Criticism from Türkiye’s top industrialists continues to highlight concerns over the country’s economic direction, as the central bank’s decision to hold interest rates—despite high inflation and rising costs—pushes more manufacturers to relocate production abroad.

Türkiye’s central bank kept its policy interest rate steady at 46% during Thursday’s monetary policy meeting, maintaining its tight stance despite falling inflation and weakening domestic demand. Although the market had priced in a possible rate cut, the bank cited the risk of rising global costs—particularly due to the Iran-Israel conflict—as justification for postponing any loosening. The statement was interpreted as a dovish signal, indicating that a rate cut could come as early as July.

Türkiye’s annual inflation, the main driver of the central bank’s tight monetary stance, fell unexpectedly to 34.5% in May—just ahead of the June policy meeting—while market interest rates declined to around 43%. Nevertheless, the policy rate was kept unchanged, further widening the gap between official rates and real economic conditions. Business leaders, already strained by weakening domestic demand and rising input costs, are increasingly grappling with what they describe as policy rigidity that undermines production and competitiveness.

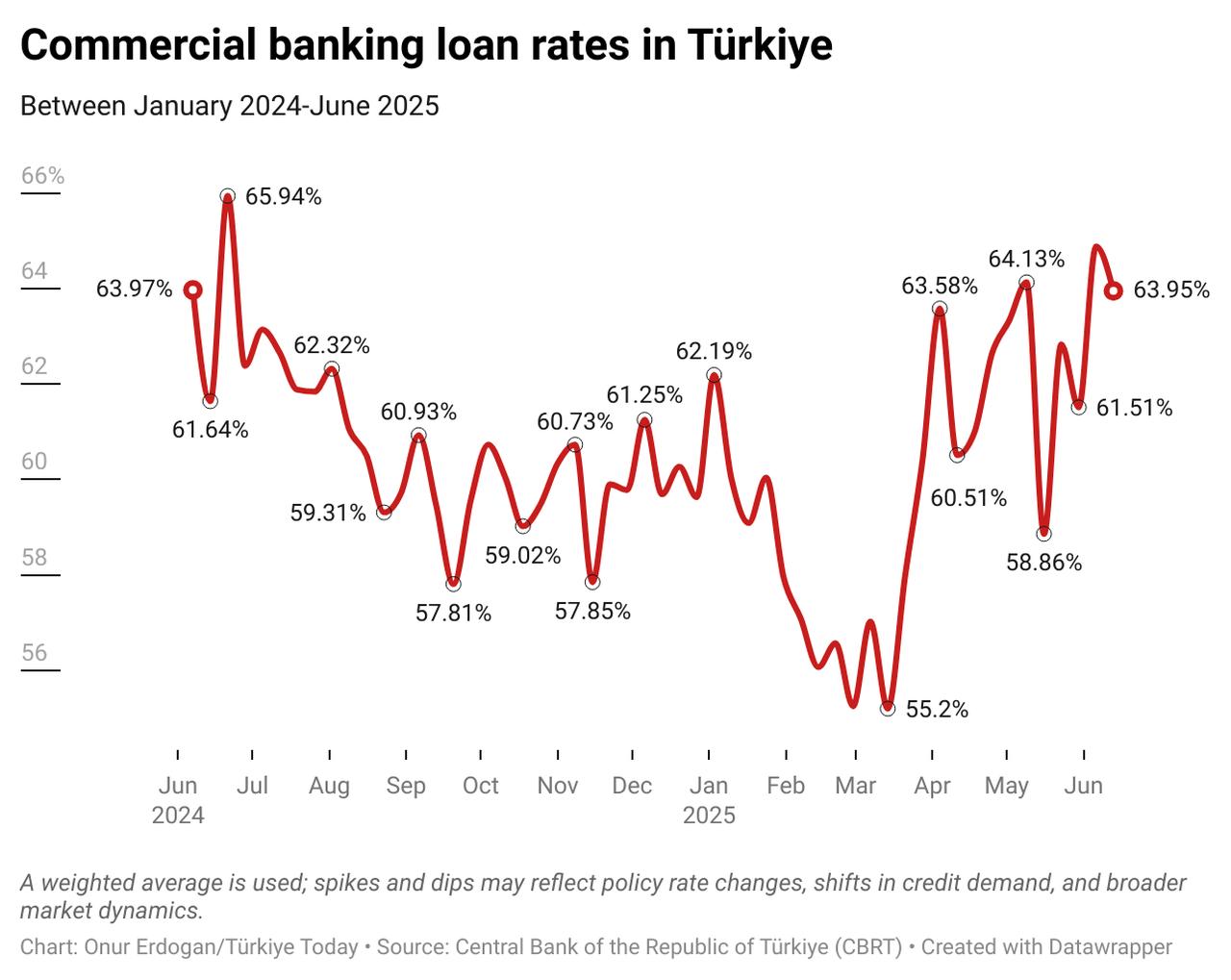

As of June 13, the average interest rate on commercial bank loans is 63.95%, which places a significant burden on Turkish companies.

According to Türkiye daily, as the Central Bank of the Republic of Türkiye (CBRT) holds its benchmark rate at 46%, criticism from the private sector has intensified. Despite earlier calls from President Recep Tayyip Erdogan for an interest-free economy, the monetary authority maintained high rates to curb inflation, frustrating business leaders who warn of mounting pressure.

Istanbul Chamber of Industry (ISO) Chair Erdal Bahcivan noted that manufacturers are paying the highest price in the inflation fight. “While inflation in manufacturing is around 20%, loan rates exceed 60%. This is unsustainable,” he warned, adding that production cuts and factory closures could follow.

Istanbul Chamber of Commerce (ICOC) President Sekib Avdagic said rising costs, limited credit, and a weak lira are eroding competitiveness. “Unless we ease the burden on producers, future investments are at risk,” he said, stressing that trust in the disinflation program depends on support for industrial output.

Türkiye Exporters Assembly (TIM) President Mustafa Gultepe said investment outflows are no longer optional. “With labor costs now near $1,400, we can’t stay competitive. Many firms are relocating to lower-cost countries like Egypt,” he said. Cetin Tecdelioglu, TIM’s deputy chair, called for urgent rate cuts and a credit guarantee scheme. “We’re seeing up to 15% market contraction. Consumer power is down, and export demand is weakening,” he noted.

Rifat Hisarciklioglu, head of the Union of Chambers and Commodity Exchanges of Türkiye (TOBB), said access to financing is the top challenge. “The market is nearly paralyzed. Credit contraction and high interest are shackling SMEs. Payments are delayed, purchases fall, and growth slows,” he stated, urging support for labor-intensive sectors hit by rising input costs.

Even before the most recent rate decision, industrial firms had already begun relocating production due to what they described as unsustainable operating conditions at home. The sharp disparity between Turkiye’s labor costs and those in North Africa has pushed companies toward Egypt and Morocco, where wages and investment costs are lower.

Egypt has attracted nearly $3 billion in Turkish investment, with roughly 200 Turkish textile factories relocating by early 2025. This trend led to the loss of over 300,000 jobs in Türkiye in April.

Among the notable investments:

Taken together, these business voices reflect a consistent and long-standing message: Türkiye needs a policy reset that emphasizes rule-based governance, cost competitiveness, and international credibility. While their remarks predate the latest central bank decision, the policy continuity has made those concerns even more relevant.

At the same time, the combination of rising input costs, weak domestic demand, and a suppressed exchange rate has significantly undermined the competitiveness of Turkish manufacturers in global markets. Labor-intensive sectors such as textiles, apparel, and machinery—which traditionally played a central role in Türkiye’s export performance—have seen profit margins eroded and pricing power weakened.

Exporters, manufacturers, and trade organizations agree that unless Türkiye recalibrates its macroeconomic strategy to support real-sector growth, the country risks deepening industrial contraction, rising unemployment, and diminishing foreign trade performance at a critical juncture for its economy.