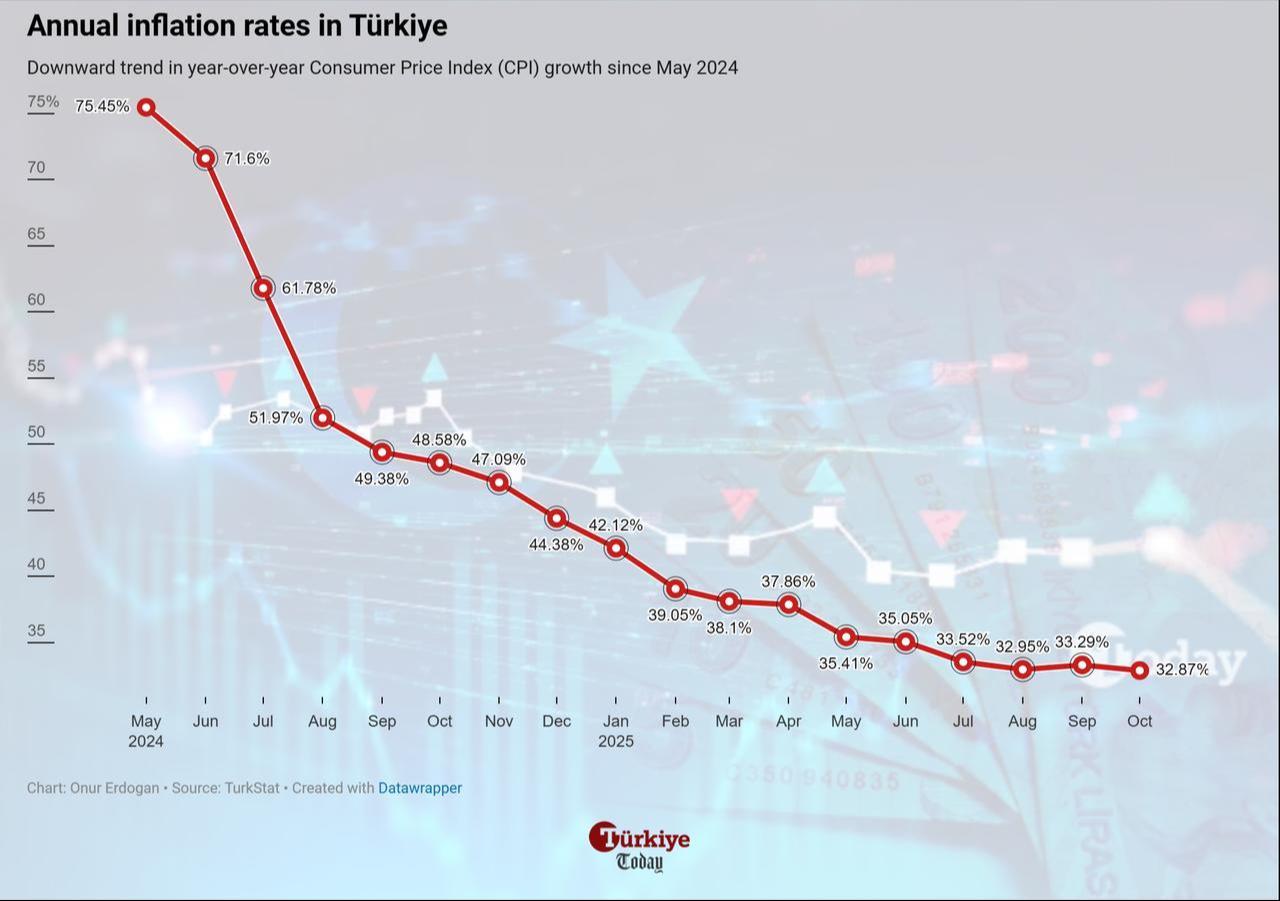

The increase in consumer prices in Türkiye came in at 2.55% in October, bringing down the headline rate again to 32.87%, the Turkish Statistical Institute (TurkStat) reported on Monday.

Figures represent a return to the downward trend after September’s uptick — the first since May 2024 — when the annual rate rose to 33.29% and prices increased by 3.23% from the previous month.

Expectations had centered on a 2.34% rise, which would have brought the year-on-year inflation rate to an estimated 32.59%, according to the Central Bank of the Republic of Türkiye's (CBRT) Survey of Market Participants in October.

The three main expenditure groups with the highest weight increased annually by 34.87% for food and non-alcoholic beverages, 27.33% for transportation, and 50.96% for housing.

The change in food prices slightly retreated but continued to pose a significant risk to overall inflation, with a monthly increase of 3.41% as the effects of the nationwide drought persist. The highest increase among expenditure groups was seen in clothing and footwear, at 12.42%.

None of the expenditure groups slid on a monthly basis, the data showed.

Core inflation — excluding energy, food, and non-alcoholic beverages, alcoholic beverages, tobacco, and gold — comes in at 2.41% for the month, bringing the annual rate down to 32.05%.

On the producer side, Türkiye’s domestic producer price index (PPI) rose 1.63% month-on-month in October, while the annual increase edged up to 27.00% from 26.59% in September. The largest monthly gains were seen in metal ores (10.69%), other manufactured goods (9.21%), and tobacco products (4.26%), whereas the sharpest declines occurred in electricity, gas, steam, and air conditioning supply (-1.16%) and coke and refined petroleum products (-0.73%).

Türkiye’s stock exchange, Borsa Istanbul, welcomed the figures, as expectations grew that the Turkish central bank would continue its easing cycle with a larger rate cut at its next meeting in December.

The benchmark BIST 100 index rose 1.43% to its highest level in Monday’s session, climbing above the 11,100 mark for the first time since October 3. The gains were led by the banking index, which surged 2.49%, followed by financials and industrials with increases of 1.3% and 1%, respectively.

The Turkish central bank extended its easing cycle at the October meeting with a 100-basis-point cut, bringing the policy rate down to 39.5%. The move marked a smaller reduction compared to previous cuts, as inflationary pressures reemerged in September. The bank also adopted a more cautious tone on the future rate-cut path, citing seasonal factors and shocks on the food supply side.

On the other hand, the bank will present its fourth inflation report of the year on Friday, Nov. 7, which is expected to revise its interim inflation targets and projection ranges, as the current path of disinflation appears to have slowed. In its third inflation report, the central bank had set interim targets of 24% for end-2025 and 16% for end-2026, while Finance Minister Mehmet Simsek recently acknowledged that the 2025 projection is "hard to reach" amid persistent economic pressures, drought, and geopolitical tensions.

Market analysts interpreted Türkiye’s October inflation data as largely consistent with expectations but noted that sectoral dynamics and policy signals could shape market sentiment in the weeks ahead.

Local brokerage Info Yatirim said the rise in food prices driven by agricultural frost and drought continued to exert pressure during the month. The transition from summer to winter produce led to supply-side constraints, fueling further price increases.

In the clothing sector, it pointed to the reliance on imported raw materials and a slight rise in the exchange rate as key drivers of price increases. "With the arrival of winter collections, the rise in clothing and footwear prices was reflected in overall inflation," it said. "These sharp monthly gains could temporarily support profitability in the textile retail segment, even as the weak manufacturing PMI keeps retail in focus in the near term."

Another local brokerage, Trive Yatirim Menkul Degerler, emphasized that core inflation appeared softer due to the exclusion of food prices, in line with the central bank’s year-end outlook. "There is still some way to go," the firm said, "but the data is generally positive for markets." Referring to the rise in Borsa Istanbul, it added that "investors have turned more optimistic about the December monetary policy meeting, with some pricing in a 150–200 basis point rate cut."