The acceleration of regulatory measures targeting cryptocurrencies in the U.S. and many other countries has increased companies' interest in the digital assets.

In particular, Donald Trump's more constructive approach to cryptocurrencies following his election as president has had a positive impact on institutional investors' attitudes.

Additionally, the U.S. Securities and Exchange Commission (SEC) approving Bitcoin and Ethereum exchange-traded funds (ETFs) has made it easier for companies to invest in these assets.

Furthermore, some banks in the U.S. have begun offering cryptocurrency investment and custody services to companies.

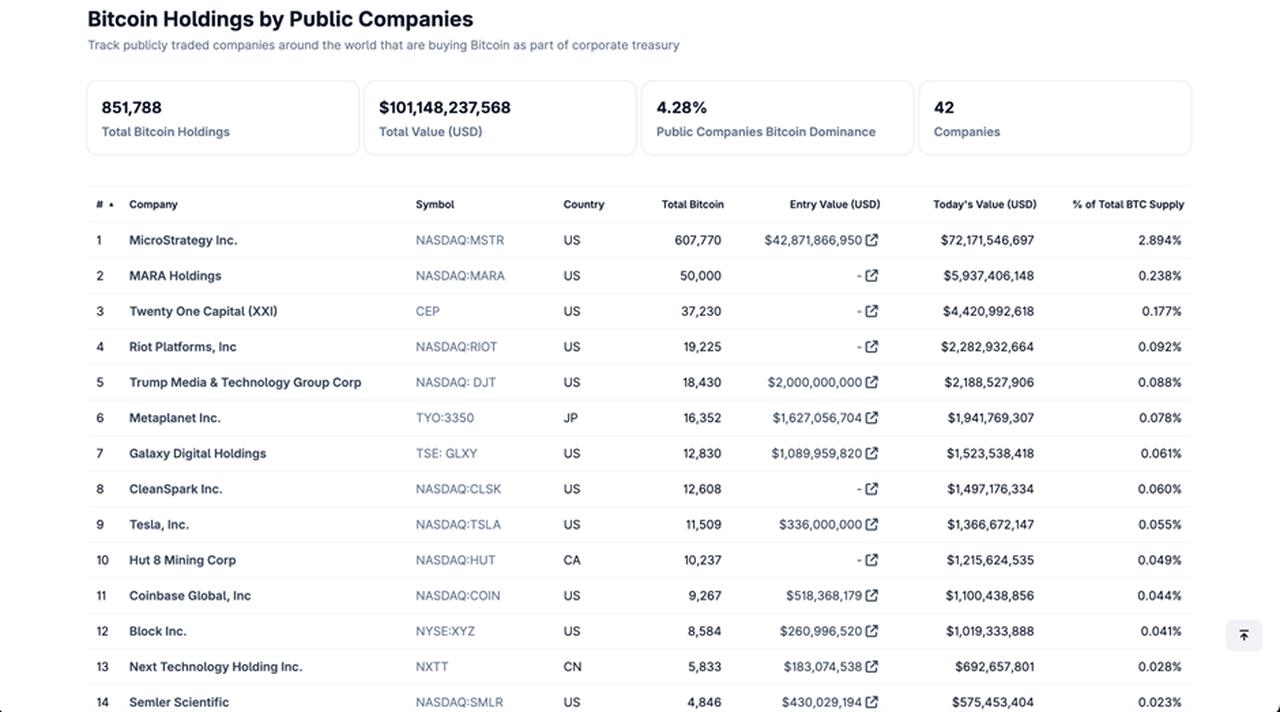

U.S-based software company, Strategy (prev. MicroStrategy) has become one of the leading institutions attracting attention with its cryptocurrency investments. The company, which has been buying Bitcoin for a long time, currently holds more than 607,000 BTC, according to data compiled by Anadolu Agency. Strategy, which directed the funds it obtained from the sale of shares in Bitcoin, rose to the position of the world's largest institutional cryptocurrency investor with this step.

The company made an investment of approximately $43 billion by purchasing Bitcoin at an average price of $71,000. With the price of cryptocurrency rising above $115,000, Strategy's unrealized profit reached approximately $25 billion.

U.S. President Donald Trump's company, Trump Media and Technology Group, is also attracting attention with its $2 billion investment in Bitcoin. One-third of the company's $3 billion in liquid assets consists of Bitcoin.

Another major name is Tesla. The company founded by Elon Musk holds over 11,000 Bitcoin. Tesla, which purchased $1.5 billion worth of BTC in 2021, still holds the remaining portion of these assets on its balance sheet despite having sold part of them.

Block Inc., the company founded by Twitter's Jack Dorsey, digital asset firm Galaxy Digital, and mining company Marathon Digital, is also among the major institutional Bitcoin investors.

In addition, there are numerous American companies such as MARA Holdings, Twenty One Capital, and Riot Platform Inc.

Corporate companies are not only investing in Bitcoin, but also accelerating their investments in Ethereum. Sharplink, which is traded on the U.S. stock exchange, has purchased more than 360,000 Ethereum to date. The total value of the company's investment has reached $1.3 billion.

BitMine Immersion Technologies, backed by Peter Thiel, is also among the largest corporate investors with over 100,000 Ethereum.

According to data analysis platform the Block, the total market capitalization of Bitcoin ETFs has surpassed $160 billion, while the value of Ethereum ETFs has exceeded $18 billion, driven by these investments.