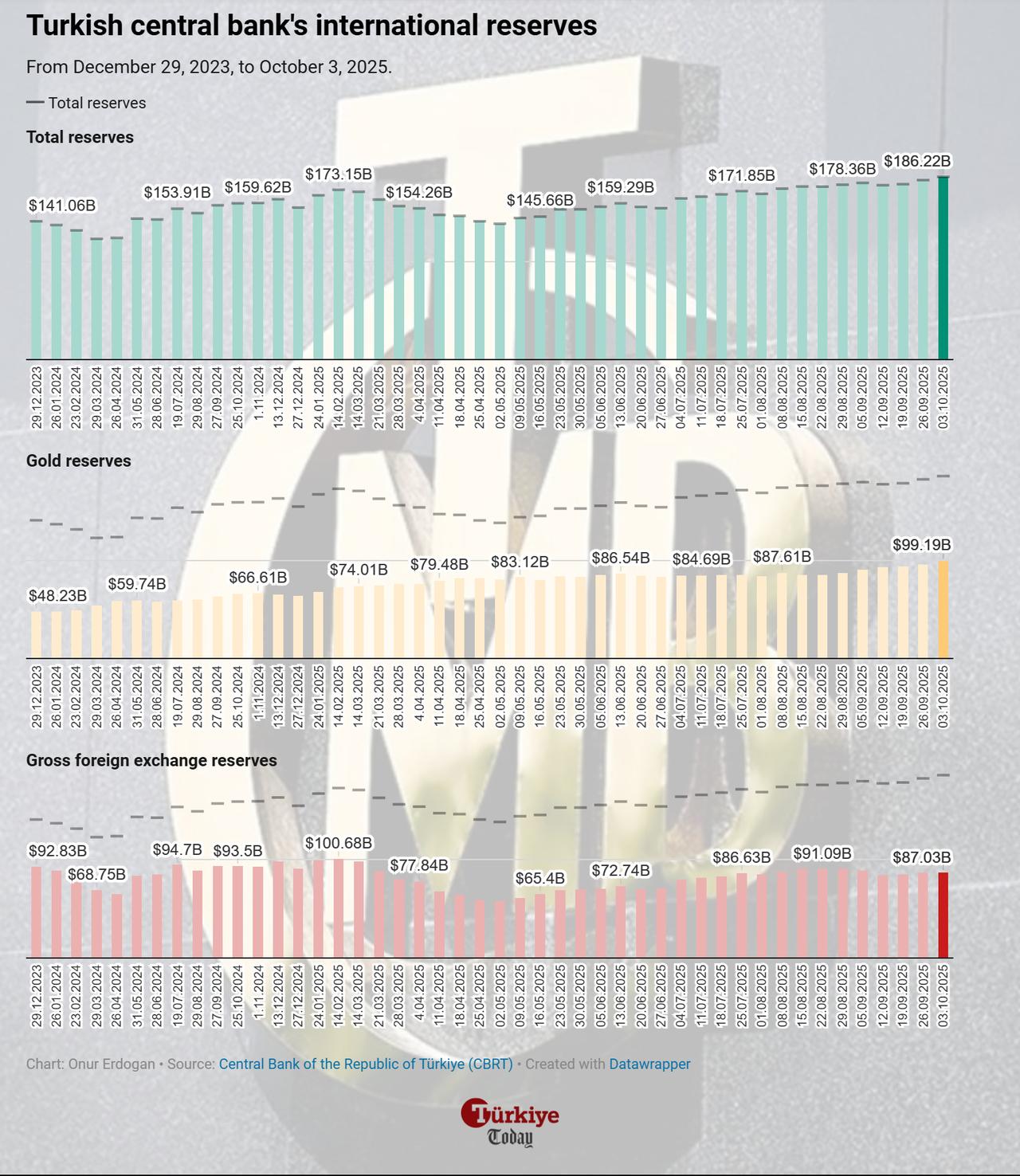

Türkiye’s Central Bank (CBRT) total reserves rose by $3.26 billion in the week ending Oct. 3, reaching an all-time high of $186.22 billion, driven largely by gains in gold prices.

The value of the bank’s gold reserves increased by $2.94 billion to $99.19 billion during the same week, the Turkish central bank reported on Thursday, as spot prices climbed to a then-record weekly close of $3,886.83 per ounce.

Meanwhile, gross foreign exchange (FX) reserves rose by $329 million to $87.03 billion.

Net reserves also strengthened, increasing from $72.7 billion to $75.2 billion, while net reserves excluding swap agreements rose from $57.2 billion to $59.5 billion.

Foreign investors, however, trimmed their exposure to Turkish assets during the same period. In the week ending Oct. 3, non-residents sold a net $84.1 million in equities, $358.5 million in government domestic debt securities, and $12.6 million in other sectoral securities.

Their total holdings of Turkish equities fell from $33.82 billion in the previous week to $33.26 billion. Likewise, holdings of government bonds decreased from $15.66 billion to $15.39 billion, while other securities declined from $696.9 million to $682.5 million.

Local brokerage Colendi Securities noted that despite last week’s outflows, foreign investors have remained net buyers of Turkish assets since the start of 2025. Year to date, foreign investors have made net purchases of $1.74 billion in equities and $605 million in government bonds.

Analysts said the higher-than-expected September inflation rate, which rose to 33.2%—the highest since May 2024, likely contributed to last week’s withdrawals. However, they described the overall net inflow since January as "modestly positive," reflecting limited yet steady foreign interest.

The brokerage expects capital flows in October to depend largely on upcoming market events, including S&P Global Ratings’ Türkiye review on Oct. 17 and the Central Bank’s policy rate decision later in the month. If softer inflation data emerges in October and November—following the stronger September figures—the likelihood of year-end inflation falling below 30% could increase, potentially accelerating inflows toward year-end, it added.

Total deposits in Türkiye’s banking sector fell by ₺169.24 billion ($4.05 billion) in the week ending Oct. 3, declining from ₺26.06 trillion ($624.56 billion) to ₺25.90 trillion.

Lira-denominated deposits dropped by 2.6% to ₺14.08 trillion, while foreign currency deposits—those held in U.S. dollars or euros—rose by 1% to ₺8.52 trillion.

The central bank data indicated that individual (retail) foreign-currency deposits increased by $1.1 billion in the week, after adjusting for exchange rate effects. In contrast, corporate foreign-currency deposits fell by $934 million.