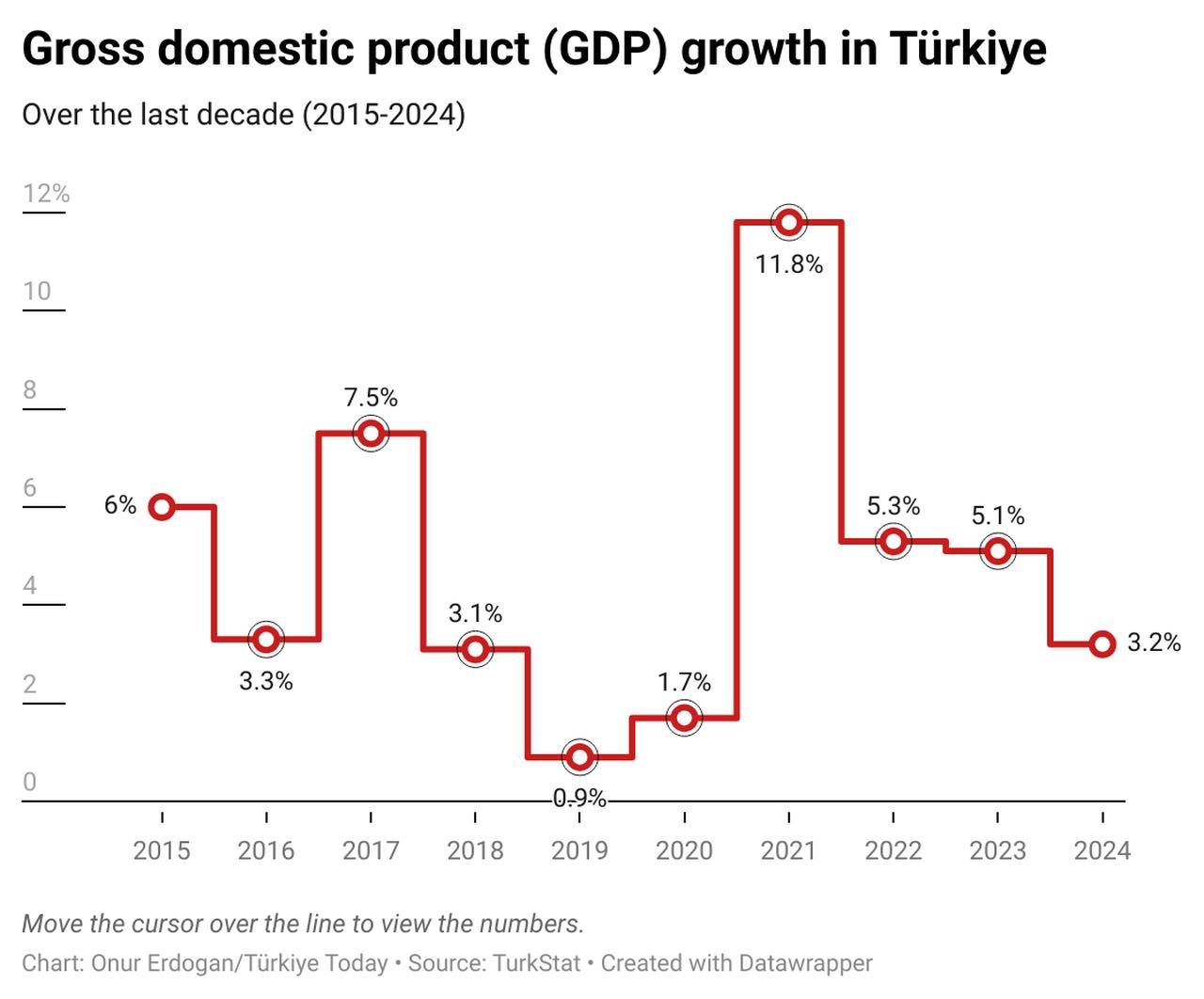

Türkiye’s own growth trajectory has been revised slightly downward. The OECD now expects the Turkish economy to expand by 2.9% in 2025 and 3.1% in 2026, down from previous forecasts of 3.1% and 3.9%. The moderation in growth is seen as a result of necessary policy adjustments, as well as the global slowdown.

The Turkish economy grew by 3.2% in 2024, slowing from 5.1% in the previous year.

Inflation in Türkiye is forecast to average 31.4% in 2025 and fall further to 18.5% in 2026. The general government budget deficit is projected to decline from 4.9% of GDP in 2024 to 3.3% in 2025 and 3% in 2026, aided by improved revenue performance and scaled-back capital spending.