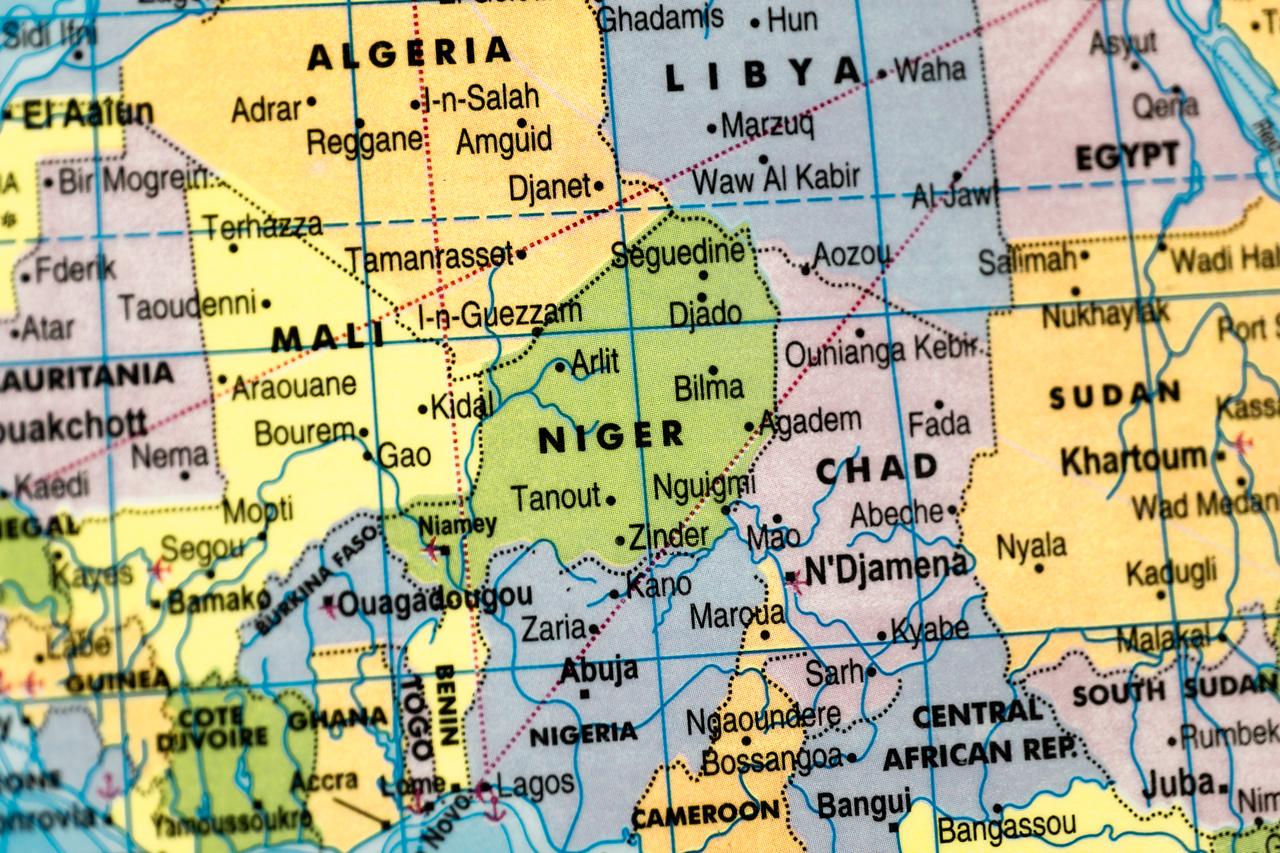

A silent revolution is unfolding across Africa’s coup belt. Military-led governments in Mali, Burkina Faso and Niger are tearing up the old rules of the game and tightening their grip over gold, uranium and critical minerals such as lithium, manganese and other transition-critical metals that feed global defense industries and green-tech supply chains.

In the name of sovereignty, they are forcing Western companies to accept new terms, while Chinese and Russian actors move rapidly into the vacuum. In this turbulence, one country faces a pivotal choice: Will Türkiye remain a marginal player, or turn the Sahel’s resource nationalism into a strategic opening?

The story of the Sahel since 2020 is often told through the lens of security: a chain of coups, the expulsion of French troops, and the rise of new military juntas. Yet the more decisive shift is happening in contracts rather than barracks.

Governments in Bamako, Ouagadougou and Niamey are rewriting mining codes, increasing mandatory state shares and demanding local value addition. Behind the rhetoric of sovereignty lies a hard calculation: decades of extraction left these states rich in resources yet poor in infrastructure, jobs and fiscal space.

Western firms, already wary of reputational and security risks, have started to scale back. When confronted with higher taxes or the threat of nationalization, many opt to divest or freeze investments. Beyond Orano’s suspended operations in Niger, several Canadian and Australian mid-tier mining firms have halted exploration activities in Mali amid stricter fiscal regimes and insurgency-related disruptions, reinforcing a broader retreat trend across the region.

This retreat creates room for others. Chinese companies arrive with capital, while Russian-linked entities offer regime protection. The Sahel is no longer a French backyard; it is a contested frontier of the global energy transition.

This new resource nationalism is not a temporary tantrum. It reflects a broader continental shift. The message from the Sahel is clear: the next cycle of extraction must look different, or it will not happen on the same terms.

Türkiye enters this scene with unusual advantages. It carries no colonial baggage, presents itself as a partner rather than a patron, and effectively combines diplomatic and security tools. Trade with Africa has climbed to nearly $40 billion, and Turkish Airlines has woven the continent into its global network.

Ankara’s Africa outreach rests on a multidimensional toolkit: high-level diplomacy, development assistance through TIKA, education exchanges, construction and health projects, humanitarian programs, expanding private-sector engagement and security cooperation. Over the past two decades, Ankara has opened dozens of embassies and built a solid reputation through these diverse initiatives.

Yet, in the Sahel’s mining politics, Ankara still behaves cautiously. Its presence is visible in construction and security, but less so in large-scale resource ventures. This caution reflects not only political and security risks in coup-prone environments but also concerns about regulatory uncertainty and possible sanctions exposure. It is further reinforced by the reality that entering high-risk mining environments requires long-term capital commitments, something Turkish investors traditionally approach more prudently.

Suppose Türkiye continues to prioritize selling drones and signing relatively generic trade agreements. It will risk stabilizing regimes whose minerals are still largely extracted and processed by others. Ankara would play the role of a valued security and economic partner, while Beijing and Moscow consolidate deeper control over the subsoil and high-value segments of the supply chain.

An alternative path exists. Türkiye can offer what the Sahel desperately seeks: a partner willing to share risk in creating local industry. This means joint ventures in refining, battery materials processing and technology transfer. It means keeping a meaningful share of value inside Sahelian economies.

Turning this possibility into reality requires strategic nerve and clear choices in Ankara.

First, Türkiye needs a distinct Sahel strategy. The region’s mix of threats and resources demands tailored instruments. Diplomatic missions and private investors must operate under a framework that privileges transparency and local ownership. Without alignment, any Turkish project risks being perceived as another external grab.

Second, Ankara should avoid responding only through a security lens. Providing drones is necessary but insufficient. Stability depends on whether local communities see real benefits: schools, clinics and jobs. Turkish firms that insist on community engagement would strengthen Ankara’s image as a responsible partner and complement the country’s broader diplomatic, humanitarian and economic outreach in Africa.

Third, Türkiye can use its role as a bridge. European capitals worry about critical minerals; African governments resent conditionalities. Ankara is positioned to convene trilateral dialogues that connect African producers, Turkish investors and European markets.

The most significant risk lies in hesitation. The Sahel’s political landscape is volatile, but the direction of resource policy is unmistakable. If Türkiye waits for perfect conditions, others will lock in long-term concessions.

The Sahel’s new resource nationalism is often portrayed as a threat. For Türkiye, it can be a rare opportunity to prove that a mid-level power can act differently and to extend its already expanding African engagement into higher-value industrial and mining partnerships.

History tends to remember who moved first when the map was still being drawn. If Ankara steps forward with strategic clarity, this decade could be remembered as the moment it turned its African presence into genuine strategic power. If it stands aside, the region will still change—only without Türkiye at the table where the real decisions are made.