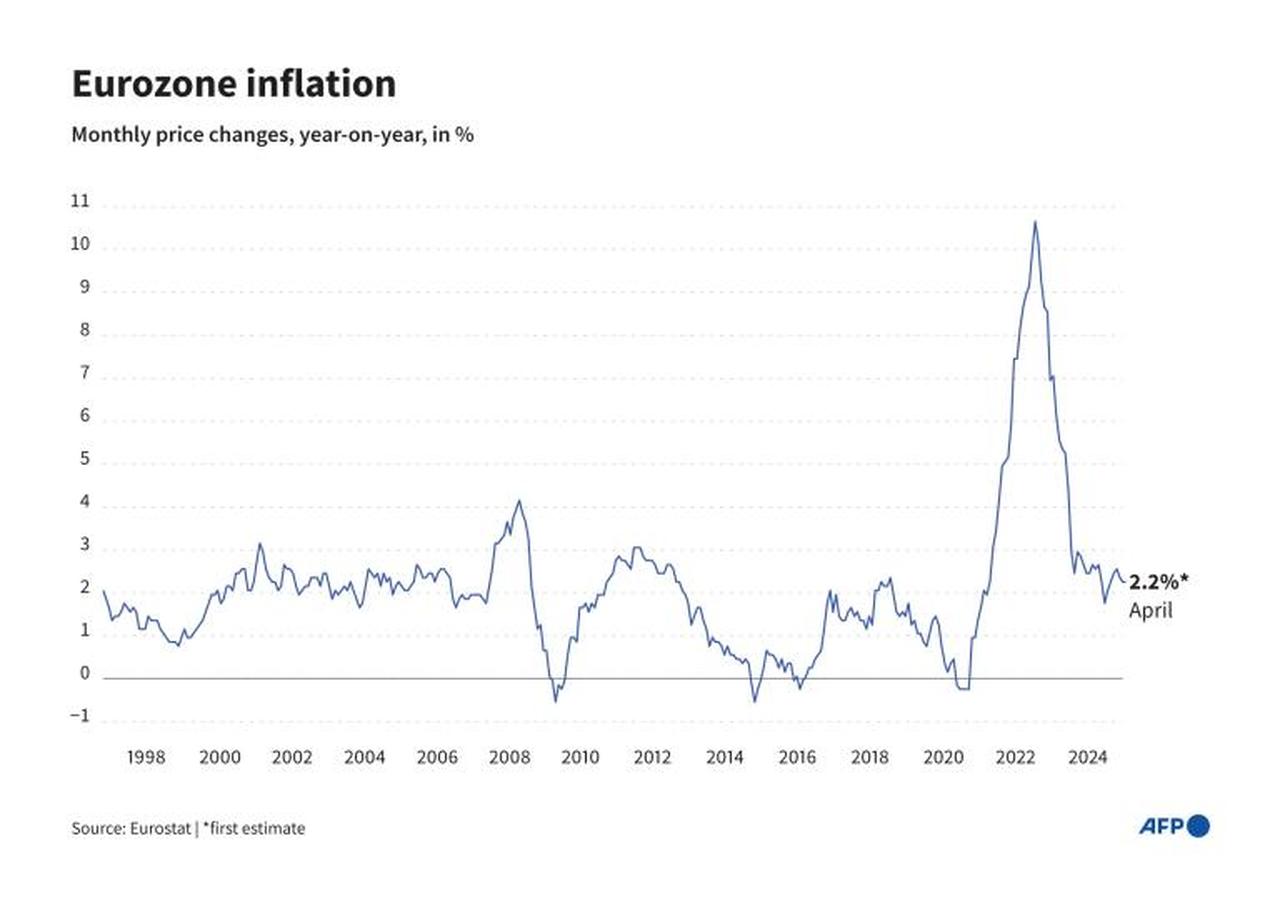

Eurozone inflation measured 2.2% in April, exceeding analyst projections despite a sharper drop in energy prices, according to official data released on Friday.

Core inflation — which excludes energy, food, alcohol, and tobacco and serves as a key metric for the European Central Bank (ECB) — increased to 2.7% from 2.4% in March, Eurostat reported.

Analysts surveyed by Bloomberg and FactSet had expected headline inflation to ease to 2.1%, with core inflation rising to 2.5%.

The data disappointed markets, particularly as service sector inflation climbed to 3.9% in April, up from 3.5% in March. The ECB pays close attention to this component due to its strong correlation with wage growth, amid concerns about a wage-price spiral complicating the path to price stability.

Despite these developments, ECB Vice President Luis de Guindos expressed optimism earlier in the week that inflation would continue to decline, even as trade frictions linked to U.S. President Donald Trump’s tariffs remain a concern.

Inflation has come down significantly from its October 2022 peak of 10.6%, which followed a surge in energy prices triggered by Russia’s invasion of Ukraine. With price growth approaching the ECB’s 2% target, policymakers have begun shifting toward interest rate cuts in an effort to support the eurozone’s weakening economy.

Friday’s figures also showed a 3.5% annual decline in energy prices in April, compared to a 1.0% decrease in March. In contrast, prices for food, alcohol, and tobacco rose by 3.0%, slightly above the 2.9% increase recorded the previous month. Among major economies, inflation eased to 2.2% in Germany and 0.8% in France.