Türkiye’s external assets stood at $378.4 billion at the end of July, up 4.2% month-over-month, while liabilities against non-residents rose 3.4% to $722.3 billion, Türkiye's central bank said Friday.

The country’s net international investment position (NIIP)—assets minus liabilities—came in at minus $343.9 billion, down $9.4 billion from June.

Direct investments under assets reached $70.6 billion, up 1.1% from June, while other investments fell 3.6% to $134.3 billion. Reserve assets surged 12.9% to $169.2 billion, while portfolio investments stood at $4.4 billion. Foreign exchange deposits of resident banks abroad dropped 13.2% year-over-year to $40.9 billion.

On the liabilities side, direct investments totaled $220.5 billion, down 6% due to a rise in the BIST 100 index. Portfolio investments climbed 7.8% to $125.8 billion, while other investments inched up 0.7% to $375.9 billion.

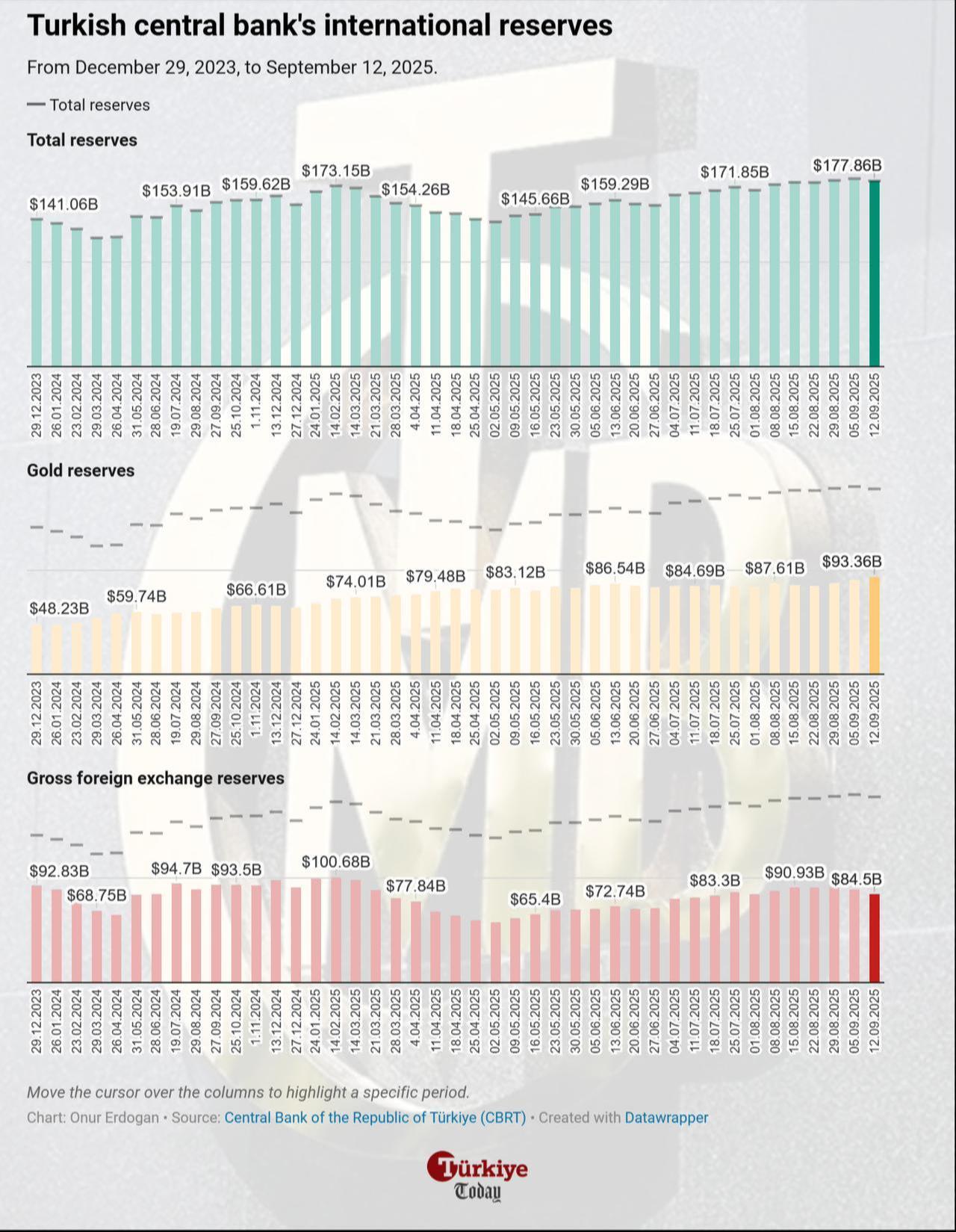

Meanwhile, the central bank's gross international reserves slipped to $177.9 billion in the week ending Sept. 12, down $2.24 billion from a record $180.1 billion the previous week.

Foreign exchange reserves fell $4.68 billion to $84.5 billion, while rising gold prices boosted gold reserves by $2.43 billion to $93.36 billion. Net reserves dropped from $71.3 billion to $69.6 billion. Excluding swap agreements, net reserves decreased from $54.4 billion to $51.8 billion.

Foreign investors continued their exit from Turkish equities, pulling $164.9 million in the week ending Sept. 12, marking the third consecutive week of outflows. Their equity holdings fell to $30.96 billion.

At the same time, foreign holdings of government domestic debt securities rose from $14.49 billion to $15.08 billion, while private-sector bond holdings declined from $835.4 million to $665.5 million.