The European Central Bank (ECB) decided Thursday to keep its three key interest rates unchanged, maintaining its cautious stance as the eurozone economy recorded a modest 0.2% growth in the third quarter of 2025 compared to the previous quarter.

The ECB’s Governing Council announced that it will maintain all three key policy rates at their current levels—2% for the deposit facility, 2.15% for the main refinancing operations, and 2.4% for the marginal lending facility.

The decision marks the third consecutive meeting in which the central bank has opted for stability, signaling a wait-and-see approach after a series of rate adjustments earlier in the year.

In its statement, the ECB said inflation across the euro area has moved close to its 2% medium-term target, while incoming data suggest that price pressures continue to ease gradually. However, policymakers noted that the inflation outlook remains uncertain due to persistent geopolitical tensions, fluctuating energy prices, and weaker global trade conditions.

The central bank reaffirmed that future decisions will depend on new economic and financial data, including the evolution of core inflation, wage dynamics, and the transmission of past rate cuts into the broader economy. "The Governing Council is determined to ensure that inflation stabilizes at its 2% target in the medium term and will continue to follow a data-dependent, meeting-by-meeting approach," the statement said.

The council emphasized that it is not pre-committing to any particular rate path, leaving room to adjust course as new data emerge.

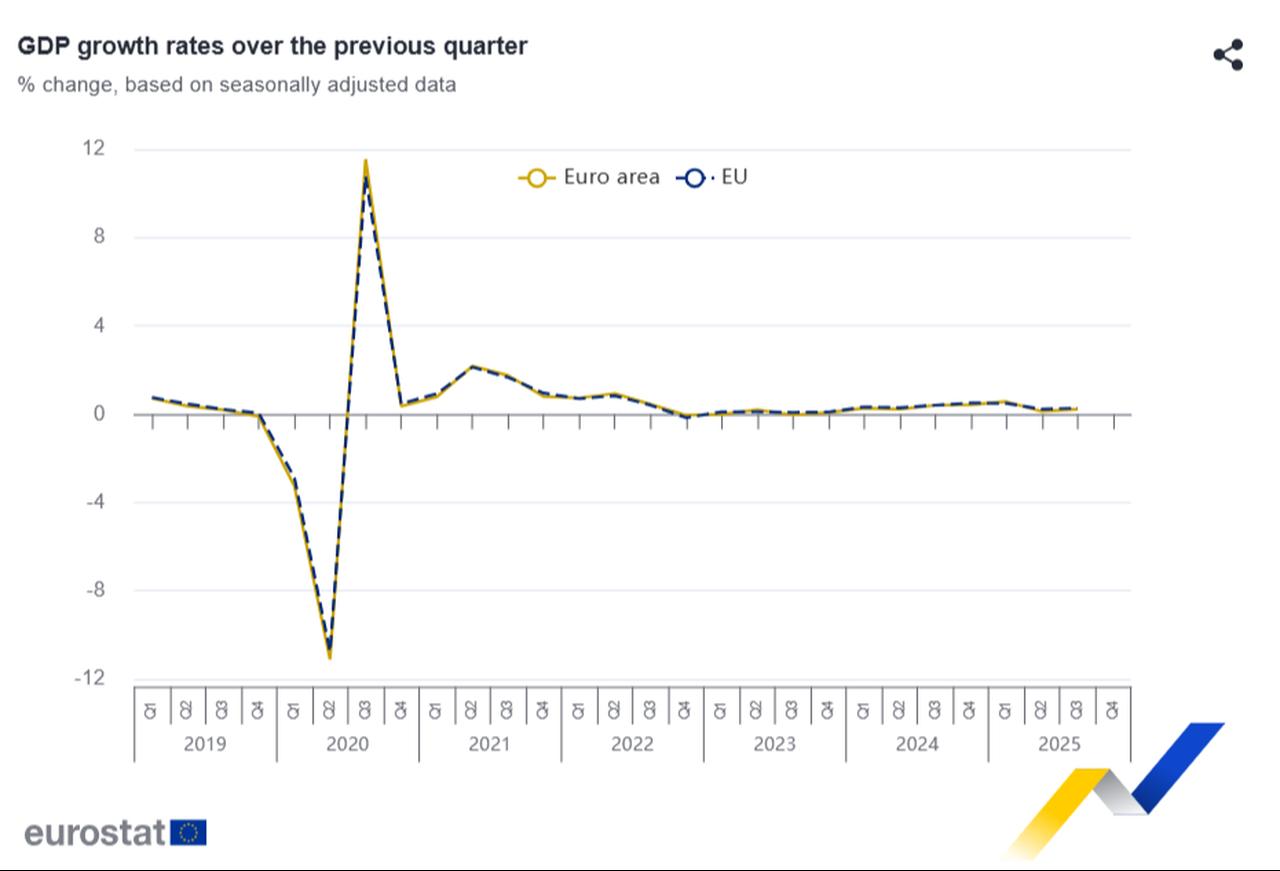

According to Eurostat, the eurozone’s 20-member economy expanded by 0.2% between July and September, following 0.1% growth in the second quarter. The broader European Union, which includes seven additional countries, grew by 0.3% in the same period, up from 0.2% in the previous quarter.

The moderate expansion was supported by stronger-than-expected output in France and Spain. France’s gross domestic product rose 0.5% in the third quarter, despite ongoing political and fiscal challenges, while Spain’s economy expanded 0.6%, easing slightly from 0.8% in the previous quarter.

Germany and Italy—the eurozone’s first and third-largest economies—both saw stagnant output over the same period, though Germany narrowly avoided a recession.

Among smaller economies, Sweden led growth with a 1.1% quarterly increase, followed by Portugal at 0.8% and Czechia at 0.7%. Lithuania recorded the steepest contraction at 0.2%, while Ireland and Finland both slipped by 0.1%.

On an annual basis, eurozone GDP was up 1.3% in the third quarter compared with a year earlier, while the European Union as a whole recorded 1.5% growth.

In its September projections, the ECB had forecasted that the eurozone economy would expand by 1.2% in 2025.