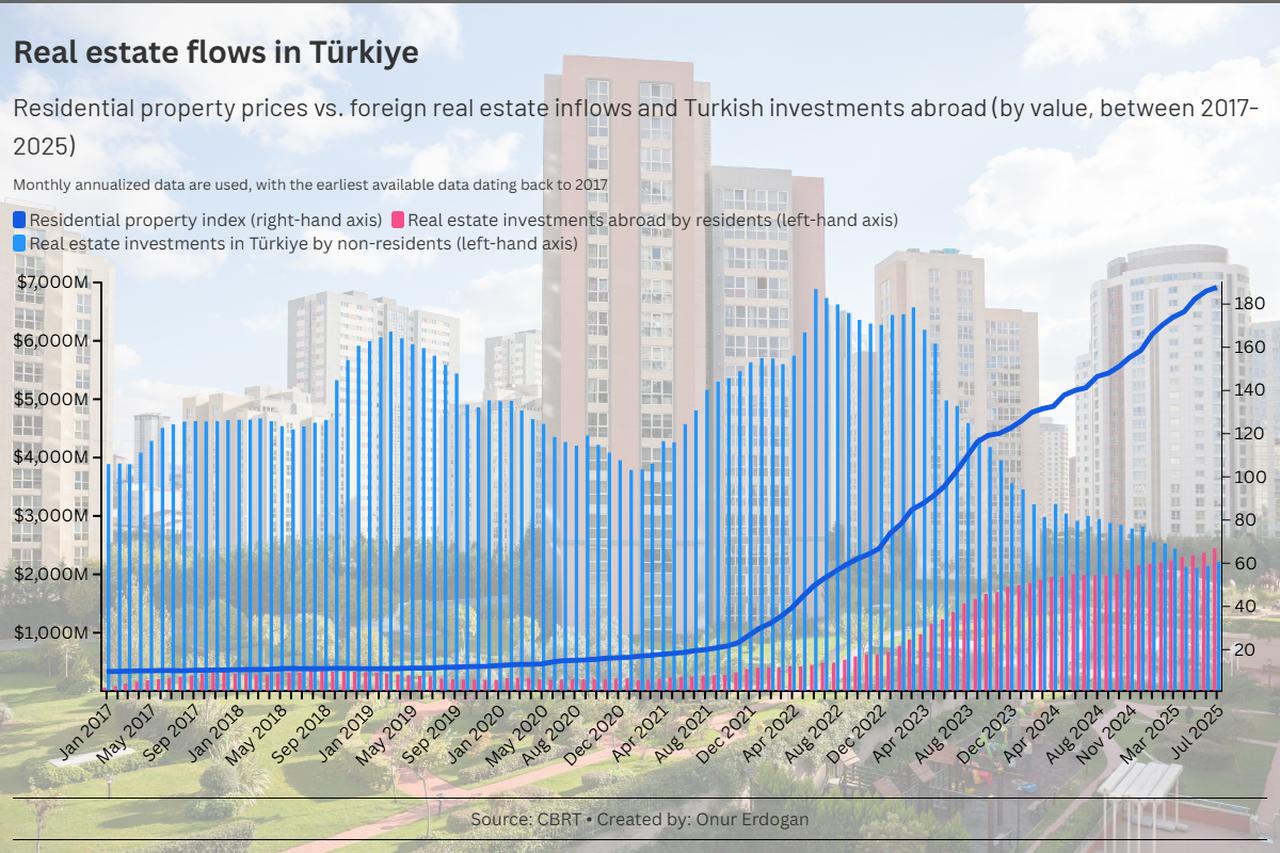

Turkish citizens are increasingly directing their real estate investments abroad, with overseas property purchases surpassing $1.49 billion in the first seven months of 2025, representing a 24.5% increase compared with the same period a year earlier.

Overseas real estate investment by Turkish residents reached $2.48 billion in July on an annualized basis, surpassing the $2.16 billion spent by foreign buyers in Türkiye and widening the country’s real estate deficit, which first emerged in April 2025 as rising domestic prices diminished investor interest.

Sector representatives told Türkiye daily that if the current pace continues, total overseas property purchases by Turkish citizens could reach $3 billion by the end of the year.

Analysts point to restrictions on housing loans for second homes as a leading factor driving investments abroad.

In Türkiye, first-time homebuyers can borrow up to 80% of the property’s value, but for a second purchase, this ratio falls to 20–25%, with significantly higher interest rates.

Industry insiders argue that the policy aims to prioritize genuine housing needs rather than investment-driven demand.

However, rising property prices, high interest rates, and stagnant income levels have left even first-time buyers struggling to secure homes, further shrinking the domestic housing market.

Tax regimes also play a role in encouraging Turkish investors to look overseas.

Property taxes, title deed fees, and other charges in Türkiye are often higher than in many European and Middle Eastern countries. Markets such as the United Arab Emirates, Greece, Cyprus, Malta, and Monaco offer notable tax advantages for foreign property buyers.

New tax regulations set to take effect in 2026 are expected to accelerate this outward trend, as Turkish investors seek more favorable conditions abroad.

Citizenship and residency programs have become another major driver of overseas purchases.

So-called "Golden Visa" schemes in several European countries grant residency or citizenship to foreigners making qualifying real estate investments.

In Greece, for example, a property purchase worth €250,000 ($293,639) provides residency rights, while in Spain and Portugal, investments starting at €500,000 can open a path to citizenship. For many Turkish businesspeople, these programs not only represent an investment but also provide easier international mobility.

On the other hand, the minimum investment requirement of $400,000 to obtain Turkish citizenship is also seen as a factor deterring foreign buyers, with house sales to non-residents falling to 21,790 on an annualized basis as of August from the record 67,490 in 2022, a 67.7% decline.

This drop reduced the share of foreign purchases in total house sales to 1.3%, down from 4.5%.

Despite the incentives, experts warn that overseas investments carry risks. Limited rental returns, high insurance premiums, agency commissions, service charges, and maintenance costs can reduce profitability.

Legal disputes, coupled with the risk of natural disasters in some markets, also present challenges that investors must weigh carefully.