Türkiye’s economy must stay firmly on its current policy course to sustain disinflation progress, QNB Türkiye General Manager Omur Tan said, likening inflation to diabetes—a "silent disease" that can inflict deep internal damage if left untreated.

Speaking in Gaziantep during the Life with Water Project, Tan said the economic program, introduced nearly two and a half years ago, continues to produce results by slowing inflation without stalling growth. He warned that any deviation from rational policies could have severe consequences for the economy,

"This path is difficult," he said. "The program doesn’t apply brakes to the economy abruptly but gradually opens it up. The success we’ve achieved so far stems from not deviating from this path, and straying from it would bring serious risks."

Tan described inflation as a persistent and destructive force, similar to a chronic illness that worsens if left untreated. “Inflation is like diabetes—slow but harmful from within,” he said, emphasizing that Türkiye’s policy discipline must be maintained even as inflation declines.

"This program may be noisy and difficult, but its success depends on discipline," he said. "Everyone must take their share of the bitter medicine. The key is to stay the course—because the alternative could be much worse."

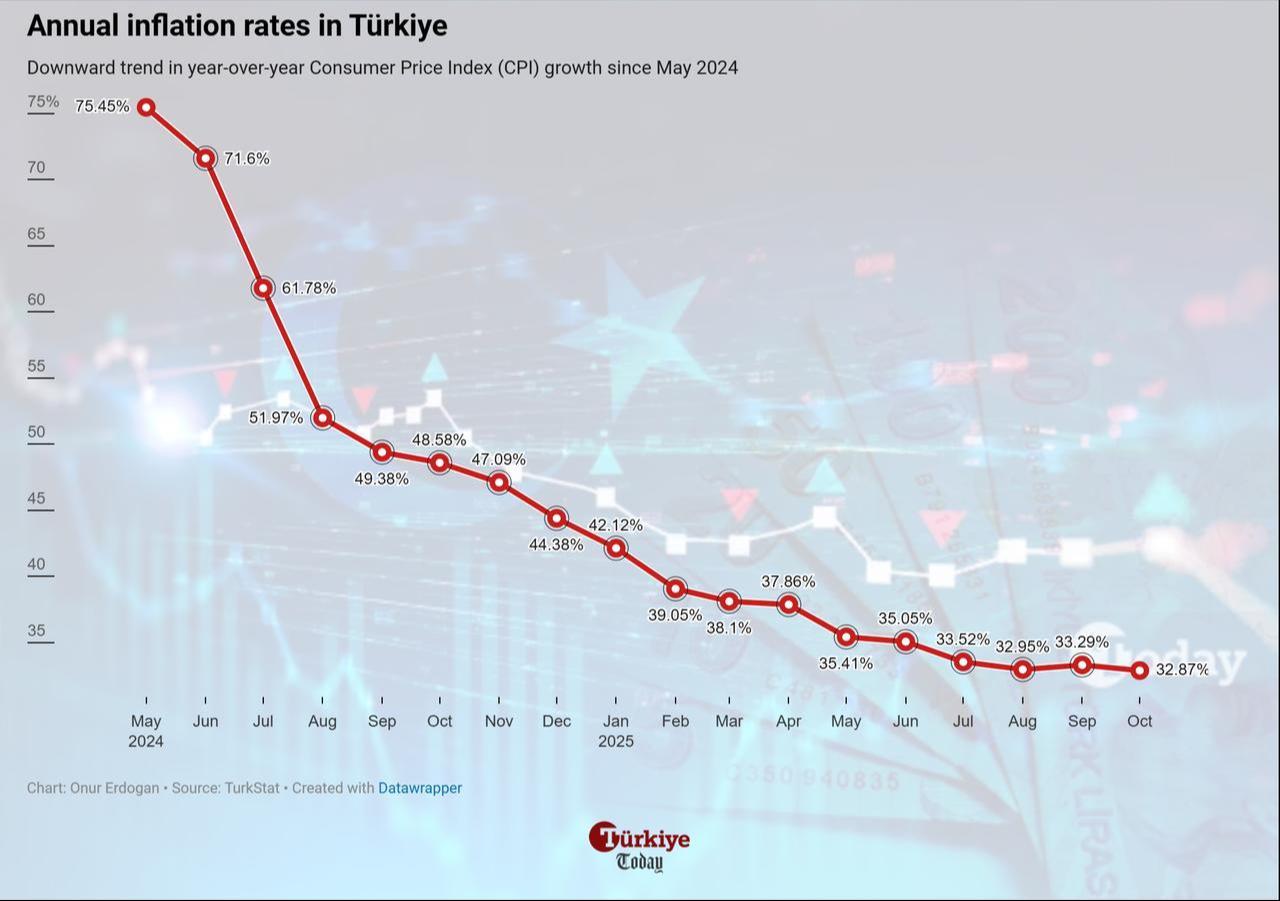

He noted that while reducing inflation from 60% to 30% had been challenging, lowering it further to single digits would be even more difficult due to sticky price pressures and lagging effects. "Impatience could block the road we’ve built," Tan said, stressing that the fight against inflation requires patience, consistency, and collective responsibility.

QNB Türkiye expects year-end inflation to stand at 32%, slightly above its earlier forecast of 29.5%. Tan added that the gap between real interest rates and inflation is likely to close toward the end of 2026, as the economy continues to stabilize.

Tan highlighted the strength of Türkiye’s foreign exchange reserves, which he said have reached historic highs. Gross reserves currently stand at around $185 billion, while net reserves excluding swaps are estimated at $52 billion–$53 billion.

"With such a strong buffer, we do not expect stress in the exchange rate," he said, projecting the U.S. dollar to Turkish lira rate to be 42.9 by the end of 2025. Tan added that the Central Bank of the Republic of Türkiye (CBRT) possesses sufficient tools and regulatory measures to maintain balance in currency markets.

"The central bank reacts appropriately to market developments," he said. "When larger cuts are needed, it acts decisively, and when caution is warranted, it proceeds gradually."

Tan said that recent policy rate cuts have not yet translated into lower lending costs because of regulatory limits. "Credit caps are challenging us," he noted. "Restrictions will likely continue through the first half of 2026, meaning credit channels may only open in the second half."

The policy rate in Türkiye has dropped to 39.5% following the Turkish central bank’s cuts over the last three monetary policy committee meetings. However, official data show that the weighted average interest rates on personal loans remain above 60%, while commercial loan rates continue to hover above 50% as of Oct. 31.

Tan added that a regulatory requirement mandating 65% of deposits to be held in Turkish lira has triggered strong competition among banks. "If you fail to meet the ratio, the penalty is huge," he said. "So banks prefer to offer slightly higher interest rates to attract more deposits instead of paying heavy fines."

The weighted average interest rate on Turkish lira deposits stands at around 47.25%, while the total amount of Turkish lira deposits rose to ₺14.41 trillion ($341.19 billion) as of Oct. 31, accounting for 54.2% of all deposits.

Despite the global challenges, Tan said Türkiye could benefit from improving U.S.-China trade relations and the potential for lower global interest rates. "Even small improvements in trade dialogue between the two countries could bring positive effects for emerging markets," he said.

He also noted that Türkiye’s diplomatic rapprochement with various nations may help attract investment and strengthen economic resilience.

"The world is going through a turbulent and stressful phase," Tan said. "But I believe the global environment will offer Türkiye opportunities to differentiate positively."