Weak capital inflows and a deepening foreign trade gap drove the continued expansion of Türkiye’s current account deficit in November, sustaining its gradual upward trend, according to an assessment by ING Global.

December foreign trade figures also suggested further deterioration in December, with the foreign trade gap reportedly widening by $0.6 billion year-on-year, the Dutch lender added.

"Persistently high inflation expectations, combined with ongoing easing in financial conditions and the wealth effect from rising gold prices, continue to support domestic demand in the fourth quarter of 2025," it noted, highlighting the pickup in economic activity amid the Central Bank of the Republic of Türkiye’s (CBRT) gradual easing cycle, which is likely to support gross domestic product growth.

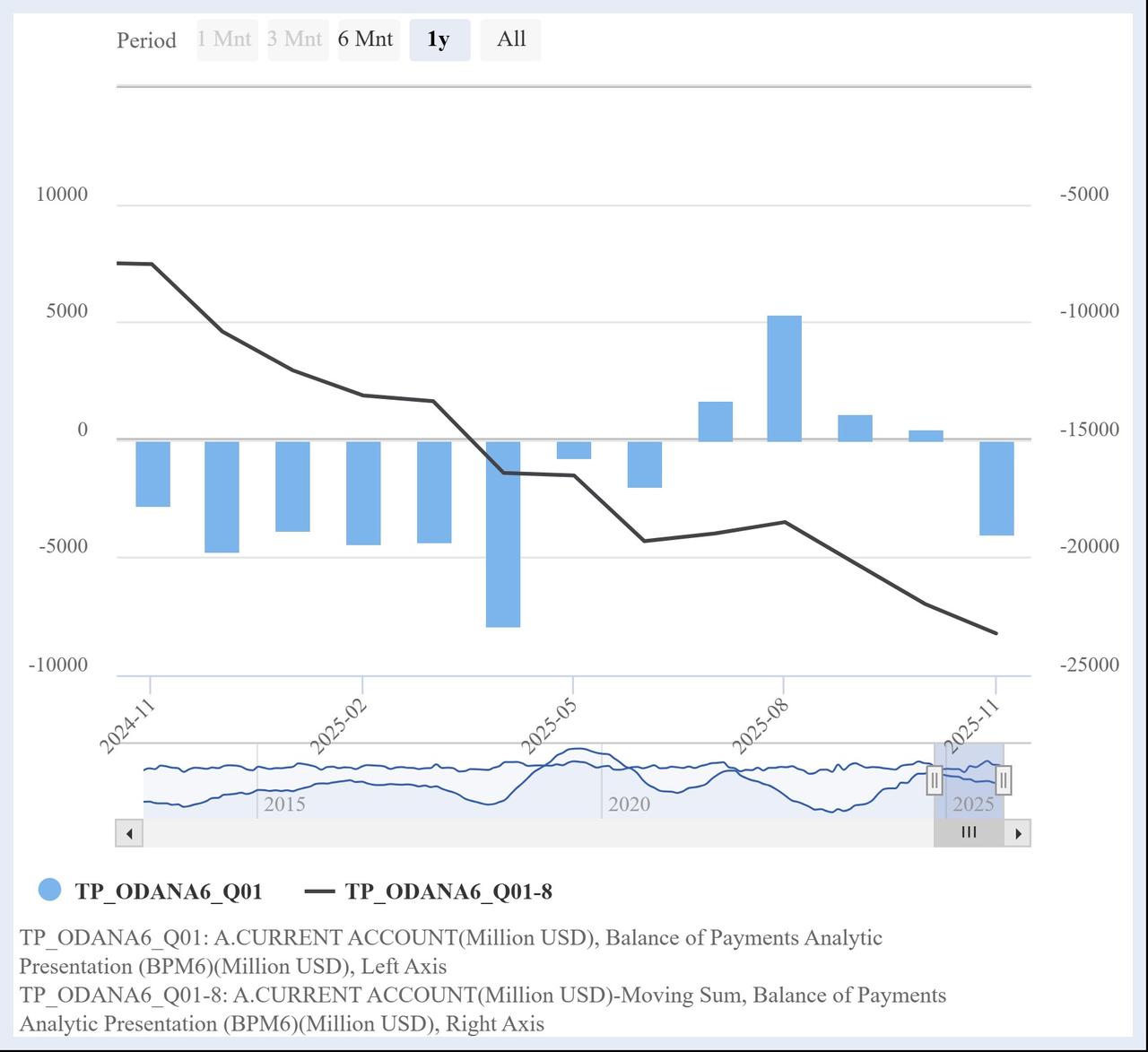

Türkiye’s current account registered a deficit of $3.99 billion in November, ending a four-month streak of surpluses.

The figure exceeded market expectations, extending the deterioration trend largely driven by a deepening trade imbalance and higher gold imports, while the core balance, excluding gold and energy, posted a surplus of $2.13 billion.

According to the central bank’s balance of payments data, the goods trade deficit, adjusted for balance of payments terms, reached $6.39 billion in November. This brought the cumulative trade deficit under the same definition to $68.4 billion over the 12 months. As a result, Türkiye’s rolling current account deficit stood at approximately $23.2 billion.

Foreign direct investment (FDI) into Türkiye rose by $990 million in November, while outbound FDI by residents increased by $647 million.

Total FDI inflows reached $12.4 billion in the first 11 months of 2025, led by $2.9 billion in wholesale and retail trade, and $1.3 billion each in information and communication technologies and food manufacturing.

Treasury and Finance Minister Mehmet Simsek said the government expects the current account deficit to remain at sustainable levels in the year ahead, with a projected ratio close to 1.5% of gross domestic product (GDP) in 2026.

He linked the forecast to improvements in the export structure, lower energy prices, a favorable euro-dollar exchange rate, and structural reforms already implemented.

Simsek also highlighted that gold-related pressures played a key role in the recent widening. "The $6.4 billion deterioration in the gold balance, mostly due to price effects, played a decisive role in the $12.8 billion increase in the annual current account deficit during the January–November period," he said.

Trade Minister Omer Bolat said that the current account deficit remains below historical averages and reflects the broader success of Türkiye’s coordinated economic policy approach.

He added that this environment supports the continuation of structural reforms aligned with the country’s broader goals of price stability and sustainable growth.

"In the period ahead, we will continue to protect our producers from unfair import pressure while strengthening Türkiye's position in global trade through targeted policy actions," Bolat stated.