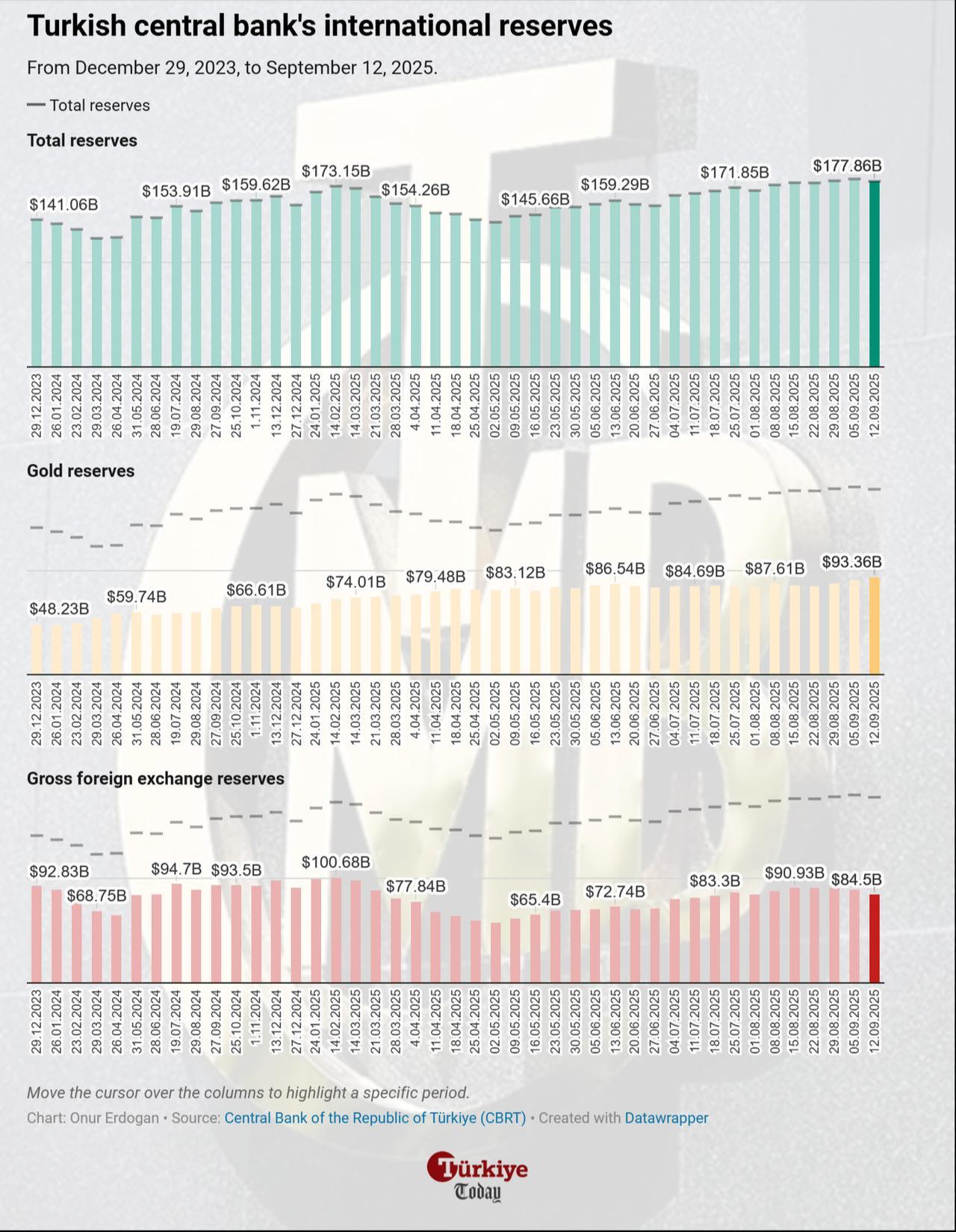

The Central Bank of the Republic of Türkiye’s (CBRT) gross international reserves dropped to $177.9 billion in the week ending Sept. 12, the figures released on Thursday showed.

This represents a $2.24 billion decline compared to the previous week, when the reserves reached their all-time high of $180.1 billion.

According to the central bank’s figures, foreign exchange reserves fell by $4.68 billion to $84.5 billion.

During the same period, record-breaking gold prices lifted the value of the central bank’s gold reserves, which increased by $2.43 billion from $90.93 billion to $93.36 billion.

Net reserves also decreased, falling from $71.3 billion to $69.6 billion.

Excluding swap agreements—short-term currency exchanges with foreign counterparts—net reserves dropped from $54.4 billion to $51.8 billion.

Foreign investors extended their sell-off for a third week, withdrawing a net $164.9 million from Turkish stocks.

As a result, the value of foreign-held equities declined to $30.96 billion in the week ending Sept. 12.

At the same time, foreign investors’ holdings of government domestic debt securities rose from $14.49 billion to $15.08 billion, while holdings of private-sector bonds decreased from $835.4 million to $665.5 million.

In the banking sector, deposits denominated in Turkish lira increased by 2.6%, reaching ₺14.17 trillion ($343.1 billion).

Foreign-currency deposits also rose by 1.7% to ₺8.29 trillion ($240.4 billion), of which $201.6 billion belonged to residents.

Meanwhile, consumer loans held by residents grew by 1.6% during the same week, rising to ₺5.05 trillion ($162 billion).