All eyes on Nvidia's earning report: Can AI demand sustain growth?

The stock price of Nvidia (Nasdaq: NVDA) is displayed on a mobile phone in Yichang, Hubei Province, China, May 23, 2024. (Reuters Photo)

August 28, 2024 11:04 AM GMT+03:00

Nvidia, a leading player in the AI revolution, is set to release its quarterly earnings this Wednesday, a report that could significantly influence its market valuation.

Investors are bracing for crucial insights as the company deals with a rapidly evolving market landscape, including fluctuating AI demand and potential delays in its next-generation chip production.

What’s driving Nvidia’s market volatility?

- Stock surge and sudden drop: Nvidia's market value skyrocketed nearly ninefold since late 2022 because of soaring AI demand, only to face a steep 30% decline after hitting a record high in June. This drop wiped out about $800 billion in market capitalization.

- Rebound amid uncertainty: Despite the downturn, Nvidia's stock has since recovered and is currently within 6% of its all-time high. The company’s ability to maintain its valuation heavily depends on sustained AI demand and its next moves in chip development.

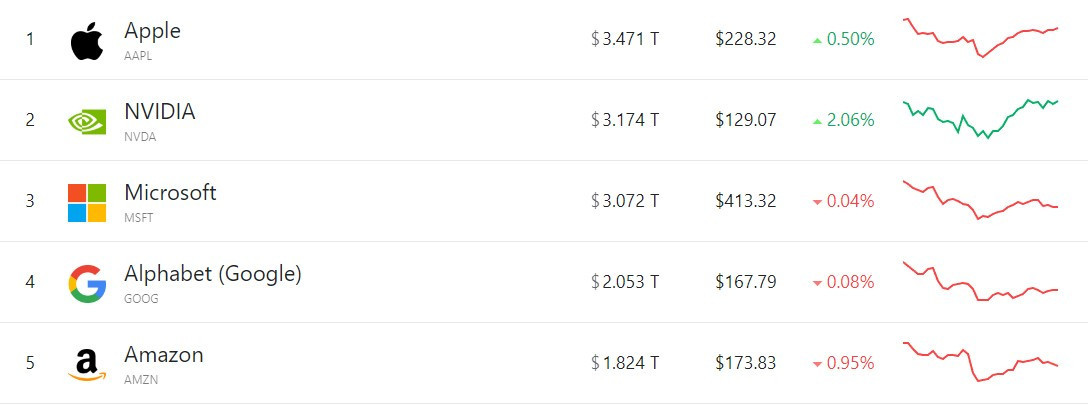

Nvidia is the world's second most valuable public company behind Apple with a market capitalization of $3.17 trillion, August 27, 2024. (Source: companiesmarketcap)

What do investors want to know about report?

- Focus on AI, cloud spending: Wall Street is particularly interested in the company’s performance in AI-driven sectors. Investors are closely watching for signs that major customers, such as cloud providers, are maintaining or cutting back on AI infrastructure spending.

- Potential risks: Any indication that AI demand is slowing or that cloud customers are tightening their budgets could lead to significant revenue impacts. As Eric Jackson of EMJ Capital notes, "If Nvidia fails to meet expectations, it could trigger a broader market correction."

What’s at stake in Nvidia's earning report?

- Hyperscale spending: Goldman Sachs analysts, who recommend buying Nvidia stock, note that the steep increase in hyperscale capital expenditures (capex) over the past 18 months has sparked concerns about its sustainability. This has left investors questioning whether the current level of AI infrastructure investment can be maintained.

- Fourth quarter of triple-digit growth: Nvidia’s revenue has tripled over the past three quarters, primarily driven by data center demand. Analysts expect another quarter of triple-digit growth, with projections suggesting a 112% increase to $28.7 billion. However, growth is expected to decelerate in the following quarters, with a projected rate of 75% for the October quarter, reaching $31.7 billion.

- Investor sentiment hangs in balance: A strong forecast could reinforce confidence that Nvidia’s core clients are committed to their AI investments. Conversely, a tepid outlook may raise red flags about overspending and future demand.

How are major customers responding?

- Ongoing commitments to AI: Despite some market concerns, Nvidia’s stock rallied nearly 10% in August, supported by positive customer commentary. Google, Meta, and other giants have underscored their commitment to Nvidia-based infrastructure, emphasizing that underinvestment in AI poses a greater risk than overextending.

- Broader industry perspective: Former Google CEO Eric Schmidt recently stated that tech companies need billions of dollars’ worth of processors, echoing sentiments of continued robust AI investment.

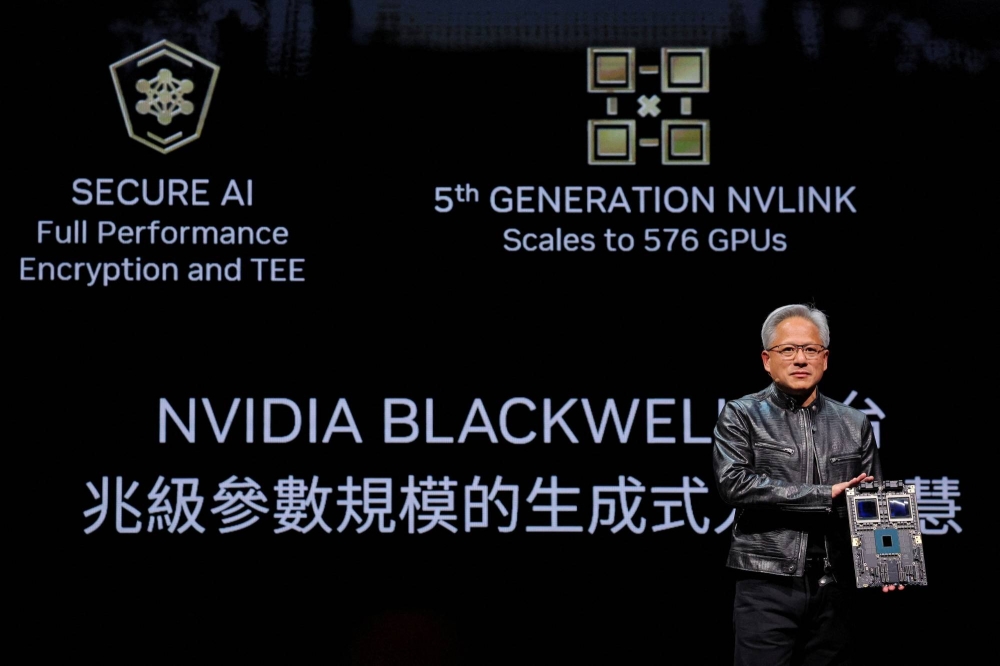

Nvidia CEO Jensen Huang presents the NVIDIA Blackwell platform at an event ahead of the COMPUTEX forum, in Taipei, Taiwan June 2, 2024. (Reuters Photo)

What is the ‘blackwell dilemma?’

- Delays in new chip production: Nvidia faces uncertainty regarding its next-generation AI chips, known as Blackwell. Reports suggest production issues could delay major shipments to early 2025, affecting Nvidia’s upgrade cycle and competitive positioning against rivals like AMD and new market entrants.

- CEO’s conflicting statements: Despite CEO Jensen Huang's earlier statements about significant Blackwell revenue in this fiscal year, potential delays could impact investor confidence. However, some analysts, like those at Morgan Stanley, believe that shifting demand to the current Hopper H200 chips could mitigate the impact.

What challenges, opportunities lie ahead?

- Profit margins: While Nvidia has seen expanding profit margins, questions remain about the long-term return on its high-cost AI processors. CFO Colette Kress has previously indicated that cloud providers could generate $5 in revenue for every $1 spent on Nvidia chips over four years, but more clarity is needed to reassure investors.

- Market competition: Nvidia continues to face intense competition from AMD, Google, and emerging startups, making its ability to deliver on both its current and next-generation products crucial for maintaining its market position.

What does Nvidia’s future hold?

Nvidia's earnings report will provide critical insights into AI demand trends, cloud customer spending, and the potential impact of new chip delays.

As the market awaits these results, Nvidia’s trajectory remains uncertain but highly influential in shaping the future of AI technology and investment.

August 28, 2024 11:04 AM GMT+03:00