Both international credit rating agencies Moody’s and Fitch Ratings acknowledged Türkiye’s recent economic policy improvements on Friday, with Moody’s upgrading the country’s long-term credit rating to Ba3 from B1 and Fitch affirming its BB- rating, both maintaining a stable outlook.

Moody’s cited a “strengthening track record of effective policymaking,” highlighting the central bank’s commitment to disinflation and the rebuilding of trust in the Turkish lira. Fitch echoed this view, noting the tightening of monetary policy and partial recovery of international reserves, while also cautioning that risks remain due to structural weaknesses and persistent inflation.

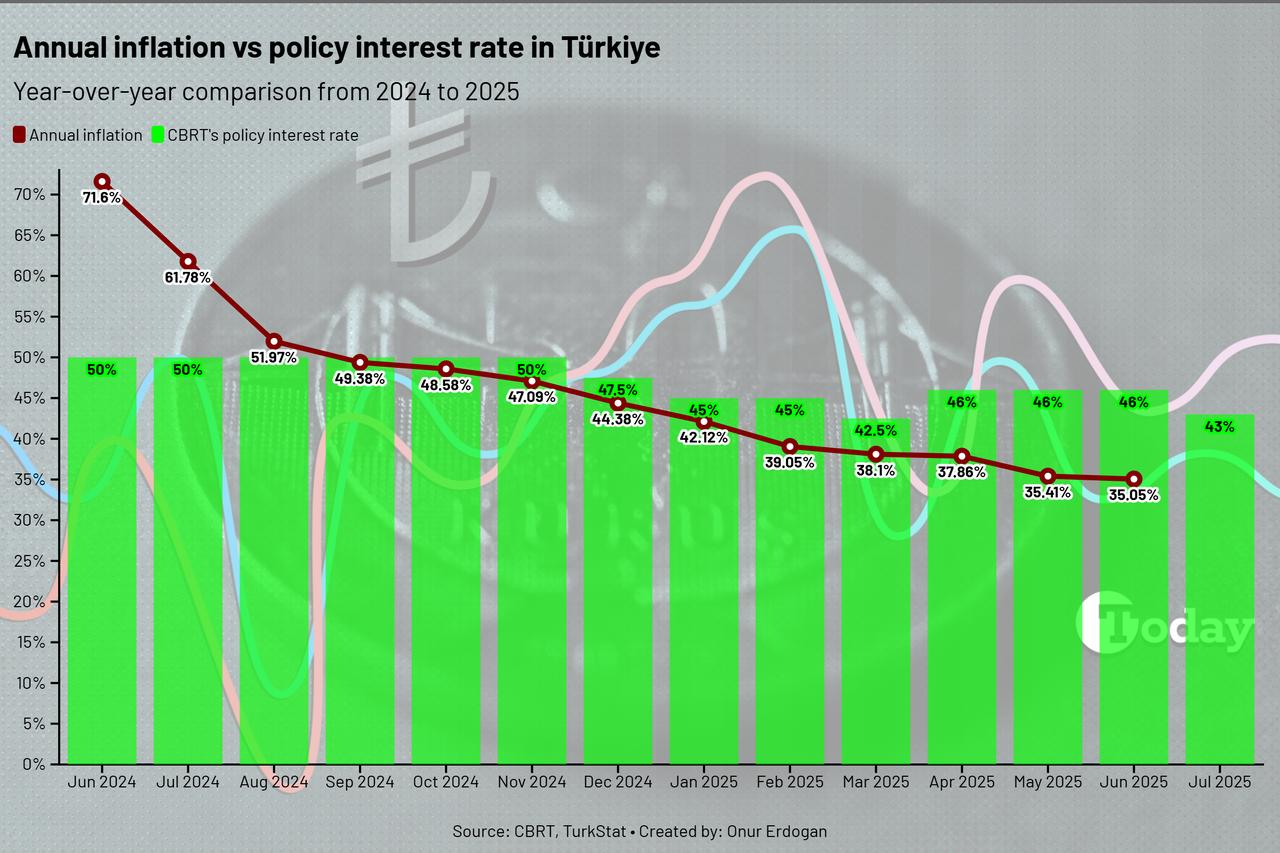

Türkiye’s annual inflation rate has dropped sharply from 72% in June 2024 to 35% a year later. Both agencies project continued disinflation, with Moody’s expecting inflation to ease toward 30% by year-end and Fitch forecasting a decline to 28% in 2025 and 21% in 2026.

The Central Bank of the Republic of Türkiye (CBRT) has maintained a tight monetary stance since mid-2023, keeping policy rates above 40% and taking liquidity-restrictive measures. These actions, along with foreign exchange interventions, were recognized as contributing to a stronger lira and improved inflation expectations.

Moody’s noted that Türkiye’s external vulnerabilities have begun to ease. The current account deficit narrowed to 0.9% of GDP in the 12 months to March 2025, down from 5.4% in 2023. Household consumption growth also slowed from nearly 14% in 2023 to 2% in early 2025, supporting macroeconomic rebalancing.

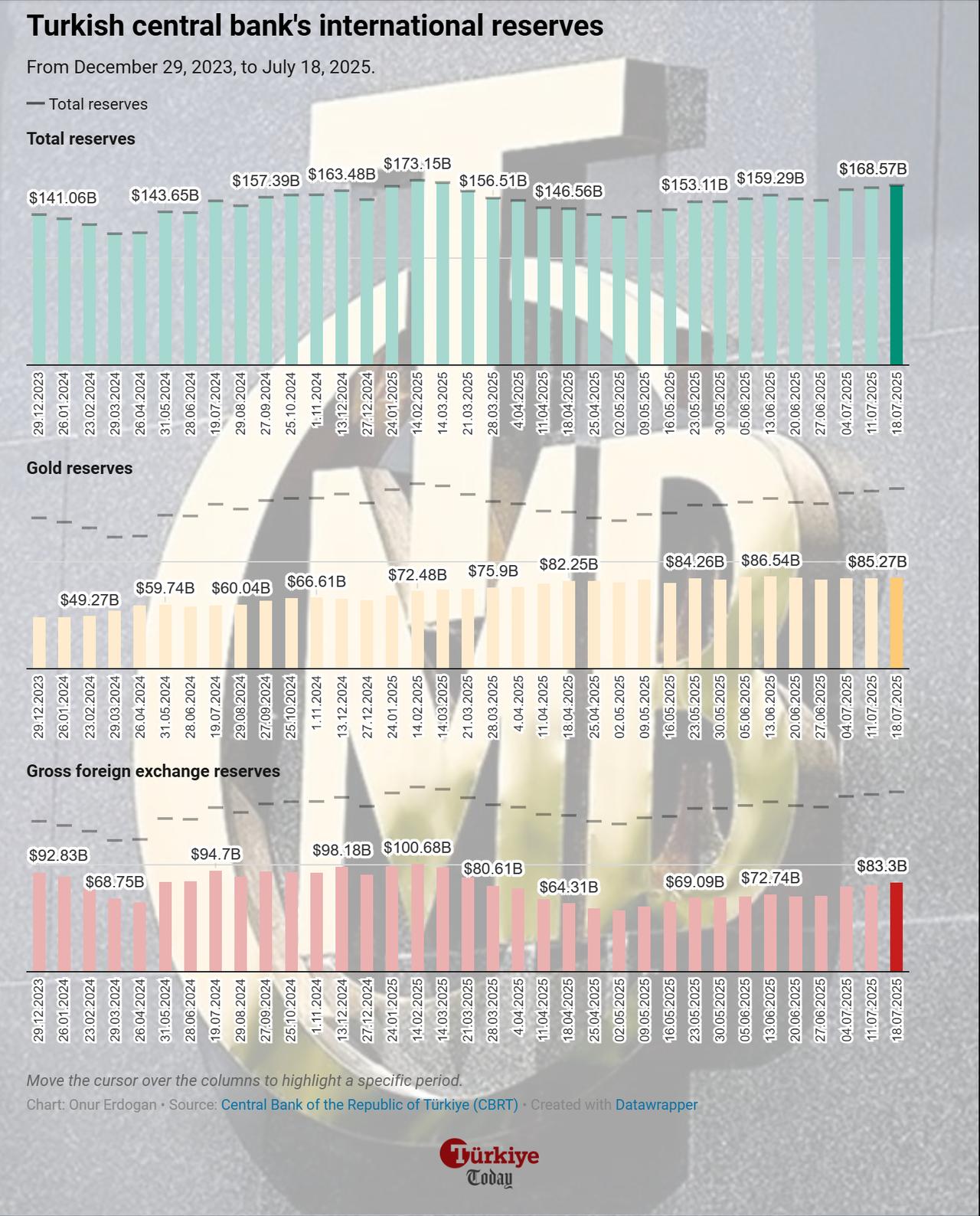

Fitch reported that net international reserves excluding swaps rose from a low of $13.7 billion in May to $40.9 billion by early July, though still below pre-crisis levels.

As of the week ending July 18, the Turkish central bank's reserves reached $168.6 billion

Fitch also highlighted Türkiye’s high external financing needs, with $222 billion in external debt maturing within 12 months, and a liquidity ratio of 80%, below the BB median of 154%.

Despite external vulnerabilities, Türkiye maintains a relatively favorable fiscal position. Fitch forecasts the general government deficit will narrow to 4% of GDP in 2025 and fall further in 2026. Public debt is expected to remain low compared to peers, rising slightly to 25.4% of GDP in 2025—roughly half the BB median.

The share of foreign-currency-denominated central government debt declined to 55% by May 2025, down from 64% at the end of 2023, reducing exposure to currency risks.

Both agencies cautioned that institutional weaknesses remain a constraint. Fitch noted Türkiye’s governance ranking had fallen to the 32nd percentile globally, reflecting concerns about political centralization and legal unpredictability. It also pointed to recent political unrest, including the arrest of high-profile opposition figures, as potential risks to stability and investor sentiment.

Moody’s similarly warned that a reversal of current policies or renewed political disruptions could erode central bank credibility and destabilize the economic outlook.

Looking ahead, both Moody’s and Fitch said Türkiye’s ratings could benefit from sustained monetary and fiscal discipline, improved governance, and a stronger external buffer. However, they also stressed that any shift back to expansionary or unorthodox policies could trigger renewed pressures on the economy and weigh on the country’s credit profile.