Standard & Poor’s (S&P) Global, one of the three major international credit rating agencies, reaffirmed the U.S. government’s long-term sovereign credit rating at AA+ with a “Stable” outlook on Tuesday.

The agency also maintained the country’s short-term rating at A-1+, noting that higher revenues from import tariffs introduced by the Trump administration are expected to offset weaker fiscal outcomes linked to recent tax and spending measures.

In its report, S&P said the U.S. economy is expected to remain resilient, supported by effective and credible monetary policy. However, the agency stressed that persistent, though not widening, fiscal deficits will continue to drive public debt, with forecasts indicating that the statutory debt ceiling could increase by as much as $5 trillion in the coming years.

The statutory debt ceiling, which is the limit on how much the U.S. government can borrow, is set at $36.1 trillion.

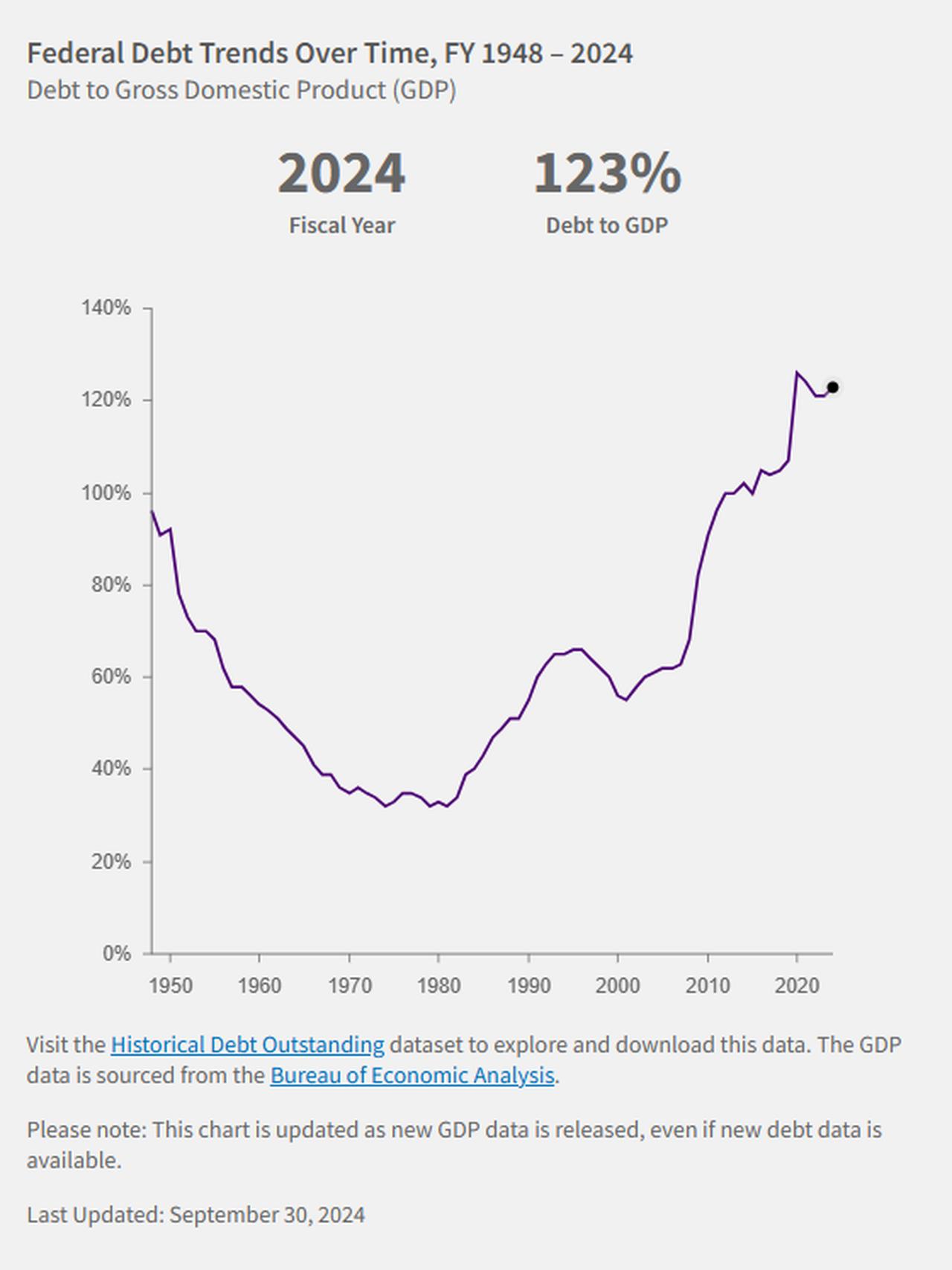

S&P projected that net general government debt will remain above 100% of gross domestic product (GDP) over the next three years, reflecting structurally higher mandatory interest payments as well as rising age-related spending.

According to the U.S. Treasury Department, the federal government’s debt-to-GDP ratio rose to 123% in 2024.

The report also highlighted the impact of tariffs introduced in August, which it said will further erode consumer purchasing power, aligning with the Federal Reserve's previous cautions over possible inflationary pressures.

The effective U.S. tariff rate, based on revenue collected over the past two months, currently stands at around 11%. With the newly announced levies, S&P Global estimated in a separate report published before the rating update that the effective rate will climb above 18%—nearly eight times the 2024 level of 2.3%.

S&P cautioned that it could lower the rating over the next two to three years if fiscal deficits widen further, particularly if policymakers prove unable to restrain spending or address revenue losses stemming from changes in the tax code.

The agency also warned that political developments undermining institutional strength, the effectiveness of long-term policymaking, or the independence of the Federal Reserve could weigh on credit quality. Such developments could ultimately jeopardize the U.S. dollar’s role as the world’s leading reserve currency, which has long supported the country’s credit standing.

Conversely, the agency noted that the rating could be raised within the same two- to three-year horizon if more effective policymaking delivers stronger fiscal performance, substantially narrowing deficits and reducing the government’s debt burden. Sustained GDP growth combined with fiscal adjustments could also ease the pace of debt accumulation, thereby reinforcing the sovereign’s credit profile.