The tragic crash of an Air India Boeing 787-8 Dreamliner near Ahmedabad on June 12, 2025, has triggered global concerns about aviation safety and its financial implications. Boeing’s share price plunged by more than 6% within hours, erasing nearly $10 billion in market value.

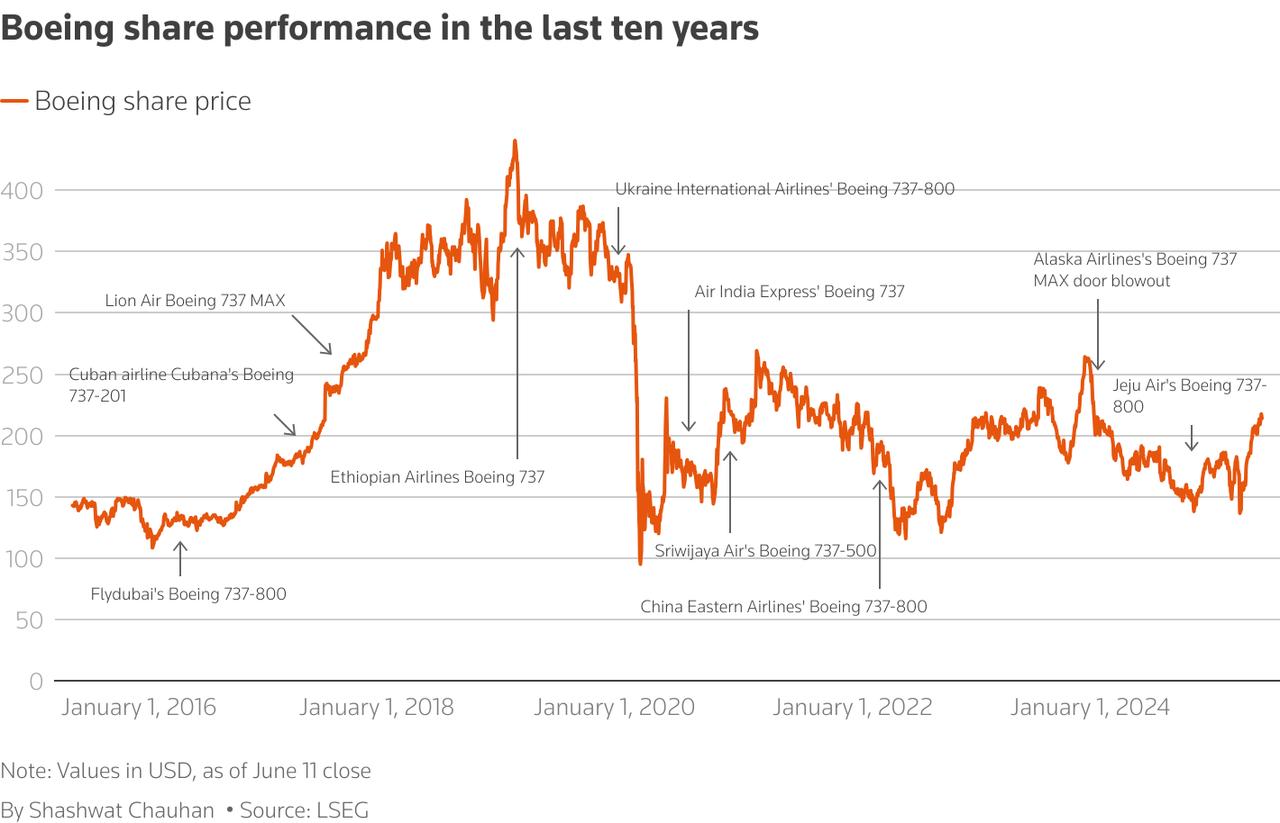

The sharp market response revived questions about how fatal aviation accidents influence the financial health of aircraft manufacturers, especially when incidents follow a pattern of safety concerns.

To better understand this phenomenon, Türkiye Today consulted Professor Nuno Moutinho from the Polytechnic Institute (IP) of Braganca, Assistant Professor António Miguel Valente Martins from the University of Madeira, and Assistant Professor Susana Raquel Granito Cro from the Center for Advanced Studies in Management and Economics (CEFAGE) at the University of Évora—authors of the peer-reviewed study "Stock Market Reaction to the Recurring Incidents at Boeing: An Event Study Analysis," published in the International Journal of Finance & Economics.

Their insights provide an evidence-based perspective on how fatal aviation incidents influence investor behavior, market valuations, and Boeing’s long-term financial health.

According to the scholars, fatal aviation incidents have a profound and often prolonged impact on the valuation of aircraft manufacturers like Boeing. Even non-fatal technical failures have been associated with significant short-term stock underperformance, with cumulative abnormal returns (CAR)—the total deviation of a stock’s actual return from its expected return—ranging between -3.65% and -6.30% over a period of 3 to 6 days.

The effects are even more severe when lives are lost and the manufacturer is perceived to be at fault.

In fatal cases, the market impact is magnified by media coverage and investor sentiment. These incidents fuel widespread anxiety and dominate headlines, accelerating market responses.

The 2018 and 2019 crashes involving the Boeing 737 Max, which led to global groundings and mass cancellations, serve as prominent examples.

The academics emphasized that when design or manufacturing faults are identified, the damage is not only immediate but also structurally lasting. Beyond the loss in share value, long-term consequences include reputational decline, lost orders, regulatory scrutiny, and weakening of strategic airline partnerships.

Critically, the authors argue that Boeing's supposed financial strength and safety momentum leading into the Air India crash are misleading.

“Investor confidence is already fragile,” they stated. They pointed to recurring safety issues, such as doors detaching mid-air, pressurization failures, and Dutch Rolls, as indicators of systemic problems in quality assurance and a gradual cultural shift away from engineering excellence since Boeing’s 1997 merger with McDonnell Douglas. This shift, according to the experts, prioritized financial returns over safety innovation.

In cases such as the Lion Air and Ethiopian Airlines disasters, the long-term effects were profound: “billions in lost orders and long-term trust erosion, which resulted not only in immediate financial loss,” the experts recall.

The accumulation of such incidents—even those not involving fatalities—has led to a brittle confidence environment. “A major crash could spark renewed calls for grounding, cancellations, and investor flight to competitors such as Airbus,” they noted.

Boeing's rivals, in fact, often experience positive stock returns when the American manufacturer faces crises, a pattern documented in their empirical findings.

The current crash comes at a time when investor confidence in Boeing remains fragile. Contrary to public perception, the professors argue that Boeing's financial and safety momentum has not been strengthening in recent years.

Instead, the firm has faced mounting issues such as doors detaching midair, pressurization failures, and Dutch Rolls, all contributing to a deteriorating safety image.

These issues, they say, stem from a long-standing shift in corporate culture that began with Boeing’s 1997 merger with McDonnell Douglas.

The transition from an engineering-led to a finance-driven approach has led to cost-cutting measures at the expense of safety, with increased outsourcing and weakened quality controls becoming hallmarks of Boeing’s operations.

Even without fatalities, recent safety-related events have triggered significant abnormal stock returns. A fatal crash, particularly if linked to Boeing, could further destabilize an already weakened investor base. The risk is compounded by regulatory scrutiny, delayed deliveries, and cancelled airline contracts—all indicators of operational fragility rather than strength.

Market data suggest that investors often overreact in the short term to dramatic aviation incidents, especially those heavily covered in the media.

Boeing’s stock typically experiences immediate declines, while shares of competitors like Airbus and Embraer tend to rise, reflecting a “switch effect” where investors anticipate a shift in airline orders.

If the manufacturer is eventually cleared of fault, a rebound is possible. However, when responsibility is assigned to Boeing, the damage deepens. This was evident in the extended fallout from the 737 Max tragedies, where reputational harm and client distrust persisted for years.

A key variable in market recovery is investor perception. If Boeing can respond swiftly and transparently, the negative financial impact can be mitigated. But repeated incidents, as seen in Boeing’s case, increase the likelihood that each new event will be interpreted as part of a systemic failure rather than an isolated case.

The financial market’s reaction to aviation disasters does not occur in a vacuum. Macroeconomic conditions and reputational standing significantly shape the magnitude of investor responses. Periods of heightened market volatility, high interest rates, or weak credit conditions tend to amplify the shock from accidents. So too does a weakened brand reputation.

Incidents occurring under regulatory investigation or during periods of heightened scrutiny add additional layers of financial risk.

The cancellation of major airline orders following accidents serves as a clear signal to investors that the firm’s future revenue stream may be at risk. This not only undermines confidence in Boeing’s stock but also affects suppliers and airline customers—particularly those heavily reliant on Boeing aircraft.

The professors highlight that airlines with Boeing-dominant fleets, especially low-cost carriers, also experience negative abnormal returns in the wake of such events—a “guilt by association” effect that reinforces the systemic risk embedded in Boeing’s crisis.

The recent Air India crash has once again exposed the fragile investor confidence in Boeing and underscored the market’s sensitivity to aviation safety.

As Professors Moutinho, Martins, and Cro explain, these incidents are not isolated in their financial impact.

The long-term effects of such crashes go beyond immediate stock volatility. According to experts, as history has shown, recovery is possible—but only if Boeing addresses the core issues that lie at the heart of its recurring crises.