What to read from Turkish central bank’s inflation projection?

Central Bank Governor Fatih Karahan (center) speaks during the Inflation Report briefing at the Centreal Bank of the Republic of Türkiye (CBRT) headquarters in Istanbul Financial Center, Türkiye, November 7, 2025. (AA Photo)

November 10, 2025 09:46 AM GMT+03:00

This article was originally written for Türkiye Today’s weekly economy newsletter, Turkish Economy in Brief, in its Nov. 10 issue. Please make sure you are subscribed to the newsletter by clicking here.

While inflation remains one of the key issues Türkiye’s economy that continues to face, the Central Bank of the Republic of Türkiye (CBRT) released its final inflation report for 2025 on Friday, Nov. 7. Prior to this report, inflation figures for October were also disclosed earlier in the week.

To briefly recap:

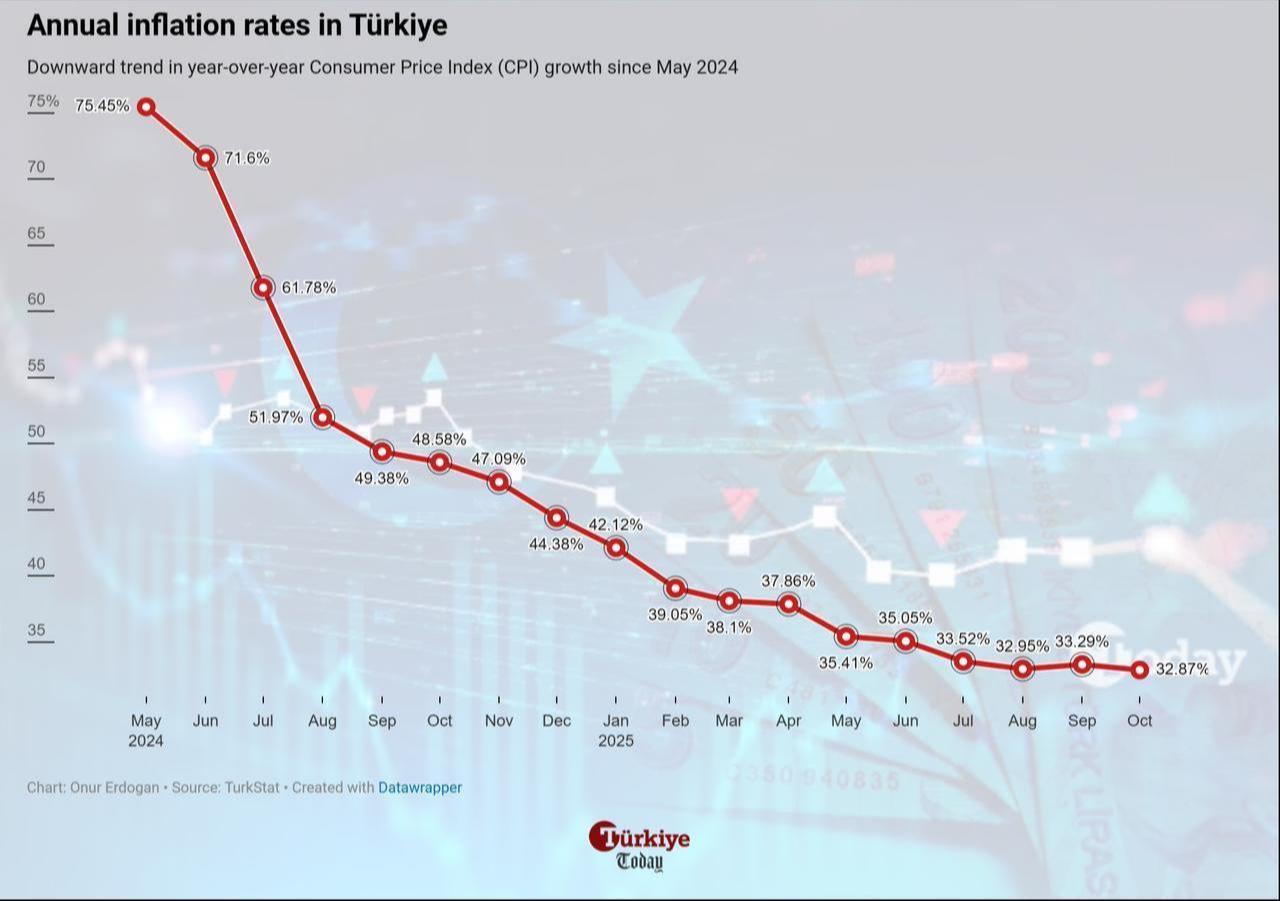

- Inflation in October was 2.55% on a monthly basis, coming in lower than expectations. Annual inflation dropped to 32.87%.

- The CBRT raised its inflation forecast range for 2025 to 31%-33%, setting the midpoint at 32%.

- The inflation forecast range for 2026 is 13%-19%, with a year-end target of 16%. There was no change compared to the previous report.

Line chart illustrates Türkiye’s annual inflation rates from May 2024 to October 2025. (Chart by Onur Erdogan/Türkiye Today)

When we look at the messages given in the inflation report presentation:

- In recent months, items such as food, clothing, and education have pushed inflation higher. While there is a disinflationary process, it’s more of a slowdown than a halt.

- If inflation expectations worsen, monetary policy may be recalibrated. This could mean halting interest rate cuts, maintaining the current stance, or reducing the size of cuts.

- The stock of gold kept outside the banking system is estimated at $400-500 billion. With the increase in gold prices, there is a “wealth effect” of around $100 billion, which complicates demand management.

- In the past year, the difference between the deposit rates paid by banks and the interest rates on loans they charge has narrowed to almost zero. As a result, this is not seen as a major factor driving up consumption expenditures.

- The CBRT will be ready to take additional measures in the fight against inflation if needed. In consideration of this internal response, the 2026 targets and projections were not updated.

In short, the message to the market is that interest rate decisions will be made according to inflation and that tight monetary policy will continue.

This approach supports expectations of a “stable exchange rate” and a “strong Turkish lira in real terms.”

In the positive scenario, as inflation decreases, risk-free Turkish lira returns may rise to reasonable levels, and alternative investment instruments like the stock market may become more prominent.

November 10, 2025 10:18 AM GMT+03:00