The eurozone economy expanded more than expected in the first quarter of 2025, according to official figures released on Wednesday, defying headwinds from U.S. President Donald Trump's tariff measures.

However, economists warn that ongoing global trade tensions could weigh heavily on growth prospects for the remainder of the year.

Eurostat, the European Union’s statistics agency, reported that the 20-nation eurozone saw its gross domestic product (GDP) grow by 0.4% from the previous quarter.

This result surpassed analysts’ expectations of 0.2%, as estimated by Bloomberg, and followed 0.2% growth in the final quarter of 2024.

The broader 27-member European Union recorded a quarterly growth of 0.3%, down slightly from 0.4% in the previous three-month period.

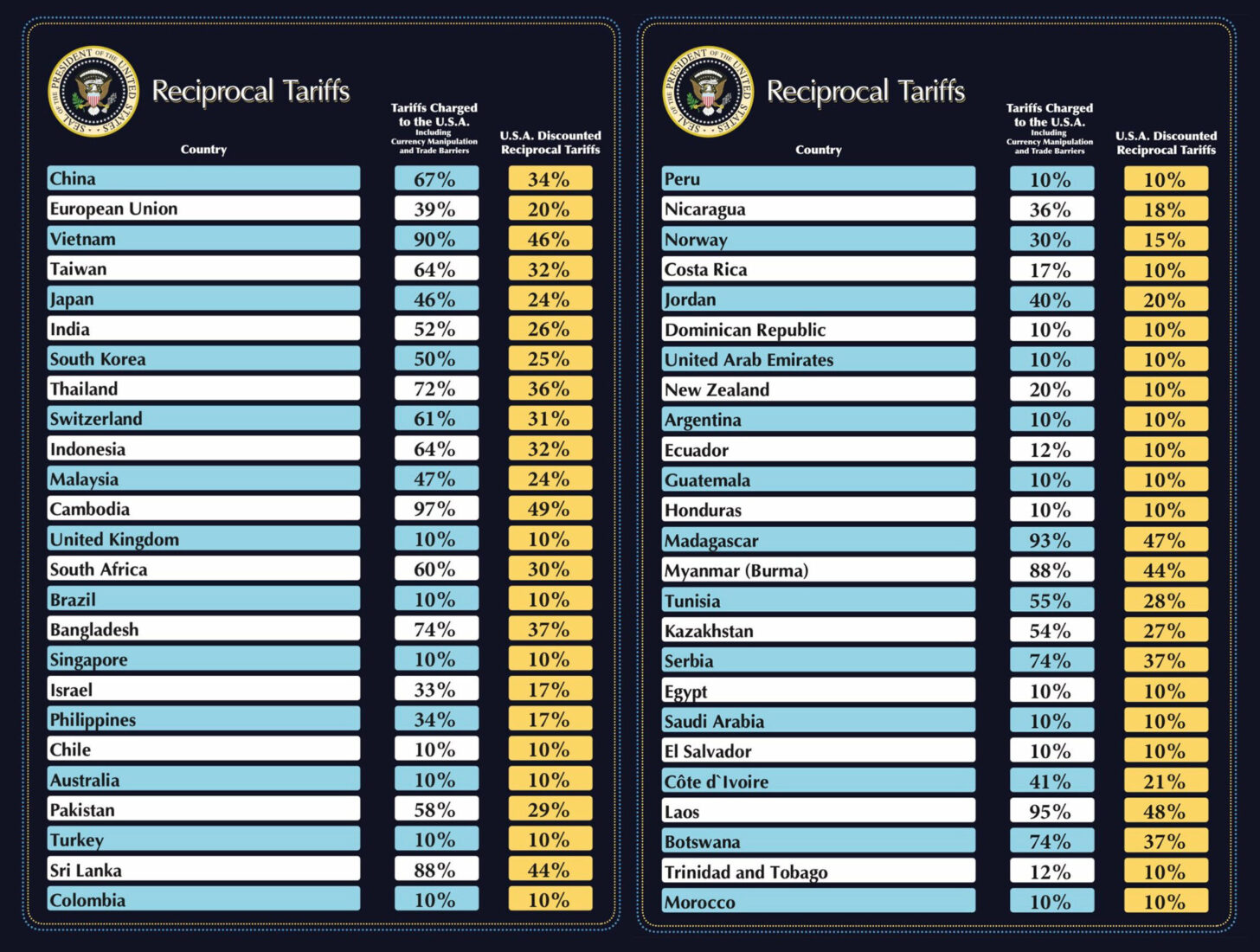

The stronger-than-anticipated performance appears to be partly driven by companies accelerating shipments to the United States in anticipation of higher import tariffs. President Trump imposed a 20% tariff on most European goods on April 2 but later announced a 90-day pause.

Nevertheless, a 10% baseline tariff remains in place, and unless Washington and Brussels reach a new agreement, the steeper tariffs are set to take effect, raising the risk of a full-scale trade war.

Besides these levies, Trump's administration has maintained 25% tariffs on European steel, aluminum, and automobile imports.

"The economy started the year on a stronger footing than we expected and what activity surveys had indicated," said Franziska Palmas, Senior Europe Economist at Capital Economics.

"However, we still anticipate a sharp slowdown in the second half of the year, as the April tariffs begin to affect trade and any benefits from Germany's planned fiscal stimulus are unlikely to materialize before next year."

Many European exporters increased shipments to the United States early in the year to avoid upcoming tariffs.

Ireland, in particular, saw its exports to the U.S. surge by 210% in February, reaching nearly €13 billion ($14.8 billion), with pharmaceuticals and chemical ingredients accounting for the vast majority.

Palmas noted that part of the eurozone’s strong quarterly performance can be attributed to Ireland’s 3.2% quarter-on-quarter GDP growth, though she emphasized that the country’s figures tend to be highly volatile and were likely amplified by front-loading ahead of U.S. trade restrictions.

The eurozone has struggled with sluggish growth for the past two years, hindered largely by elevated energy prices following Russia’s invasion of Ukraine in 2022.

Earlier this month, the International Monetary Fund downgraded its annual growth forecast for the eurozone by 0.2 percentage points, predicting the region would grow by just 0.8% in 2025 due to expected fallout from trade tensions with the United States.

Among major eurozone economies, Spain posted the strongest quarterly growth at 0.6%, while France grew by just 0.1% amid political instability and planned fiscal tightening. Germany, the bloc’s largest economy, expanded by 0.2%, slightly above forecasts.