Central Bank of the Republic of Türkiye (CBRT) Governor Fatih Karahan rejected claims that he blamed citizens’ gold hoarding for the country’s inflation problem, saying his remarks at an investor meeting had been misrepresented on social media.

In a parliamentary address on Tuesday, Karahan explained that during a panel in the Netherlands on global macro-financial stability, he had emphasized that price stability, rather than household behavior, would ultimately reduce demand for keeping gold outside the financial system.

"Our estimates put the stock of under-the-pillow gold at between $400 billion and $500 billion.

Some institutions suggest even higher levels," Karahan said. "The wealth effect from last year’s increase in gold prices alone exceeds $100 billion," he stressed, supporting household consumption through higher perceived savings.

The disinflation process has so far slowed the growth of under-the-pillow gold—holdings kept privately at home rather than in banks—as the Turkish lira’s real appreciation strengthened, a trend that is likely to support the ongoing disinflation, Karahan added.

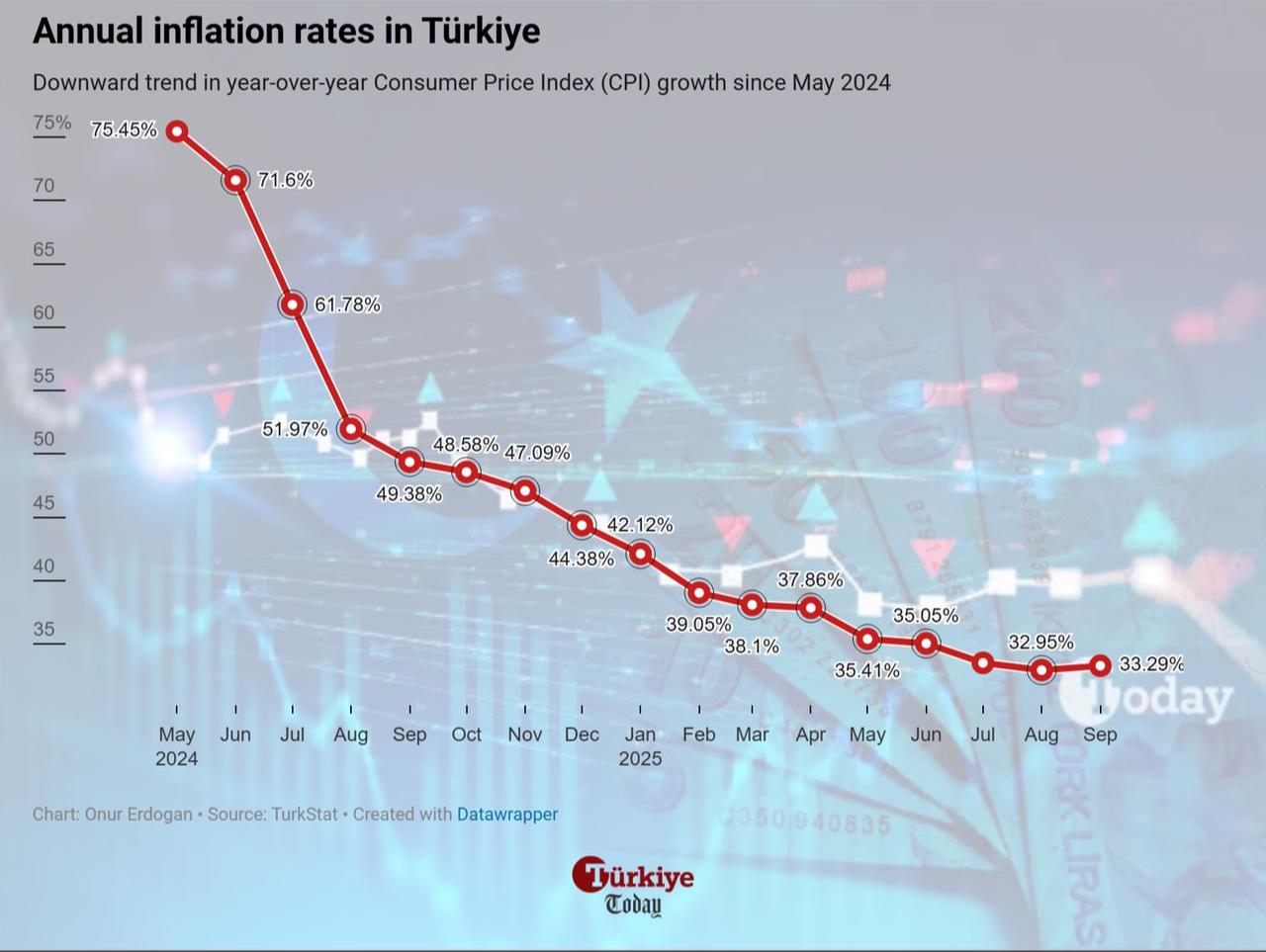

Referring to the first disruption of the annual inflation rate's decline trend since May 2024 in September, Karahan said the central bank remained responsible for curbing inflation regardless of its causes, which could include external shocks such as droughts or seasonal factors.

He highlighted that Türkiye’s annual inflation had fallen from 75% to 33% following a period of monetary tightening, rejecting the view that no progress had been made.

Karahan described the anti-inflation effort as a long race. "We liken the fight against inflation to a marathon.

Just as runners adjust their speed depending on conditions, in disinflation, there may be times when the pace quickens or slows," he said. "The important point is to continue moving steadily toward the target."

Karahan also addressed questions on "carry trade" operations, in which investors borrow in a low-interest currency and invest in higher-yielding assets. He noted that since the beginning of the year, Türkiye has not ranked among the top emerging markets in terms of carry trade returns.

"Carry trades, swaps, and other such transactions are paid by banks themselves. Banks engage in these transactions to secure their own funding, but they are under no obligation or direction to do so," Karahan said. "They simply see them as profitable given their liquidity conditions."

He reiterated that the central bank’s actions remain focused on inflation. Maintaining interest rates at necessary levels, he said, may increase the Treasury’s interest expenditures, "but this is something observed in many countries as well."

The Turkish government’s interest payments reached ₺1.4 trillion ($33.56 billion) in the January–August period, an increase of 83.2% from ₺764 billion in the same period last year.

Karahan also commented on exports and industry, responding to arguments that Türkiye’s competitive advantage had weakened with rising costs. He noted that nearly half of Türkiye’s exports are denominated in euros and that producer prices had increased in line with the euro’s appreciation.

"The main challenge is not competitiveness but weak external demand," he said in response to the criticisms. "We see growing employment in technology-heavy industries, and this will reduce economic vulnerabilities over the medium term."

Addressing the rise in corporate bankruptcies and concordat appeals, Karahan stated that the impact of failed businesses remains limited. "Even when we include the firms connected to them, the overall picture does not change much," he said.

Karahan recalled the September policy rate cut of 2.5 percentage points, which lowered the benchmark rate to 40.5%. However, he stressed the need for caution.

"Given the current inflation environment, monetary tightness must be preserved for quite some time to manage demand and expectations," he said.

The central bank would maintain a tight stance until its primary goal of price stability is achieved, Karahan reiterated, noting that inflation is expected to decline through this approach.