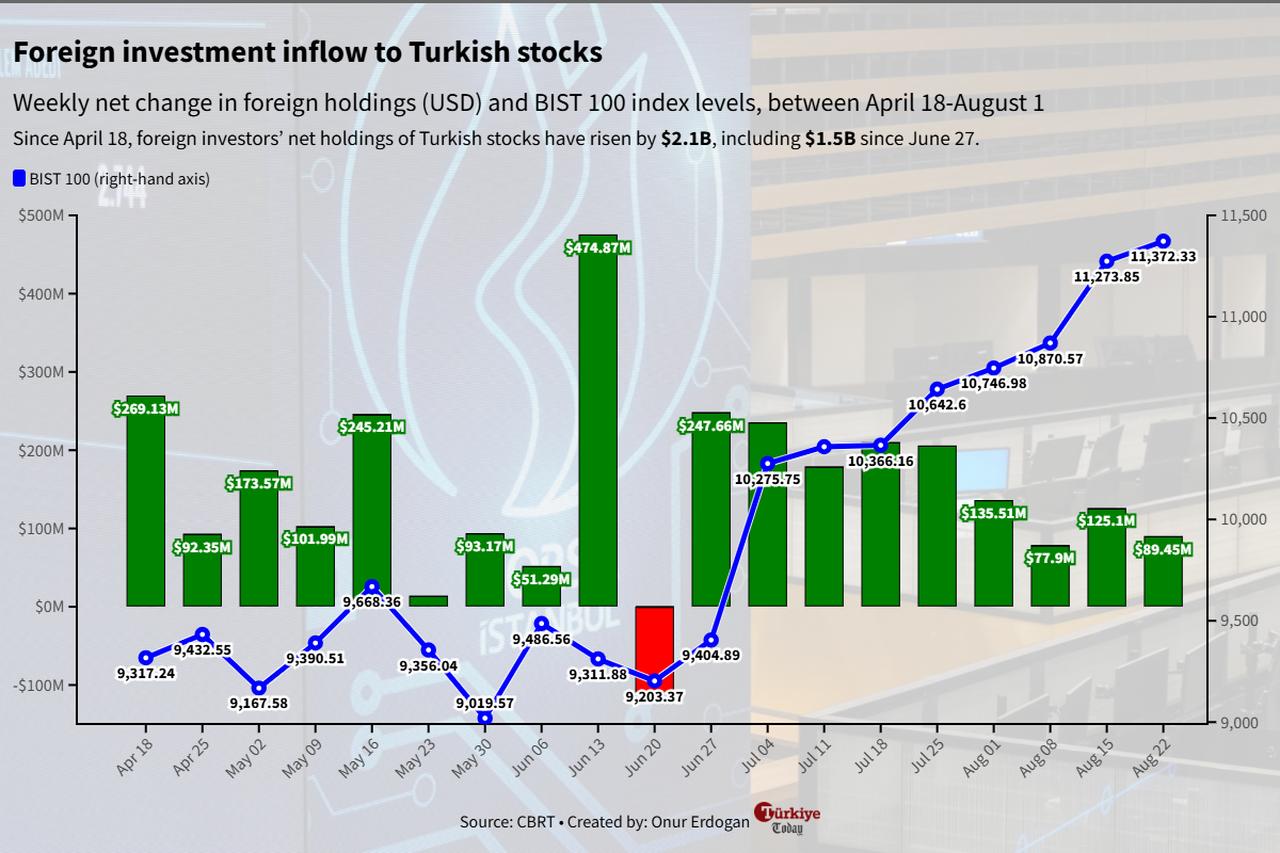

Non-resident investors extended their net buying streak in Borsa Istanbul stocks to a ninth consecutive week with a $89.45 million buyout in the week ending Aug. 22, the Turkish central bank reported Friday.

Thus, the net total inflow recorded during the period of uninterrupted entries starting on June 27 surpassed $1.5 billion. The stock of equities held by non-resident investors rose from $33.76 billion in the week of Aug. 15 to $34.89 billion in the week of Aug. 22.

Foreign investors also continued buying government domestic debt securities as their total holdings increased by $96.47 million over the last week.

In the same period, non-resident investors’ holdings of government domestic debt securities (GDDS) decreased from $14.73 billion to $14.67 billion. Meanwhile, non-government domestic debt securities rose from $831.3 million to $837.9 million.

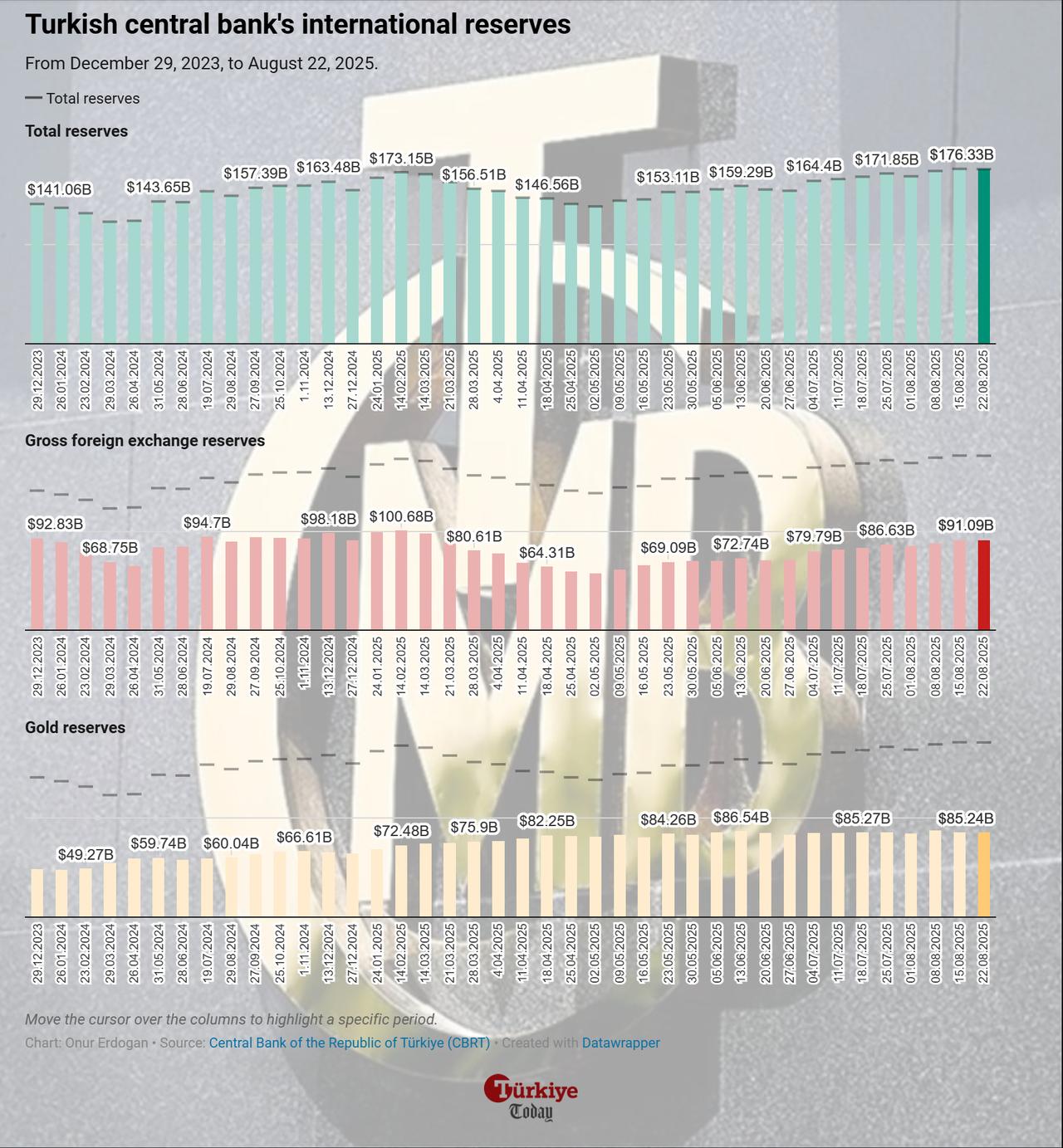

The Turkish central bank’s total international reserves slightly decreased by $183 million to $176.32 billion during the same week, while net reserves excluding swap transactions rose to $54.7 billion.

As of Aug. 22, the central bank’s gross foreign-exchange reserves increased by $162 million to $91.09 billion. Gold reserves fell by $345 million, from $85.58 billion to $85.24 billion.

During the same period, ₺13.87 trillion ($338.1 billion) deposits in lira terms in banks decreased by 0.9%, while foreign-exchange (FX) deposits increased by 1.2% to ₺7.99 trillion.

The total FX deposits in banks stood at $235.16 billion last week, with $196.22 billion of this amount held in accounts belonging to residents. When adjusted for parity effects, residents’ total FX deposits increased by $2.02 billion as of Aug. 22.

In the banking sector, residents’ consumer loans increased by 1% last week, reaching ₺4.84 trillion. Accordingly, the banking sector’s total deposits rose by ₺21.29 billion in the week ending Aug. 22, increasing from ₺25 trillion to ₺25.03 trillion.

The sector’s total loan volume, including the central bank, increased by ₺59.68 billion in the same week, reaching ₺19.73 trillion.