U.S. inflation eased to 2.7% in November from the previous month’s 3.0%, coming in well below market expectations of 3.1%, the Department of Labor reported, boosting optimism for more rate cuts by the Federal Reserve in 2026.

Following the data release, all major U.S. stock indices opened higher, with the Dow Jones Industrial Average climbing more than 300 points, or 0.63%, while the S&P 500 and Nasdaq Composite advanced 0.96% and 1.41%, respectively.

"A CPI print like this offers plenty of room for the Fed to act," said Kevin Hassett, director of the White House National Economic Council and considered a leading candidate to succeed Jerome Powell as Federal Reserve chair. In remarks to Fox Business Network, Hassett described the report as "astonishingly good" and called for greater transparency from the central bank.

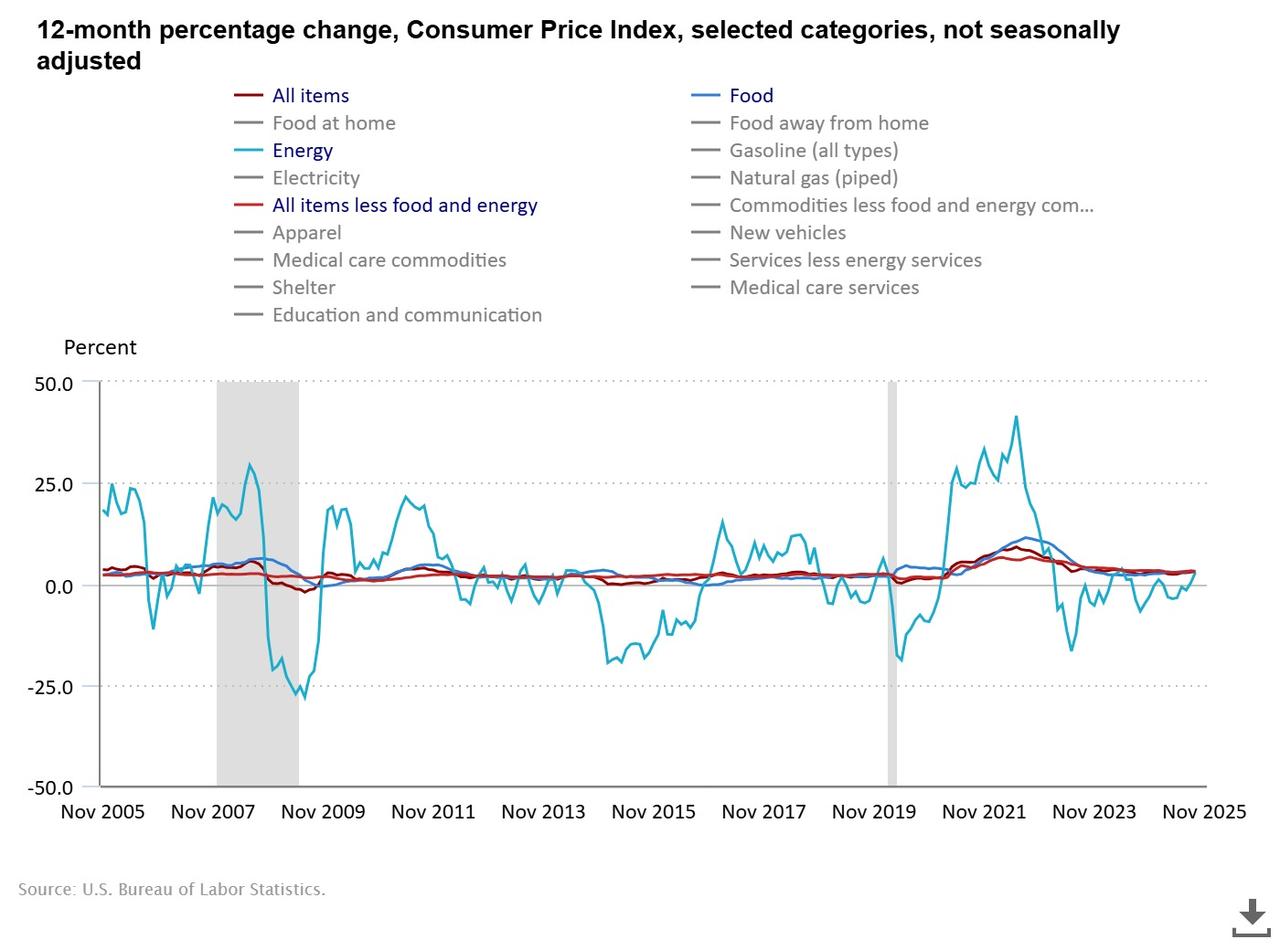

While headline figures surprised to the downside, core inflation, which excludes food and energy, stood at 2.6% year-on-year in November, remaining above the Federal Reserve’s target and suggesting that underlying price pressures have yet to ease meaningfully.

Energy prices climbed 4.2% over the 12-month period, while food prices increased by 2.6%. The index for meats, poultry, fish, and eggs saw an even sharper rise of 4.7%, adding to the cost burden faced by households.

On the other hand, a record-breaking government shutdown from October to mid-November appears to have disrupted data collection, limiting the availability of month-to-month comparisons and potentially skewing recent figures. Still, the year-on-year trend offers a clearer view of easing inflation following several months of elevated readings.

The Department of Labor noted that the November data were the first complete figures since September, when inflation had stood at 3.0%. October data were not fully compiled due to the partial closure of federal agencies.

Inflationary pressures have intensified in recent months as President Donald Trump imposed new tariffs on key trading partners, raising costs for American businesses. While the latest data offers temporary relief, some policymakers remain cautious.

The Federal Reserve has cut rates at each of its last three meetings in an effort to support a slowing economy. However, officials remain divided over how much further they should ease monetary policy. Some policymakers have pointed to ongoing tariff-related inflation and elevated service-sector prices as reasons for caution.

President Donald Trump, in a televised national address this week, claimed that economic conditions would improve in the year ahead, citing his trade and tax policies. He is expected to announce his choice to replace Fed Chair Powell early next year.