Türkiye revised its gross domestic product (GDP) growth projection for 2025 to 3.3%, down from the previous plan’s target of 4%, according to the updated Medium-Term Program (OVP) for 2026–2028. The inflation target is also revised upward to 28.5% for the year-end from 17.5%, aligning with the Turkish central bank's latest projections.

The new program, prepared by the Treasury and Finance Ministry together with the Presidency’s Strategy and Budget Directorate, sets out the country’s key macroeconomic targets, policy priorities, and fiscal framework for the next three years.

The plan projects for the economy to expand by 3.8% in 2026 and 4.3% in 2027, compared with the earlier program’s higher targets of 4.5% and 5%, respectively. The target for 2028 is set at 5%.

The Turkish economy grew 3.3% in 2024, reaching ₺44.58 trillion ($1.36 trillion) in gross domestic product in current prices, official figures show.

Inflation targets are raised to 16% from 9.7% for 2026 and 9% from 7% for 2027, while it is set at 8% for 2028.

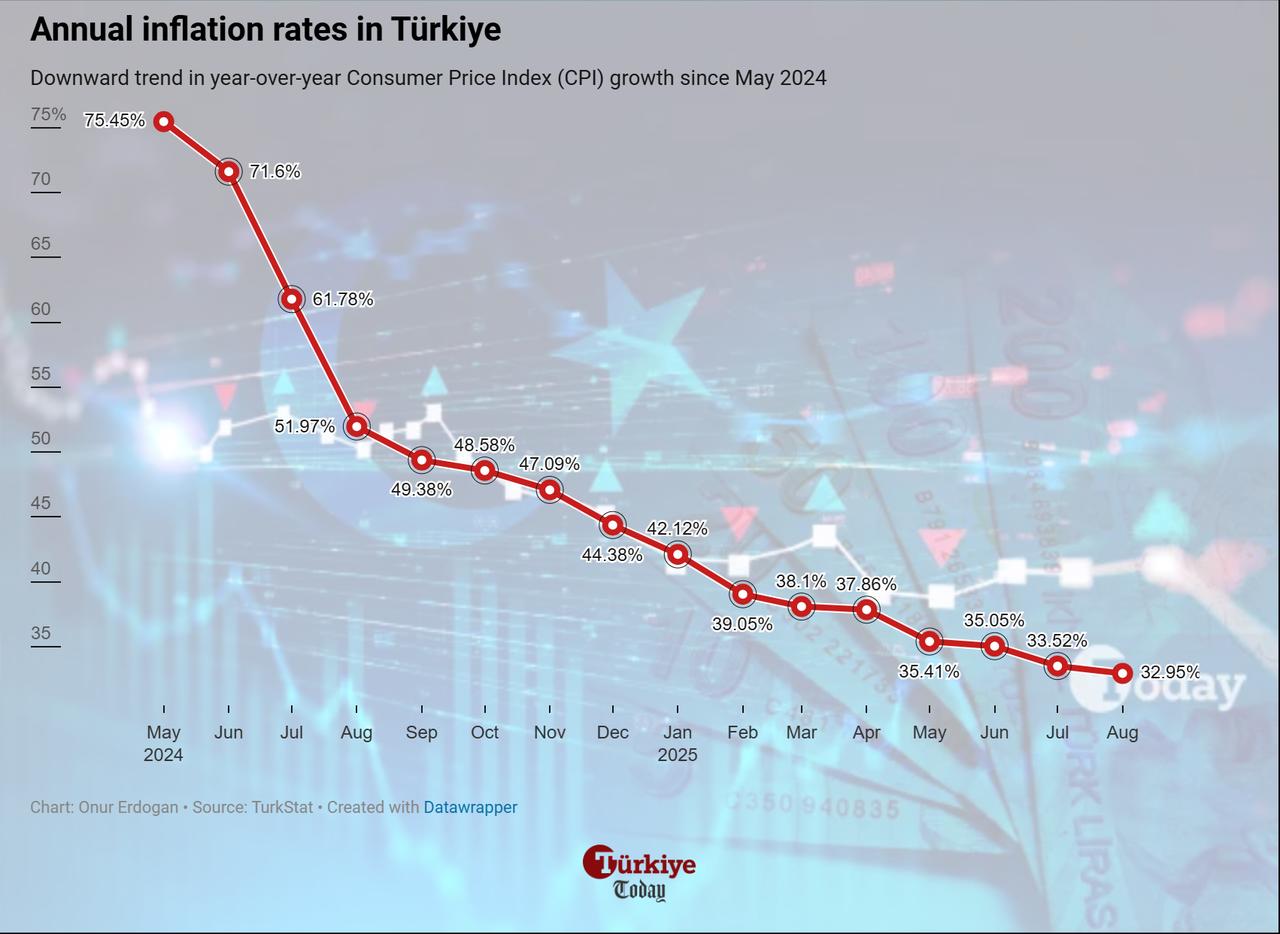

Türkiye's inflation sustained its decline trend for the 15th consecutive month in August, sliding to 32.9% from its May 2024 peak of 75.5%.

Unemployment is forecast at 8.5% at the end of 2025, gradually easing to 8.4% in 2026, 8.2% in 2027, and 7.8% in 2028. The previous program had assumed higher levels, setting the jobless rate at 9.6% for 2025, falling to 9.2% in 2026 and 8.8% in 2027.

Türkiye's unemployment rate declined to 8% in July, one of the lowest levels over the decade.

The budget balance-to-GDP ratio is projected at minus 3.5% in 2026, narrowing to minus 2.8% by 2028. In the earlier framework, the target had been slightly tighter, with a ratio of minus 3.1% in 2025 and minus 2.5% by the end of 2027.

Most recently, the ratio stood at minus 4.9% in 2024.

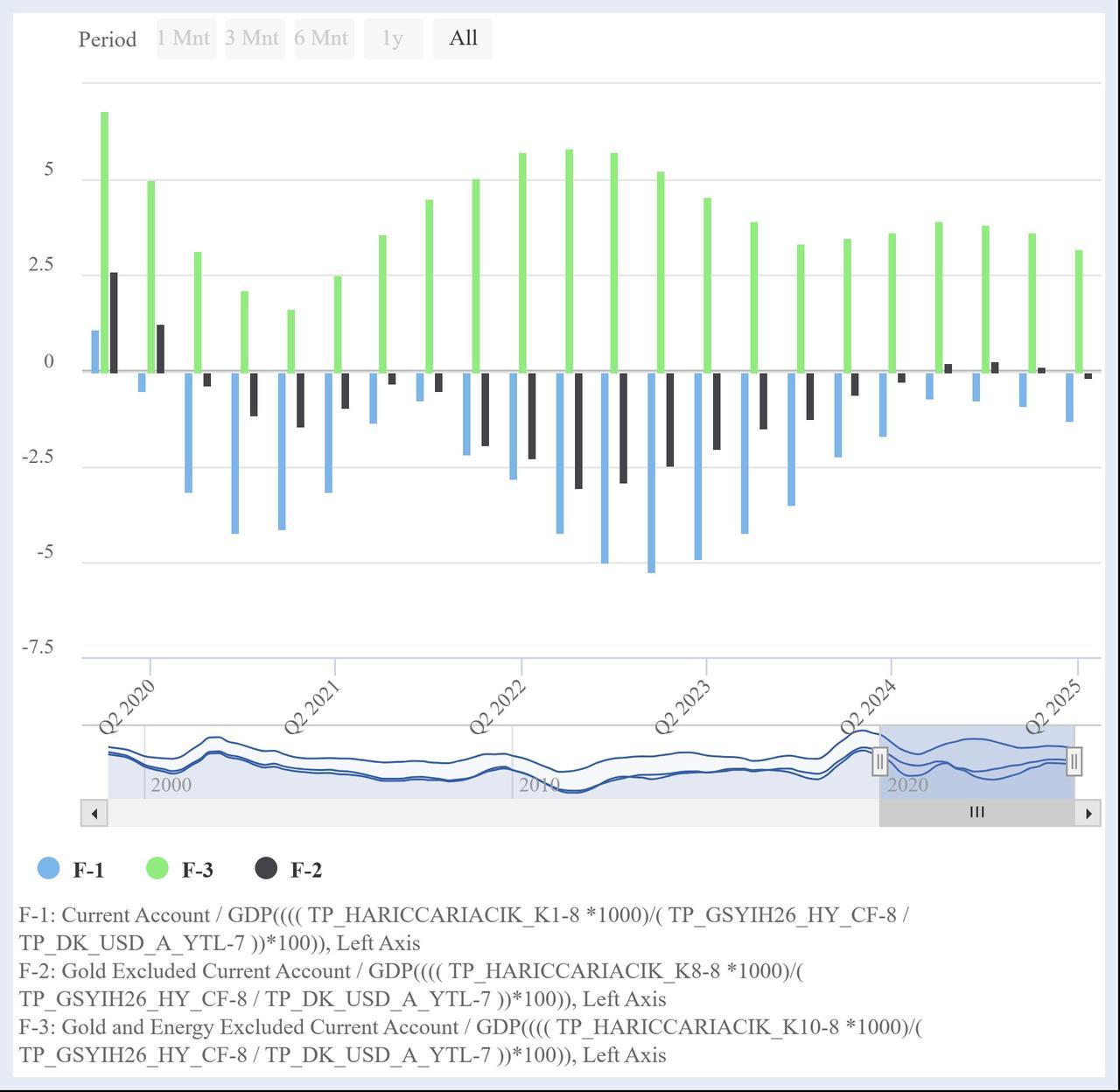

The current account balance-to-GDP ratio has been revised to minus 1.4% from minus 2% for 2025, to minus 1.3% from minus 1.6% for 2026, and to minus 1.2% from minus 1.3% for 2027. The target is set at minus 1% for 2028.

As of the second quarter of 2025, the ratio stood at minus 1.29%.

The new program also sees slightly lower momentum in foreign trade, with exports projected at $273.8 billion in 2025, down from the earlier target of $279.6 billion. Imports are forecast at $367 billion for 2025—compared with the previous projection of $369 billion.

Türkiye's annualized export and import figures rose to $269.2 billion and $340.5 billion as of August 2025, according to the latest official figures.

For 2026, exports are now set at $282 billion versus the earlier target of $296.1 billion, while imports are expected at $378 billion instead of $390.6 billion.

In 2027, exports are projected at $294 billion compared with the earlier figure of $319.6 billion, and imports at $393 billion against the previous forecast of $417.5 billion.

The target for 2028 is $308.5 billion in exports and $410.5 billion in imports.

The program was presented at a press conference held on Monday at the Presidential Complex in Ankara, with the attendance of the economic board, including Vice President Cevdet Yilmaz, Treasury and Finance Minister Mehmet Simsek, and Central Bank Governor Fatih Karahan.

Vice President Yilmaz said Türkiye entered a "continuous disinflation process" in June 2024 that is expected to persist through the year. He pointed to stronger buffers, noting, "Gross reserves increased by about $80 billion, reaching $178.4 billion at the end of August, strengthening confidence in our economy."

Yilmaz said that by the end of the program period, Türkiye is expected to rank as the world’s 16th and Europe’s sixth-largest economy, with national income approaching $1.9 trillion, per capita GDP rising to $21,000, and tourism revenues reaching $75 billion.

He also stressed the impacts of shifting global trade dynamics, noting that weak growth is being weighed down by rising protectionism and that the Russia-Ukraine war has been one of the main sources of global inflationary pressure.

Yilmaz added that employment is not only an economic indicator but also a key element of inclusive development, and reaffirmed that "fighting inflation, the main priority of Turkiye’s economy, will continue with determination."

Treasury and Finance Minister Mehmet Simsek also reaffirmed that disinflation and fiscal discipline remain the government’s top priorities. Pointing to the scope of austerity efforts, Simsek said, "We cut expenditures by about 33% thanks to the savings circular."

He also addressed rising interest payments in the central government budget, arguing that they stem from earthquake-related borrowing rather than fiscal mismanagement. "The increase in interest spending is not due to irresponsibility but because we borrowed to heal the wounds of the earthquake," he stated.

Simsek pointed to improved resilience, noting that Türkiye’s reserve adequacy ratio, as defined by the IMF, rose to 1.13 from 0.71 before the program, above the 1.0 threshold considered sufficient. "The program has passed a major stress test successfully," he said, adding that the economy remains durable against external shocks.

A research note by Kuveyt Turk Yatirim described the new Medium-Term Program as a roadmap that balances fiscal discipline with growth and provides predictability for both the public and private sectors.

On inflation, the report emphasized that the program foresees a coordinated policy mix bringing rates back to single digits. "Thanks to strong coordination in monetary and fiscal policy, the long-term goal is to return to single-digit inflation," it said.

Beyond macro targets, the bank underlined the program’s structural priorities, noting "Supporting disinflation, maintaining fiscal discipline, promoting green and digital transformation, strengthening human capital, expanding R&D, and encouraging formal employment stand out among the key policy areas."