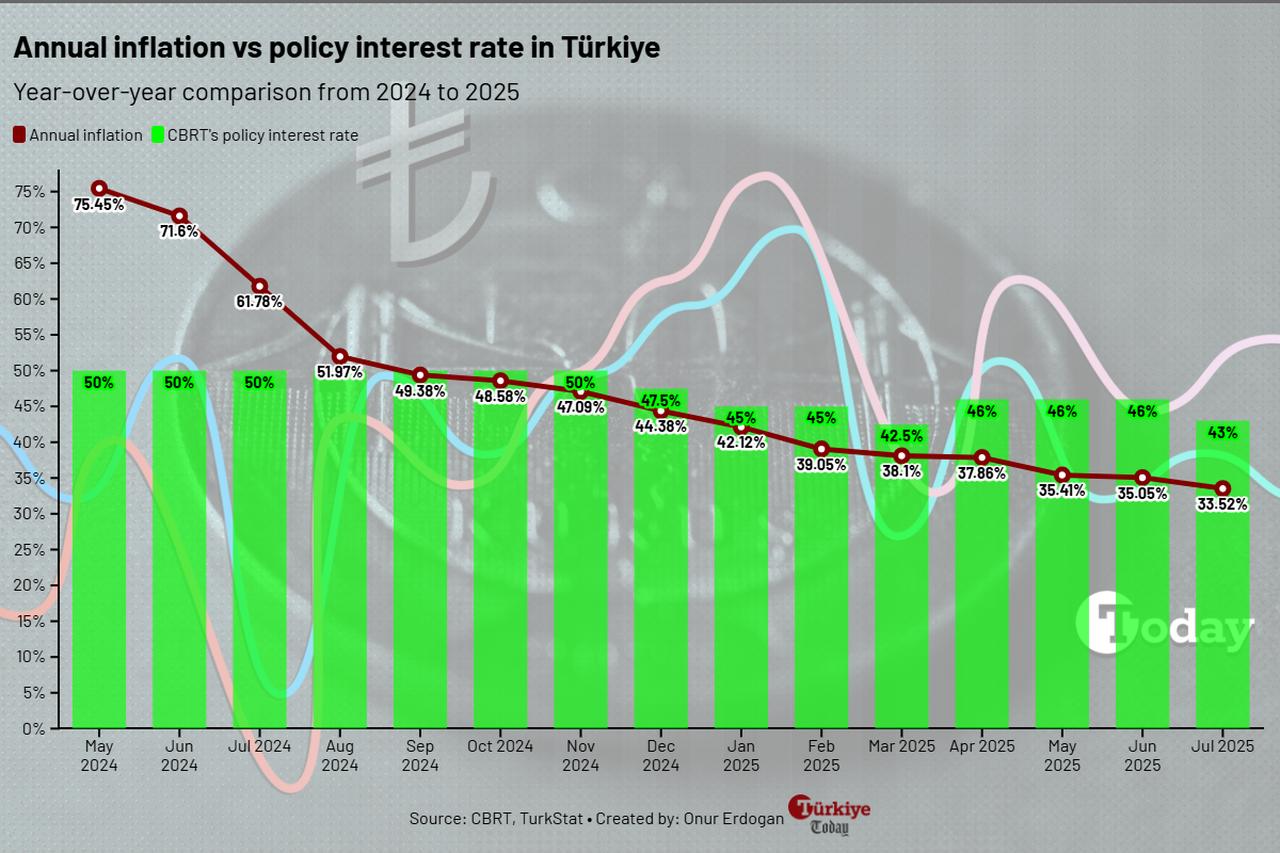

Türkiye Is Bankasi, the country's largest private lender, expects the central bank to reduce its benchmark policy rate to as low as 35% by the end of 2025, its General Manager Hakan Aran said on Monday, pointing to easing inflation pressures and strengthening international reserves.

Aran said the Central Bank of the Republic of Türkiye (CBRT) has room for up to 800 basis points of cuts this year, after resuming its easing cycle with a 300 basis points cut in July. He noted that a year-end policy rate of 35% would still ensure a positive real return, with inflation projected at around 29%.

"Whether the central bank uses this entire space or not will depend on incoming data, but in my view, the environment suggests it has the flexibility to do so," Aran told Anadolu Agency. Highlighting that the reserves have strengthened considerably while industrial production has shown signs of contraction, both of which support the case for a softer monetary stance.

Turkish central bank's international reserves reached an all-time high in the week ending Aug. 15, topping $176 billion in gross total, while net reserves excluding swap agreements rose to $52 billion. Meanwhile, Türkiye's Manufacturing Purchasing Managers' Index (PMI), which refers to a monthly indicator of business conditions in the manufacturing sector, declined in the last three months in a row, down to 45.9%─signaling the most notable slowdown in the industry since October 2024.

Türkiye Is Bankasi's internal projections indicate that consumer price inflation may settle in the 28.5% to 29.5% range by December, provided that energy and food costs do not face unexpected shocks. Aran argued that a 35% year-end policy rate would leave the economy with a real interest margin of about six percentage points, which could sustain disinflation while still supporting financial stability.

Aran also praised the CBRT’s third inflation report for presenting interim targets that, in his words, "help expectations form correctly, increase the effectiveness of monetary policy, and ensure that the disinflation process succeeds."

The Turkish central bank governor, Fatih Karahan, announced in mid-August that the bank would designate inflation targets as interim benchmarks for each period to “foster the communication strategy,” adding that projections would remain unchanged unless an extraordinary condition arises.

The bank maintained its 24% year-end inflation target with a narrowed probability range of 25% to 29%, while projections for the following years were revised upward.

The Is Bankasi executive also linked Türkiye’s monetary prospects to global financial conditions, citing that the U.S. Federal Reserve is widely expected to begin cutting interest rates in September, possibly followed by another reduction in December. "When an economy like the United States, with all its size, becomes vulnerable to volatility, the entire world feels the impact," he said.

Aran cautioned, however, that shifting trade patterns, especially between China, the United States, and the European Union, could put pressure on Türkiye’s exporters. He remarked that Turkish manufacturers already face challenges in pricing and volumes due to high domestic costs and softening global demand.

"If Europe were to adopt the same stance as the United States against China, Türkiye might gain an advantage," he said. "But if the EU takes a warmer approach to China, we could lose market share in Europe to Chinese competitors."

Despite the challenges, Aran said Türkiye’s banking industry remains strong enough to adapt to different policy conditions. He acknowledged that the brief tightening in April—when the central bank paused the easing cycle with a 350 basis point hike, bringing the policy rate to 42.5%—had squeezed margins and profitability, but added that a steady path of reductions could allow banks to recover.

"If the easing cycle continues without interruption until year-end, the sector could close 2025 with equity returns in the range of 20% to 25%," he said. While he noted that this would still imply real erosion against inflation, he argued that such levels would be "acceptable and manageable."

He added that the central bank’s measured approach to credit expansion is consistent with the disinflation path. Small and medium-sized enterprise (SME) loans, for example, have grown by roughly 33%, broadly in line with inflation.

"There is no credit expansion pattern that would concern the central bank within the disinflation framework," Aran said.

Aran stressed that Türkiye’s banking system is capable of handling shocks thanks to its adaptability. “Whatever the conditions may be, the sector always has more than one scenario and adjusts its lending accordingly,” he said. He emphasized that banks can address problems internally without burdening the state, unlike in some other economies.

Reflecting on the broader outlook, Aran concluded that the combination of easing inflation, strengthened reserves, and policy credibility places Türkiye in a position to navigate global uncertainties.

"The next two years will be critical globally,” he said. “We need to be cautious, remain committed to our roadmap, and move forward with safeguards that allow us to absorb external shocks."