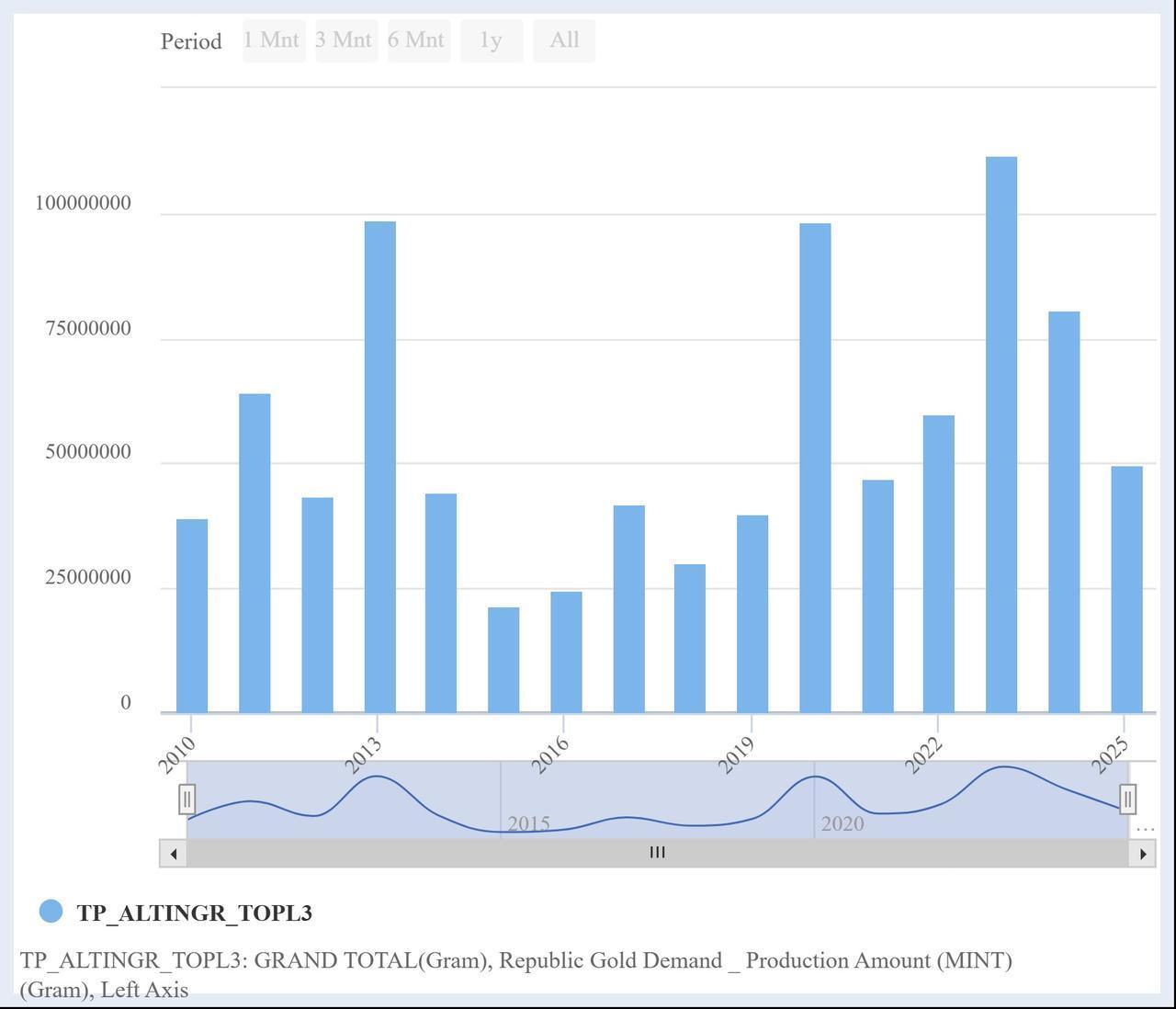

Türkiye’s State Mint used around 49.7 metric tons of gold for coin production in 2025, down 38.3% from 80.6 tons the previous year and the lowest level since 2021 as soaring global prices cooled physical demand.

Alongside the fall in tonnage, the number of coins minted declined by 43.6%, dropping from 23.39 million units in 2024 to 13.18 million units in 2025, the official figures showed.

The reduction comes amid a dramatic surge in global gold prices, which climbed over 65% in 2025, the strongest yearly gain since 1979.

The Mint produced 10.2 million ornamental coins, typically used for gifting and personal savings, and 2.56 million bullion-type coins, favored for investment purposes.

The quarter gold coin, weighing approximately 1.75 grams, remained the most minted individual variety, with 7 million units produced in 2025.

Though categorized as either ornamental or investment-grade, both types are made from 24-karat standard bullion and minted into 22-karat coins. They are produced in ten different diameters and weight classes, offering flexibility for both gift-givers and long-term holders.

Although Türkiye traditionally ranks among the top global markets for household gold accumulation, the figure stands out as high prices appear to have prompted caution in fresh purchases. Against the Turkish lira, the price of gold per gram rose by 101.75% in 2025, reaching ₺6,240 ($145.28).

While gold served as a favorable hedge against inflation, which ended the year at 30.89%, the sharp rise in prices appears to have deterred new retail buying, particularly among households seeking smaller denominations for savings or gifts.

Gold remains a deeply rooted form of savings in Türkiye, often referred to as "under-the-pillow" assets—a local term for gold stored privately at home rather than in banks or formal financial institutions. An estimated 3,100 tons, worth approximately $449.5 billion, are believed to be held by households across the country.