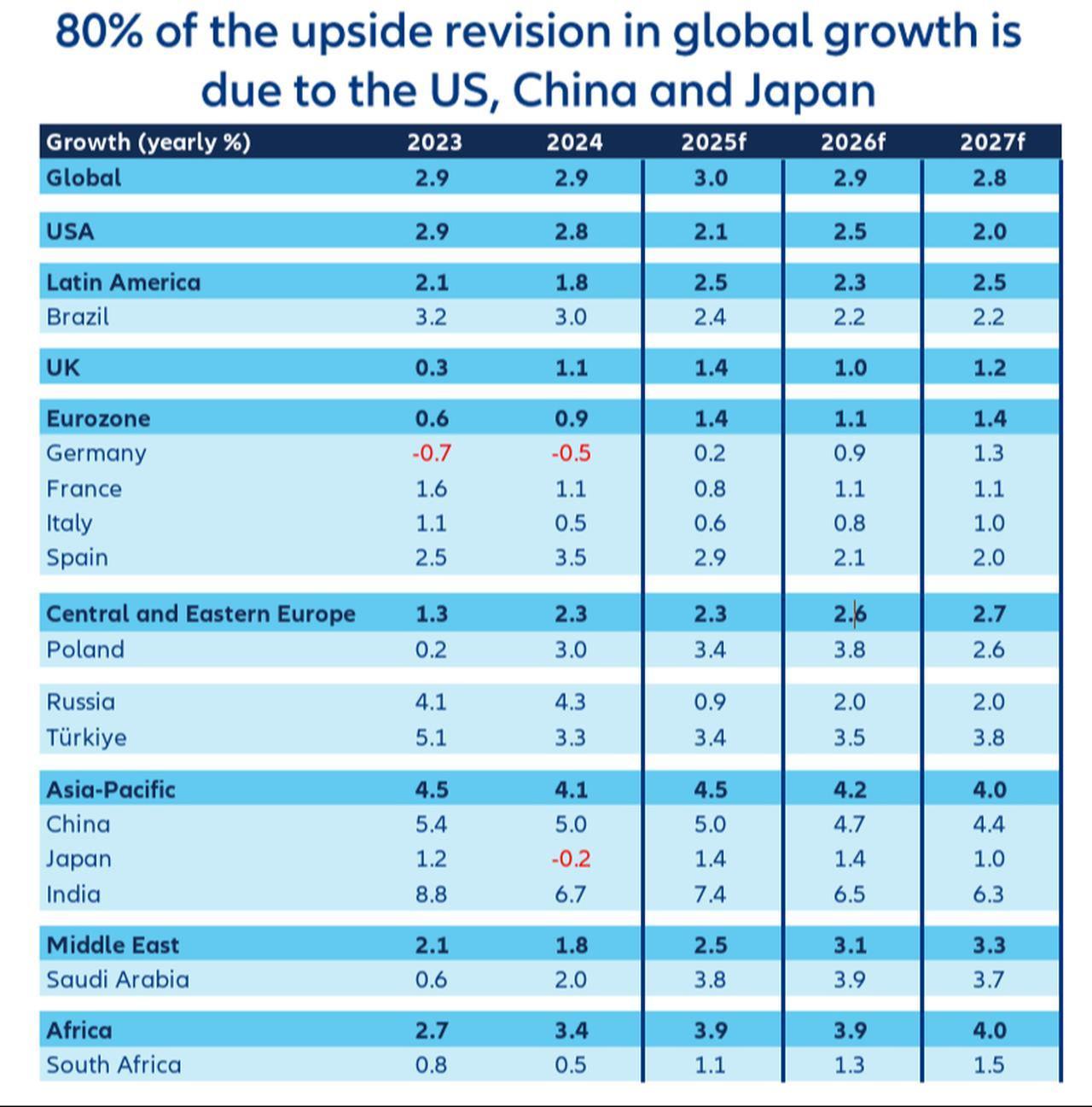

Türkiye’s economy is projected to grow by 3.4% in 2025 and 3.5% in 2026, before accelerating to 3.8% in 2027, supported by resilient domestic demand and sustained economic activity, according to Allianz Trade.

As per the German insurance group's final Economic Outlook Report for 2025, the Turkish economy continues to operate close to its potential, although inflation remains high. However, price growth is expected to ease gradually, reaching 35% by the end of 2025, 25.1% in 2026, and 15.7% in 2027.

The forecasts for 2025 are higher than the government’s Medium-Term Program for growth but lower for inflation, which the program projects at 3.3% and 28.5%, respectively.

At the global level, Allianz Trade forecasted real GDP growth of 3% in 2025, followed by 2.9% in 2026 and 2.8% in 2027. The report highlighted continued economic resilience in major economies such as the United States and China, noting that the negative effects of trade tensions had begun to fade.

In the United States, consumption proved more robust than expected, supported by easier credit conditions and the emerging economic contributions of artificial intelligence. As a result, U.S. GDP growth likely stood at 2.1% in 2025, while the forecast for 2026 was revised upward to 2.5%.

China’s economy exceeded expectations in 2025, driven by stronger external demand, a weaker currency, and strategic export re-routing to bypass tariffs. These factors allowed China to expand its global market share while curbing imports, with growth projected at 5% for 2025 and 4.7% for 2026.

In contrast to the U.S. and China, the euro area was projected to grow more slowly. Allianz Trade expected the eurozone to expand by 1.4% in 2025 and 1.1% in 2026. Structural challenges, including weak investment and demographic constraints, continued to weigh on the region’s growth prospects.

Within the bloc, Germany was forecast to grow by 0.9% in 2026, while France was expected to post a 1.1% increase, supported by a recovery in investment despite ongoing political uncertainty.

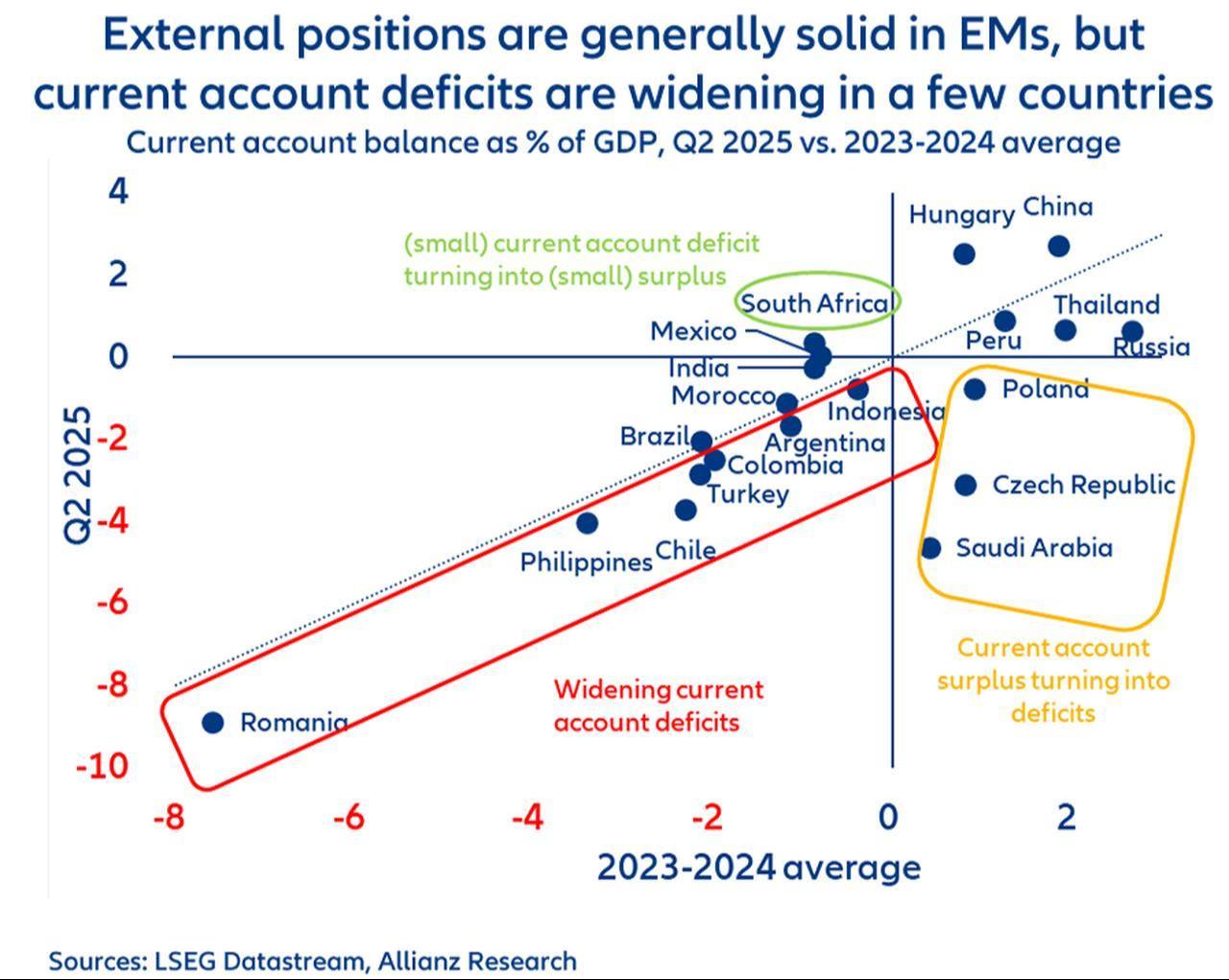

The report identifies diverging trajectories among emerging markets. While many countries continue to benefit from a relatively favorable global cycle and maintain strong external positions, others face growing imbalances.

Türkiye is among several countries, including Argentina, Chile, Colombia, Indonesia, the Philippines, and Romania, where current account deficits are projected to widen further. In contrast, countries such as Saudi Arabia, the Czech Republic, and Poland have seen previous surpluses turn into deficits, prompting the need for closer monitoring of external balances.

The report also notes that a weakening U.S. dollar and the Federal Reserve’s ongoing easing cycle in 2025 have allowed many emerging market central banks to implement more rate cuts than previously expected.

It also highlighted three categories of risk that could affect the global outlook moving into 2026. First, institutional risks such as the erosion of central bank independence, rising protectionism, and election-driven policy shifts could increase uncertainty in key markets. Second, geopolitical tensions and national security priorities may continue to generate volatility.

Lastly, financial risks are expected to intensify, including the potential for corrections in AI-driven equity markets, renewed dollarization pressures, turbulence in private credit markets, and concerns over public debt sustainability.

According to the report, these factors could test the limits of what it calls a "late and moderate financial cycle" as 2026 progresses.