Bank of America (BofA) projects that Türkiye’s economy will continue to expand steadily, with gross domestic product (GDP) expected to grow by 3.7% in 2025 and accelerate to 4.3% in 2026.

The forecasts, released by BofA Global Research, are broadly in line with the Turkish government's own expectations, which place GDP growth at 3.3% in 2025 and 3.8% in 2026, according to its Medium-Term Program for 2026–28.

The bank also noted that Türkiye’s inflation is expected to fall to 24% by end-2026, down from 30.89% in 2025, though the government aims for 16%.

BofA estimated that Türkiye’s budget deficit will reach 2.9% of GDP in 2025 and widen slightly to 3.1% in 2026, figures that align with the government’s official projection for 2025 but remain below its 2026 target of 3.5%.

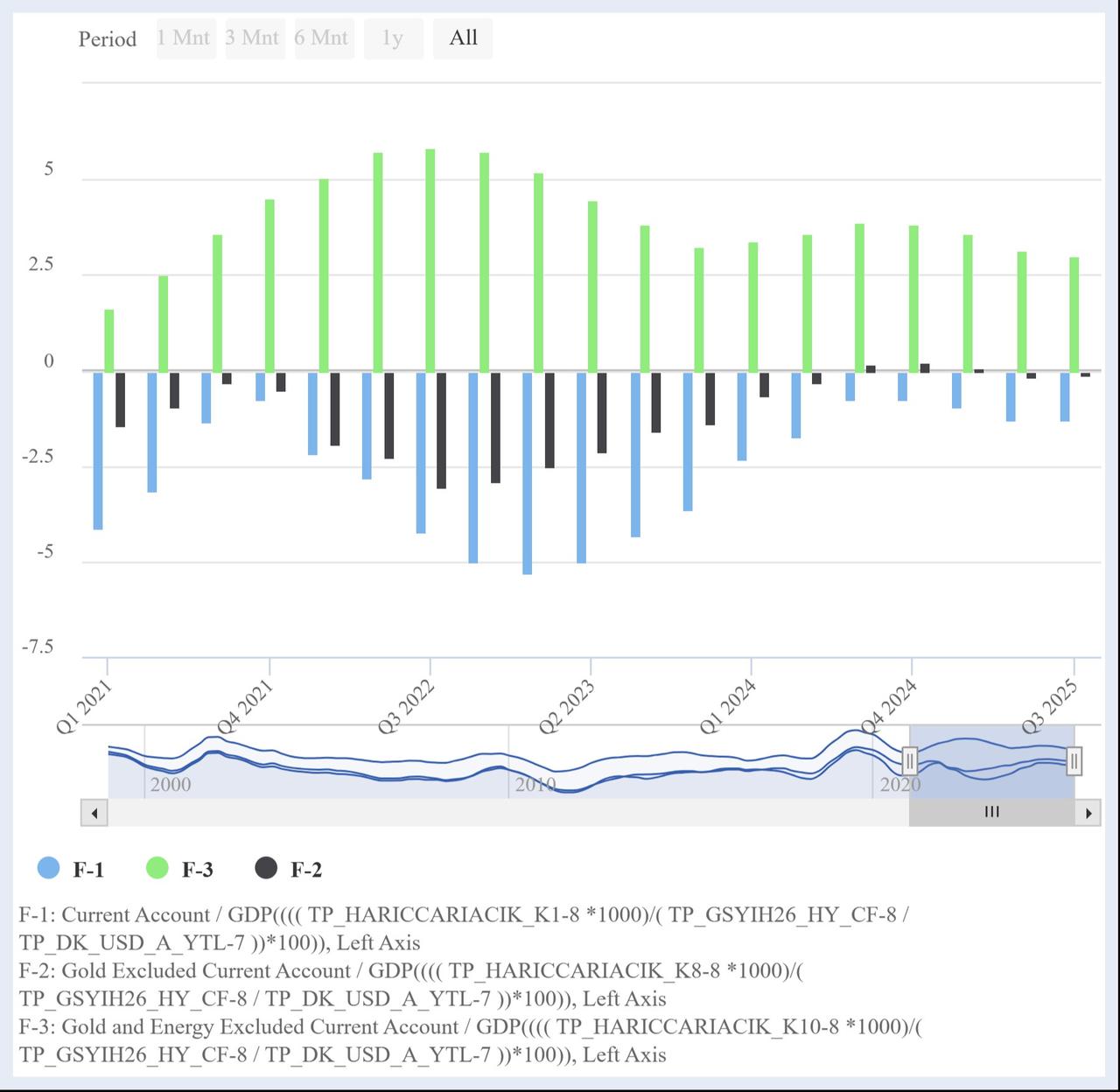

The report also forecasts a modest widening in the current account deficit, from an estimated 1.5% of GDP in 2025 to 1.7% in 2026, both exceeding the government’s projections of 1.4% for 2025 and 1.3% for 2026.

As of the third quarter, Türkiye’s current account deficit stood at 1.51% of GDP, while the budget deficit was 2.7% and is expected to reach around 2.9% by year-end.

The Central Bank of the Republic of Türkiye (CBRT) is expected to continue its monetary easing cycle through 2026, with projections pointing to a reduction in the key policy rate to 30.0% by year-end, the bank noted.

The easing cycle began in late 2025, with the central bank cutting rates in four consecutive Monetary Policy Committee (MPC) meetings, bringing the policy rate down to its current level of 38%.

Following stronger-than-expected inflation data, Turkish market participants now forecast a 150-basis-point cut at the upcoming MPC meeting scheduled for Thursday, Jan. 22.