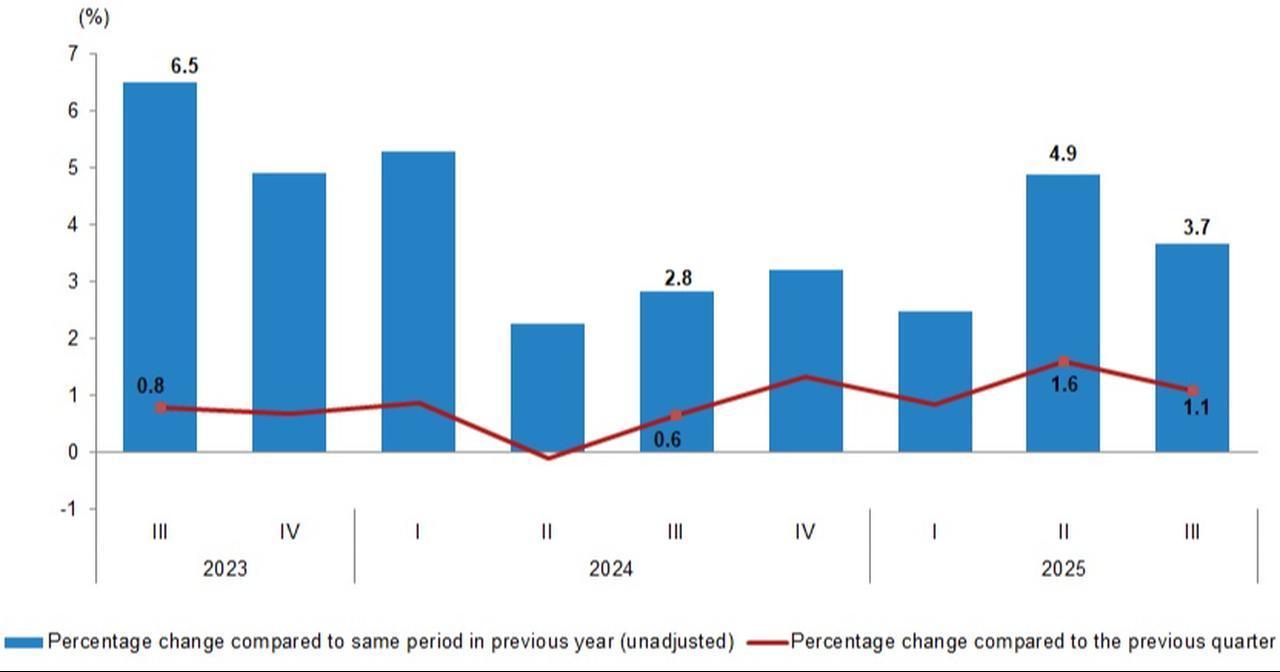

Türkiye’s economy grew by 3.7% year-on-year in the third quarter of 2025, supported by strong household consumption and rising investment, though the pace slowed from the revised figure of 4.9% in the previous quarter, official figures showed.

Every quarter, gross domestic product (GDP) rose by 1.1%, indicating a cooling from the 1.6% growth recorded in the previous quarter. Thus, Türkiye’s GDP reached ₺17.42 trillion ($432.9 billion) between July and September 2025 at current prices, the Turkish Statistical Institute (TurkStat) reported.

In real terms, the economy maintained its upward trajectory, marking 21 consecutive quarters of positive growth.

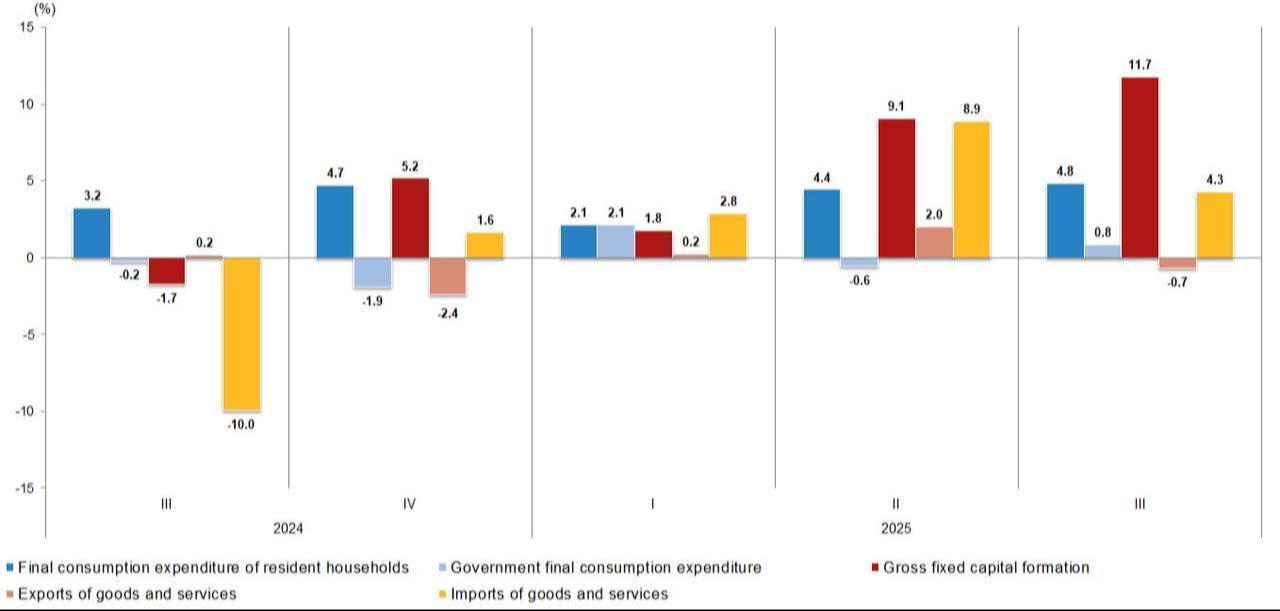

Household spending remained a key driver of growth in the third quarter, with final consumption by residents rising 4.8% in real terms compared to the same period last year. Business investment remained strong, with gross fixed capital formation rising by 11.7%, while government consumption stayed subdued, increasing by just 0.8%.

However, the external sector weighed on growth, as exports declined by 0.7% year-on-year while imports rose by 4.3%, driven by weaker global demand and stronger domestic appetite for imported goods, both of which limited the overall boost from domestic economic activity.

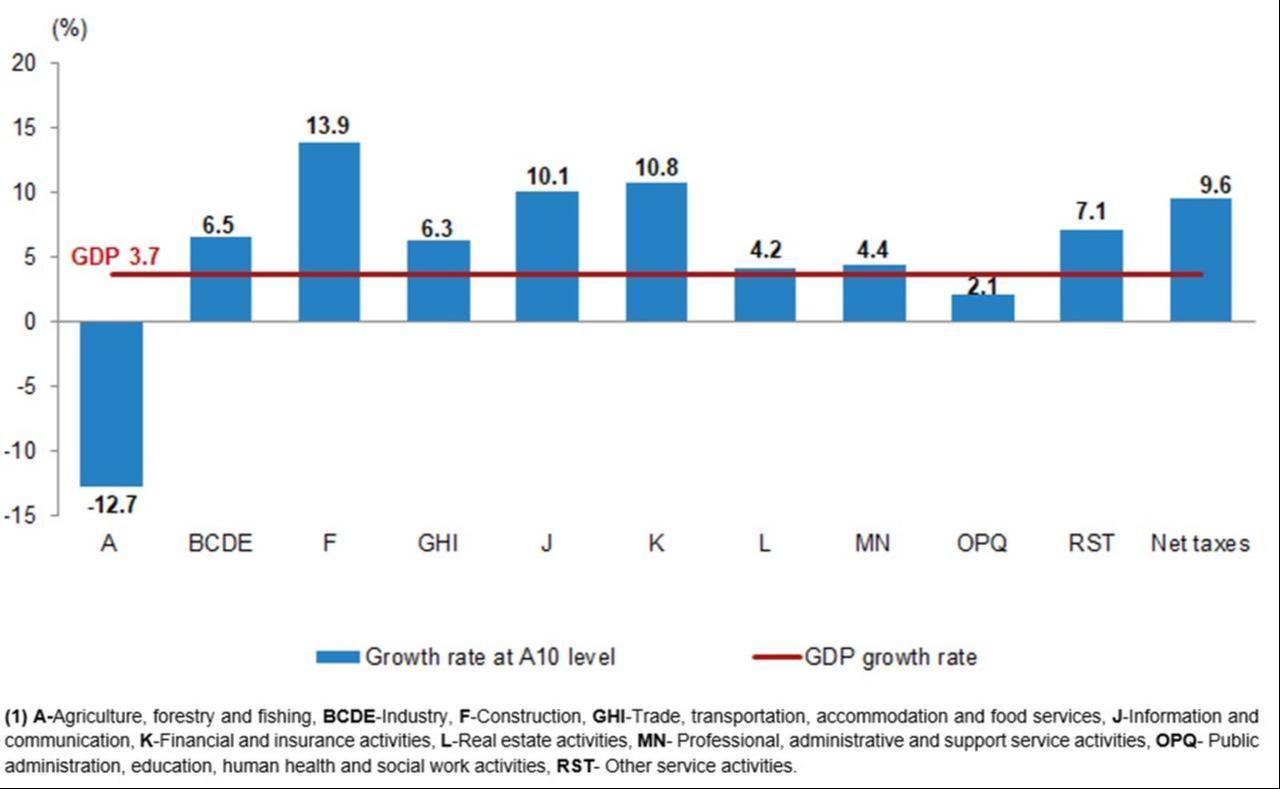

Among sectors, construction recorded the fastest growth with a 13.9% increase in value added. Financial and insurance services grew by 10.8%, while the information and communication sector expanded by 10.1% year-on-year.

In contrast, the agriculture, forestry, and fishing sector contracted sharply, falling by 12.7% compared to the third quarter of 2024.

This sectoral performance was also reflected in the income distribution side of the economy. In nominal terms, employee compensation rose by 41.1% year-on-year in the third quarter, while net operating surplus and mixed income, which include corporate profits and earnings of self-employed individuals, increased by 43.5%.

Despite these gains, the share of labor income in gross value added remained flat at 35%, indicating that wage growth kept pace with overall output but did not expand its relative share.

In contrast, the share of capital income edged up to 46.7% from 46.0% a year earlier, suggesting a slightly larger portion of the economy’s value was captured by business owners and investors.

Marbas Menkul Degerler, a local brokerage firm, said in its assessment that the third-quarter GDP data was broadly constructive for financial markets, despite growth falling short of expectations that were around 4%.

Analysts pointed out that the composition of growth—driven more by capital formation than consumer demand—may ease inflation concerns and support monetary policy easing.

"This is not consumption-heavy growth, which is important in the current macro environment," the firm said in a note to clients. "The engine this time was fixed capital formation, which helped sustain overall momentum despite weaker trade."

They noted that while some areas—such as agriculture and public services—performed below expectations, most sectors posted stronger-than-expected growth. The firm also underlined that government consumption remained flat and did not contribute meaningfully to the expansion.

On the income side, analysts observed a shift in growth dynamics, with employee compensation declining and operating surplus rising. "This shift indicates that the nature of growth is leaning toward capital-driven expansion, which could imply more limited underlying demand pressure," the note said.

Regarding monetary policy implications, the brokerage highlighted the changing expectations around the Central Bank of the Republic of Türkiye’s (CBRT) next move. "With this data, we now see little chance of a rate cut below 100 basis points. On the contrary, the probability of a 150 basis point or larger cut has increased," the firm stated.

Policymakers at CBRT are set to convene on December 11 for the year’s final Monetary Policy Committee (MPC) meeting, and Turkish market participants expect at least a 100 basis point cut, which would bring the policy rate to 38.5%.

Commenting on the latest GDP figures, Treasury and Finance Minister Mehmet Simsek said the third-quarter results align broadly with the government’s economic roadmap. He noted that the economy is expected to grow at a more moderate pace in the final quarter, with full-year growth in 2025 likely to slightly exceed the 3.3% target outlined in the Medium-Term Program (MTP).

"With more favorable financial conditions and a supportive global backdrop, we foresee stronger economic activity in 2026 compared to this year. We also believe that growth will continue to support disinflation," he added.

Simsek stressed that the contraction in agriculture stemmed from supply-side shocks such as drought and frost, which had a dampening effect on headline growth. In response, the government is working on measures to improve productivity, strengthen irrigation infrastructure, and enhance resource efficiency to reduce the impact of such shocks.

He also emphasized continued support for labor-intensive sectors. "We are maintaining support for the real sector to revive weak production and protect employment, especially in labor-heavy industries," he said. "We are firmly implementing our program, which prioritizes price stability and aims for sustainable, high growth and lasting welfare gains."

Simsek concluded that the structural reforms outlined in the economic plan are intended to preserve the progress made over the past two years and to boost productivity and competitiveness through long-term transformation.