China’s economy expanded by 5% in 2025, meeting the government’s growth target despite mounting pressure from weak domestic demand, a prolonged slump in the property sector, and renewed trade tensions with the U.S.

Official figures released by the National Bureau of Statistics (NBS) on Monday showed the gross domestic product (GDP) exceeded 140 trillion yuan for the first time, surpassing the equivalent of $20 trillion. The expansion matches the previous year’s growth rate of 5.2%, but remains among the slowest rates recorded in recent decades.

Industrial output, a key gauge of manufacturing activity, rose by 5.9% in 2025, a slight deceleration from the prior year.

In contrast, fixed asset investment, which includes infrastructure, machinery, and equipment, declined by 3.8% year-on-year, with the property sector showing sustained weakness. Real estate investment plunged 17.2%, posting the third consecutive annual drop and underscoring continued challenges in the sector.

Retail sales, often used as a barometer for household consumption, grew 3.7% last year, down from 4% in 2024. Despite government efforts to stimulate domestic demand, including subsidies for replacing old household goods, consumer sentiment remained subdued.

Officials reiterated their commitment to consumption-driven stimulus measures in 2026, including trade-in schemes for household appliances and removing restrictions across various consumption sectors.

"The gradual implementation of policies to clear unreasonable restrictions in the consumption sector will support consumption growth," said NBS official Kang Yi.

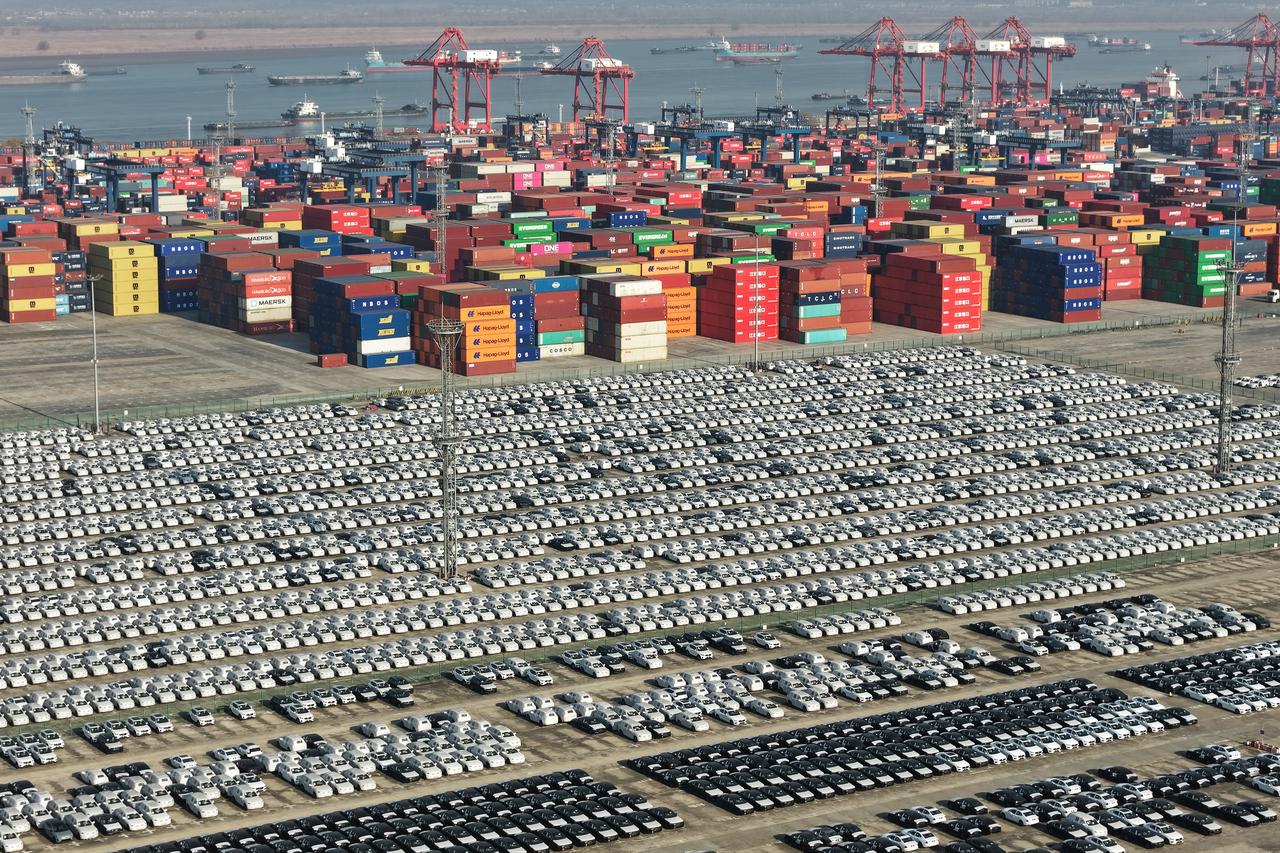

The data reflect a year in which strong export performance, totaling 26.99 trillion yuan ($3.87 trillion), helped offset domestic economic weaknesses. As a result, China’s trade surplus rose to $1.2 trillion in 2025, surpassing the $1 trillion mark on an annual basis for the first time.

The revival of a U.S.-China trade war in 2025, following Donald Trump’s return to the White House, introduced fresh volatility. While Chinese exports to the United States fell 20% last year, Beijing’s exports to other regions surged.

Shipments to the Association of Southeast Asian Nations (ASEAN) grew 13.4% annually, exports to Africa jumped 25.8%, and those to the European Union rose 8.4%. Imports from the EU, however, declined during the same period.

Despite mounting tariffs and economic friction, China’s export engine proved resilient, helping stabilize overall growth.

The Chinese economy grew by 4.5% in the final quarter of 2025, aligning with expectations but pointing to waning momentum. Unemployment remained elevated at 5.2% by year-end, while consumer and business confidence appeared weak.

“The impact of changes in the external environment has deepened,” Kang acknowledged. “The domestic contradiction of strong supply and weak demand is prominent, and there are still many old problems and new challenges in economic development,” he said.

With structural challenges persisting, policymakers are expected to maintain fiscal easing into 2026, when China will release its next Five-Year Plan outlining economic and social goals through 2031. Key obstacles include industrial overcapacity, weak corporate profits, a subdued property market, and rising local government debt. Earlier statements from the Finance Ministry and central bank point to likely monetary easing.

However, a recent report by S&P Global projected that China’s GDP growth will slow to 4.4% in 2026 and 4.3% in 2027, down from estimated growth of 4.8% in 2025 and 5.0% in 2024, due to sluggish domestic demand and deteriorating export growth.