Last week, Turkish markets saw significant price movements due to political and economic developments. The Borsa Istanbul index closed at 10,729, down by -4.95%. This decline also stood out as the “biggest weekly loss” since the week of March 19, when the corruption investigation into the Istanbul Metropolitan Municipality first began.

Last week, the cancellation of main opposition Republican People's Party’s (CHP) 2023 Istanbul Congress and August inflation data exceeding expectations with a figure above 2% reduced risk appetite.

On Sept. 2–3, the Central Bank of the Republic of Türkiye (CBRT) reserves fell by about $6.4 billion. On Sept. 4, the daily balance turned positive again by $300 million.

Türkiye’s two-year benchmark bond yield, which started last week at 38.93, tested above 41 during the week before closing at 40.78 on Friday. The USD/TRY exchange rate moved toward 41.24 with a limited 0.25% gain.

The numbers show that after the initial shock, markets shifted to a "wait-and-see" stance. At this point, when we look at "what lies ahead," two important dates emerge.

The first date is Sept. 11, 2025, the CBRT’s Monetary Policy Committee meeting will be held. A 300 basis-point cut had been expected from the CBRT’s September meeting. Following last week’s developments, expectations fell to 200 basis points.

U.S.-based JP Morgan and Morgan Stanley revised their interest rate cut forecasts from 300 basis points down to 200. According to a survey conducted by Anadolu Agency with the participation of 26 economists, the CBRT is also expected to cut its policy rate by 200 basis points, bringing it down to 41%.

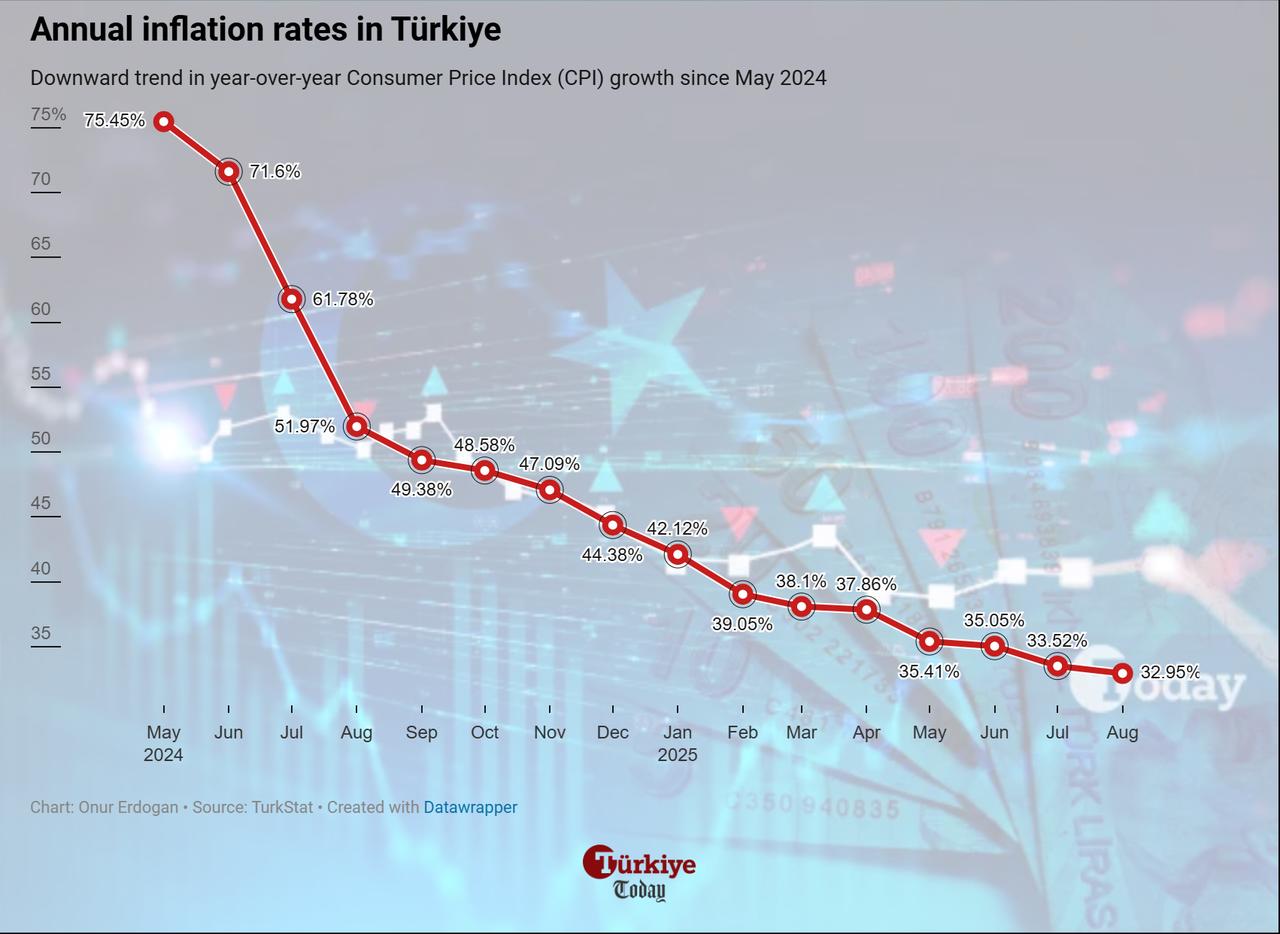

Although CPI exceeded expectations in August, annual inflation fell to 32.95%, maintaining its downward trend. The disinflation process and consequent rate cuts remain the main scenario in the market, with no concerns at this stage.

The second key date is Sept. 15, 2025, when a ruling is expected in the lawsuit seeking the annulment of the CHP congress. Legally, three outcomes are possible: a postponement to a later date, as in the first hearing; annulment of the congress; or dismissal of the case.

From the perspective of the markets, a decision that will "reduce or end political uncertainty" could be positive. In this case, dismissal or postponement of the case may be expected to have positive effects.

However, annulling the congress could mean greater uncertainty. Depending on developments, "new risks and new pricing trends" may come to the fore. Therefore, until this date, markets may shift to "a more cautious stance."