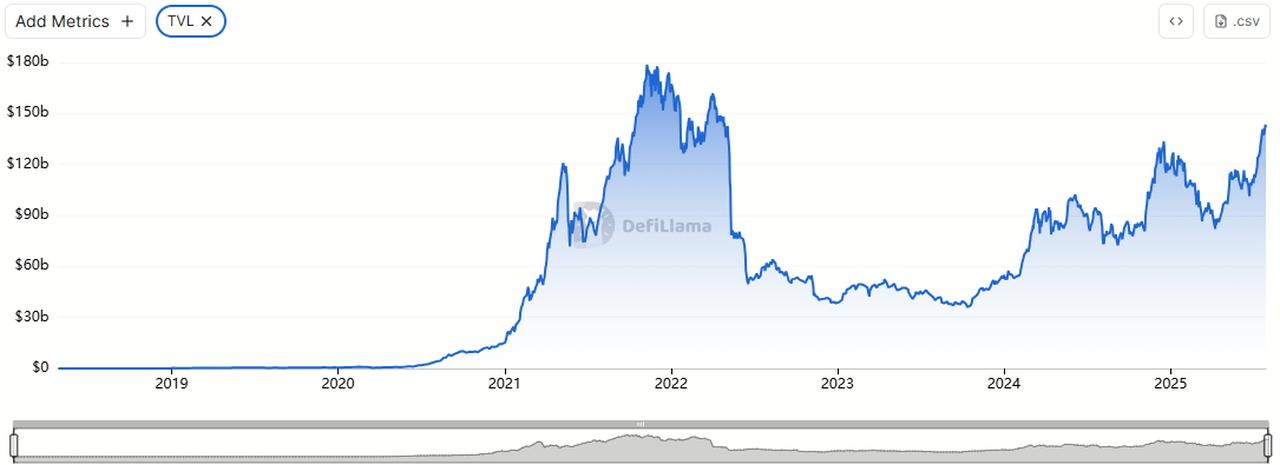

The decentralized finance (DeFi) market reached $153 billion on Monday, its highest level in three years, as ETH approached $4,000 and saw strong inflows into restaking protocols.

The milestone follows a 60% monthly gain in ethereum’s price, which climbed from $2,423 to $3,887, alongside growing institutional interest and strong inflows into restaking protocols.

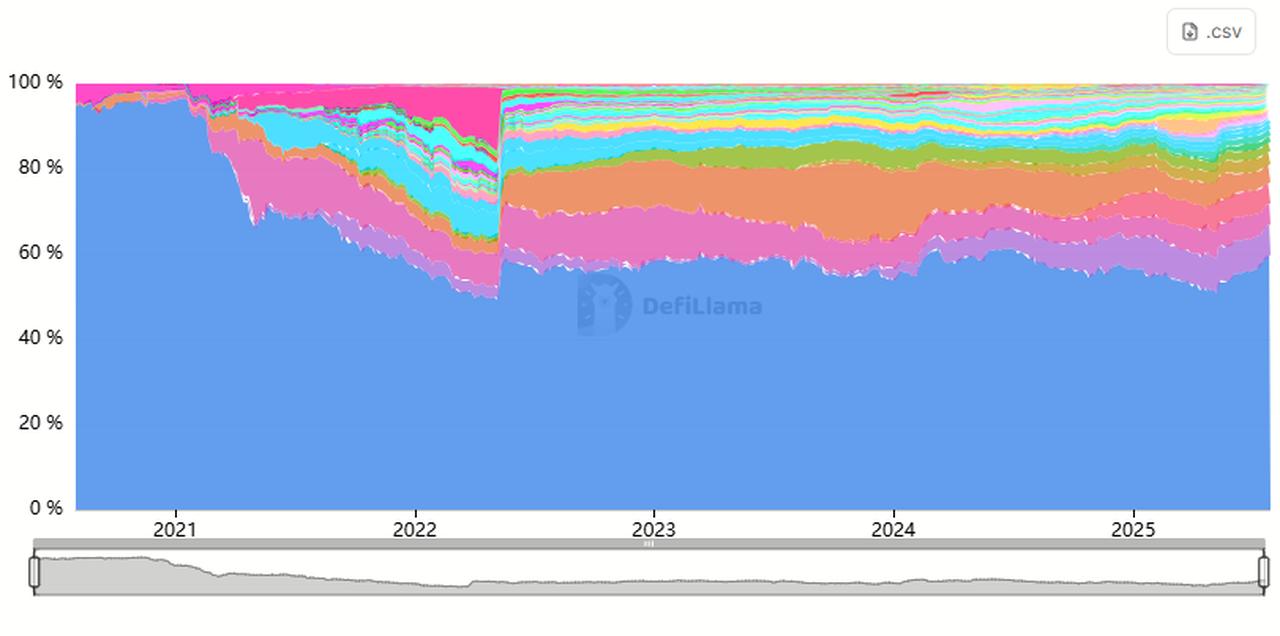

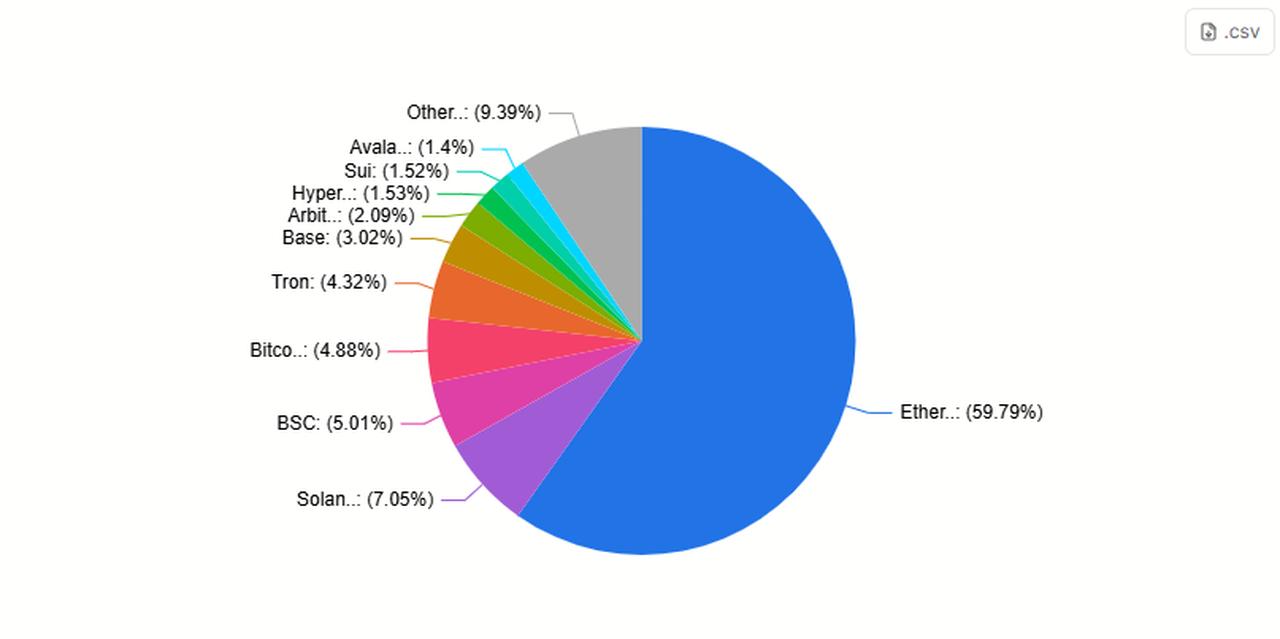

Ethereum holds approximately 60% of the total value locked (TVL), while investors are turning to advanced strategies for low-risk stablecoin yields. Solana, Avalanche, and Sui are experiencing double-digit growth in TVL, while Bitcoin's share in DeFi remains limited.

According to DefiLlama data, last week's capital inflows and rising asset prices propelled the sector above its December 2024 peak, marking the highest level since the collapse of the Terra network in May 2022, though it has yet to reach its 2021 peak.

ETH has seen a 60% increase over the past 30 days, rising from $2,423 to $3,887, driven by various institutional moves such as Sharplink Gaming's $1.3 billion treasury investment and BitMine's $2 billion acquisition.

Ethereum remains the clear leader, accounting for 59.5% of TVL in the DeFi ecosystem. A significant portion of this value comes from Lido, a liquid staking protocol with a TVL ranging between $32 billion and $34 billion, and Aave, a lending platform.

The purchase of digital assets such as Ether by institutions is only one aspect of the process; the other important point is to generate returns from these investments.

Investors can earn between 1.5% and 4% annually by staking their ETH directly. However, some investors are taking it a step further by using restaking protocols that offer a liquid token in exchange for staked ETH. This way, both the base yield is secured, and the tokens obtained can be utilized for additional gains in other opportunities within the DeFi ecosystem.

While the ethereum network naturally attracts most of the attention, other chains are also performing strongly. According to DefiLlama data, solana's TVL has increased by 23% in the last month, reaching $12 billion. Protocols such as Sanctum, Jupiter, and Marinade have led this growth, standing out in the SOL ecosystem.

Investor interest is not limited to solana; avalanche and sui have also seen notable increases. These two networks recorded growth of 33% and 39%, respectively, in TVL during July. Meanwhile, bitcoin's rise in the DeFi space was more limited. Despite reaching a record price of $124,000, the TVL in the DeFi ecosystem increased by only 9%, reaching $6.2 billion.