Global stock markets fell sharply on Friday after U.S. President Donald Trump threatened China with steep new tariffs and accused Beijing of pressuring other countries over rare earth exports that are vital for critical technologies, while oil prices declined as tensions in the Middle East eased following the Gaza ceasefire.

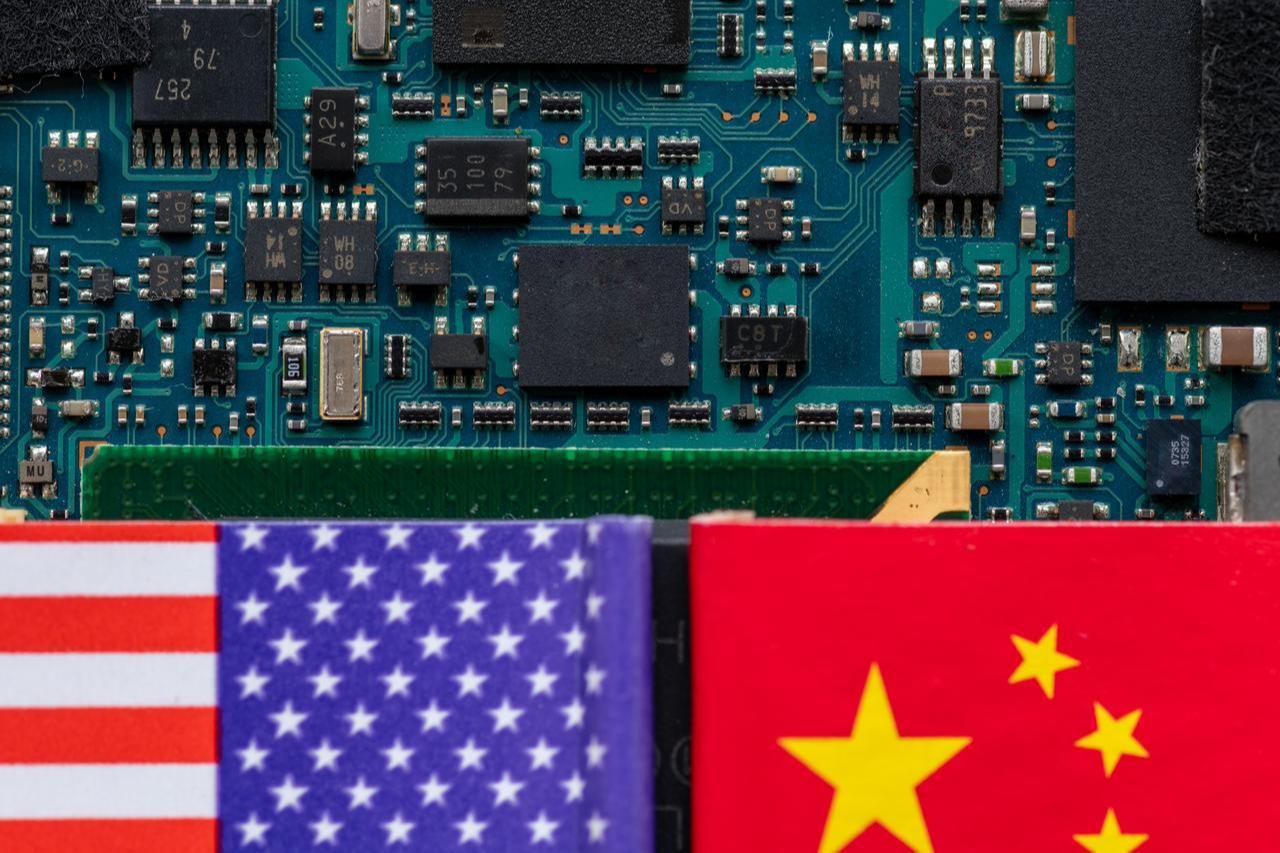

Trump announced that, starting November 1, his administration will impose a 100% tariff on Chinese imports in addition to existing duties and introduce export controls on all critical software, marking a sharp escalation in trade tensions between Washington and Beijing since April, reigniting fears of a renewed trade war.

In a social media post, Trump accused China of "very hostile" trade practices and of weaponizing its dominance in rare earth exports.

He said "massive increases in tariffs" and further countermeasures were under consideration, adding that he no longer saw a reason to meet Chinese President Xi Jinping at a summit later this month, though he clarified that he had not canceled their planned meeting at the Asia-Pacific Economic Cooperation (APEC) Summit.

Washington and Beijing had been cautiously easing trade tensions following a series of tit-for-tat tariff exchanges earlier this year, with the planned Trump–Xi meeting seen as an opportunity to extend the fragile truce.

Yet on Thursday, China introduced fresh restrictions on the export of rare-earth technologies and materials, tightening oversight of a sector that has long been at the center of its economic rivalry with the United States.

China is the world’s largest producer of these critical metals, mining at least 60% and processing around 90% of the global supply, according to a 2024 report by the Center for Strategic and International Studies (CSIS).

The announcement triggered sharp declines on Wall Street, with the Dow Jones Industrial Average, which tracks 30 major U.S. companies, falling 1.9%; the S&P 500, a broad measure of the U.S. stock market, down 2.9%; and the tech-heavy Nasdaq Composite, which is dominated by technology firms, dropping 3.6%, as tech companies faced the steepest losses amid concerns over potential disruptions in rare earth supplies. The U.S. dollar also weakened, with the dollar index sliding to 98.854.

European markets mirrored the sell-off, with Paris closing 1.5% lower amid political unease in France after President Emmanuel Macron reappointed outgoing Prime Minister Sebastien Lecornu just four days after his resignation.

Other major European stock markets also edged lower, with London’s FTSE 100 down 0.9% at 9,427.47 and Frankfurt’s DAX down 1.5% at 24,241.46 at the close.

Having closed earlier before Trump’s statements, Asian markets also declined following China’s restrictions, with Tokyo’s Nikkei 225 falling 1.0% to 48,088.80, Hong Kong’s Hang Seng Index dropping 1.7% to 26,290.32, and Shanghai’s Composite Index slipping 0.9% to 3,897.03.

The week saw a wave of record highs across several markets, with the tech-heavy Nasdaq, Japan’s Nikkei 225, and Frankfurt’s DAX all reaching new peaks.

Gold prices climbed above $4,000 per ounce, while silver surged to a decades-long high of $50.

Oil prices fell as the Gaza ceasefire eased fears of a broader regional conflict that could disrupt supply.

The U.S. benchmark West Texas Intermediate (WTI) dropped 4.2% to $58.90 per barrel, its lowest close since April, while Brent crude fell 3.8% to $62.73.

Meanwhile, the U.S. federal government remained partially shut down after Congress failed to pass a temporary budget for the new fiscal year.

Office of Management and Budget Director Russell Vought said Friday that "staff reductions have begun," raising uncertainties further.

However, despite the shutdown, the Bureau of Labor Statistics announced that it would release the September Consumer Price Index (CPI), one of the key indicators the Federal Reserve monitors when assessing inflation and potential rate cuts, on October 24, while other key indicators, such as nonfarm payrolls, remain delayed.

The closure has also disrupted data collection and publication, adding further uncertainty to markets already rattled by trade and geopolitical tensions.