The Central Bank of the Republic of Türkiye (CBRT) sold nearly $10 billion over two weeks to stabilize the lira amid renewed political risks, before resuming foreign exchange purchases on Monday, Reuters reported.

According to information obtained by traders, the initial intervention occurred on September 2, when the central bank sold about $5.4 billion following a court decision to remove the Istanbul provincial head of the main opposition Republican People’s Party (CHP).

In the following week, as pressure on Turkish assets persisted following CHP signaling it would not comply with the court order, the bank sold an additional $4.2 billion across several sessions.

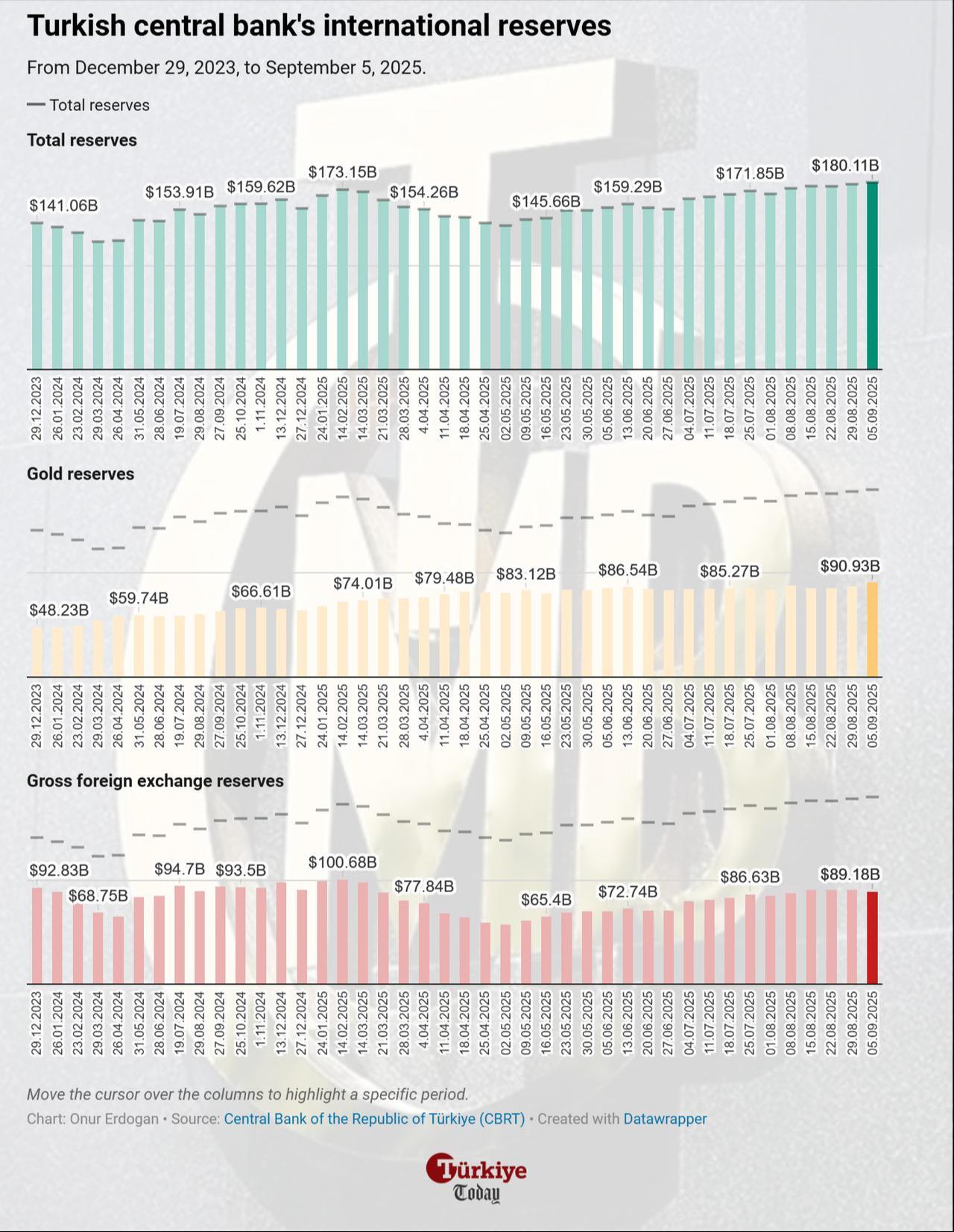

Despite the heavy sales, the central bank’s overall reserves were little changed due to the rising value of its gold holdings. Official data showed total reserves climbing to a record $180 billion in the first week of the month. Bankers calculated that the figure slipped by just over $2 billion the following week, bringing reserves slightly below $178 billion.

As a result, the combined effect of gold and currency movements left total reserves nearly flat over the two-week period.

Following the court’s decision on Monday to postpone the opposition congress case, Turkish markets staged a strong rebound.

The benchmark BIST 100 index closed the day more than 6% higher, climbing above the 11,000 level and moving back toward record territory seen before the recent political turmoil. The rally continued into Tuesday, with the index rising a further 0.6% to 11,075 points in early trade.

The lira also firmed against major currencies, while the cost of insuring Turkish debt fell as credit default swaps (CDS) tightened to their lowest level since March. In the bond market, lira-denominated government securities advanced, with yields dropping by more than 2%.