Bitcoin topped its historic high of $111,000. Bitcoin is currently trading at $118,052, driving the rise of dozens of altcoins as well.

Factors driving this price increase include increased demand for bitcoin ETFs, positive corporate purchases of bitcoin treasury assets, and the macroeconomic environment. As U.S. market makers shift toward a crypto-friendly stance, both individual investors and institutions have increased their interest in bitcoin. At the same time, the year-to-date decline in the dollar index approached 10%, falling to 97.79, prompting many institutions to seek safe-haven assets and increasing risk appetite for cryptocurrencies.

Altcoins also benefited from bitcoin's rise. The total cryptocurrency market value increased by 3.62% in 24 hours, reaching $3.52 trillion. Major altcoins such as ethereum, BNB, and XRP continued their upward trend. Ethereum gained 8.30% in value over the past 24 hours and is currently trading at the $3,000 level.

This rise is paralleled by the crypto market cap and USDT.D (USDT dominance) graphs. The USDT.D graph shows us the ratio of USDT dominance in the total market. If USDT.D is rising, it means that people are turning to USDT and the market is generally in a downward trend, but if USDT.D is falling, it means that people are investing in USDT assets. There is an inverse parallelism between the bitcoin chart and the USDT.D chart.

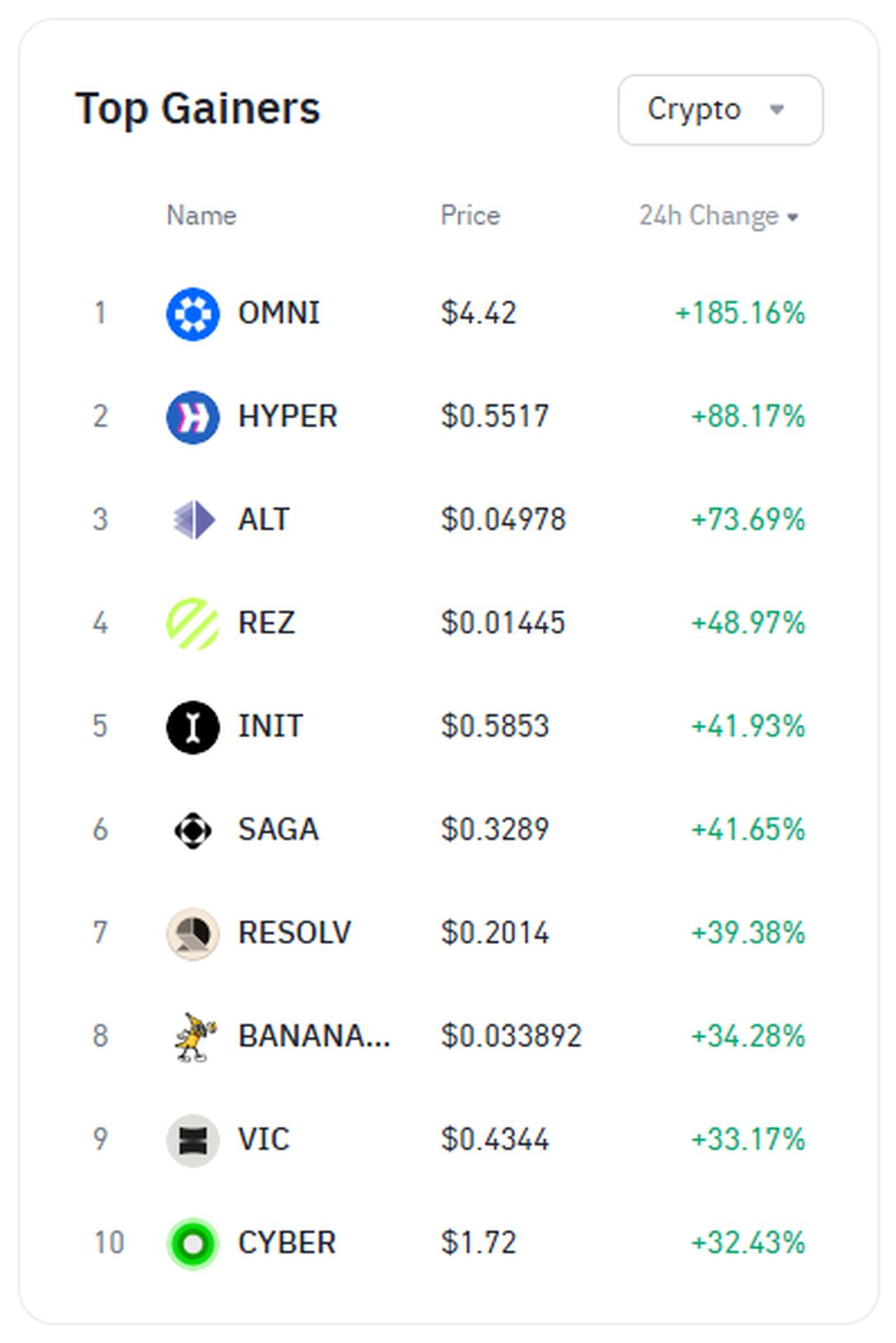

Alongside bitcoin, some altcoins have seen huge gains on the Binance exchange.

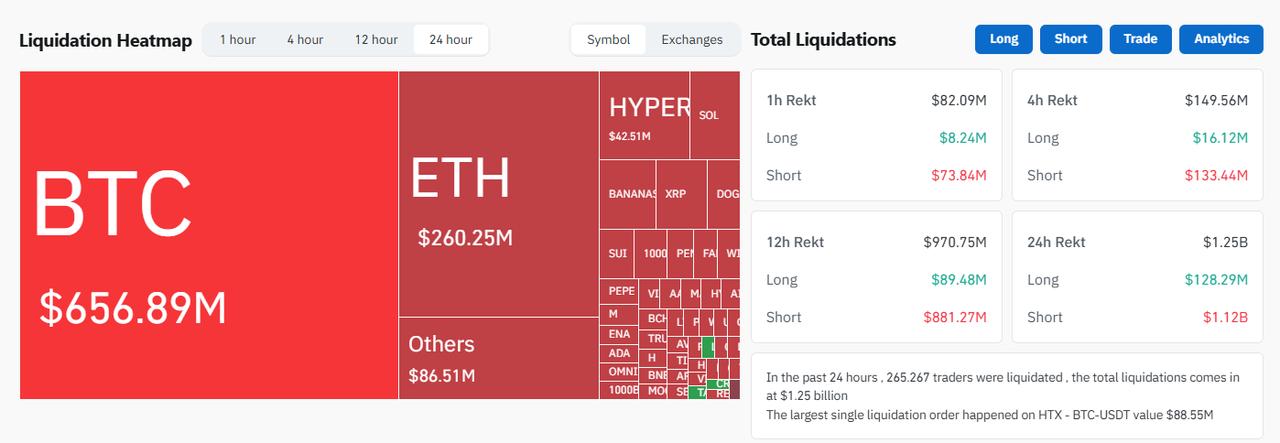

Around 232,000 traders were liquidated in the past 24 hours as the crypto market surged to fresh highs. Bitcoin's rally to a new all-time high on Thursday caught short-sellers off guard, wiping out over $1 billion in short positions in just 24 hours.

Data from CoinGlass shows that about 232,000 traders were liquidated, with bitcoin shorts making up $656 million of the total and Ether shorts adding another $260 million.

Bitcoin’s climb to $118,000 has lit up the entire crypto market. Altcoins are rallying, over 230,000 traders got liquidated, and more money is flowing in as investors gain confidence. With growing demand for bitcoin ETFs, corporate buys, and a weaker dollar, it feels like a new wave of excitement is building. The bulls are back—and this time, they’ve brought friends.