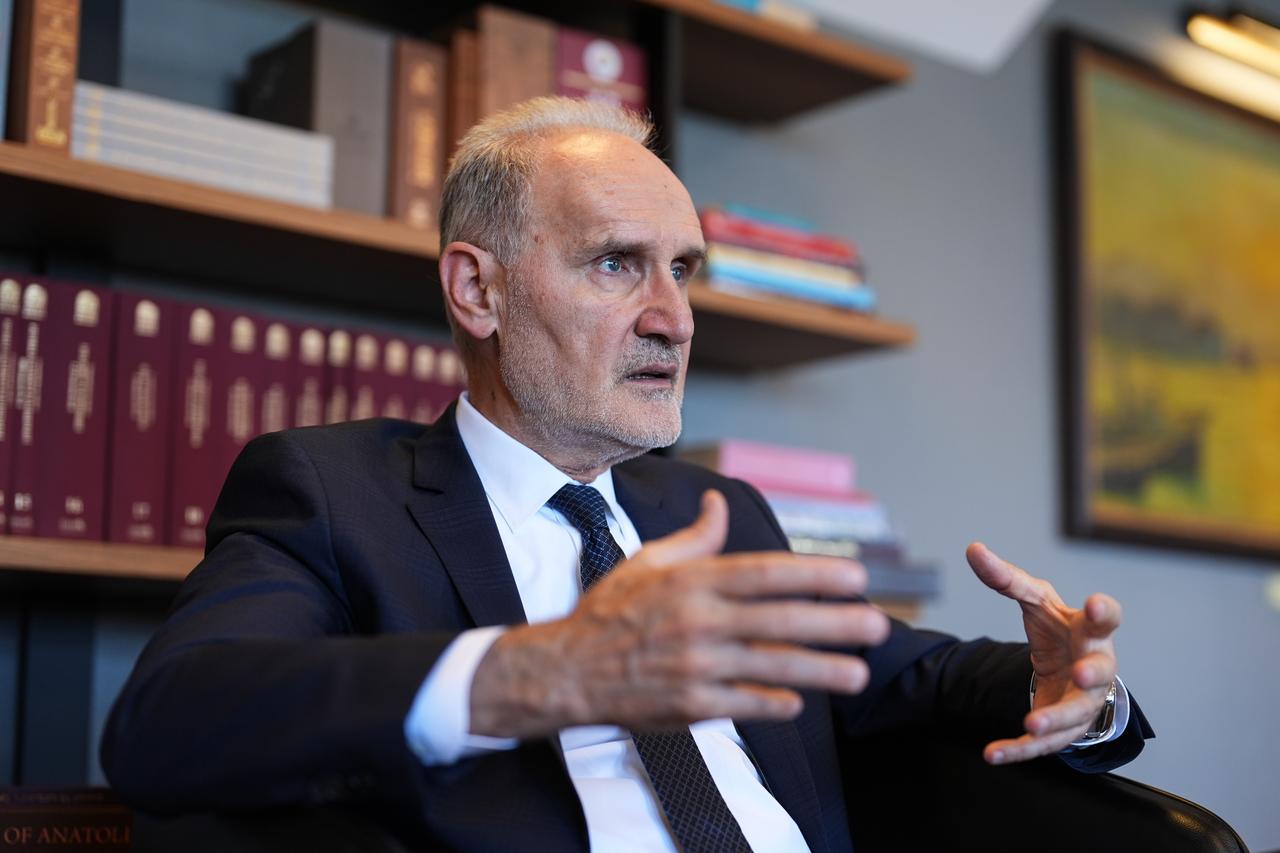

Sekib Avdagic, head of the Istanbul Chamber of Commerce (ICOC), has called for urgent economic measures to restore Türkiye’s investment capacity and export competitiveness, warning that current monetary policies are placing an unsustainable burden on the business sector.

Speaking to Anadolu Agency, Avdagic emphasized that Türkiye needs to reduce financing costs, improve access to credit, and preserve the correlation between exchange rates and inflation. “We have the strength to overcome all these challenges,” he said. “But we must swiftly implement a policy framework that will boost Türkiye’s investment capacity and gradually resolve the export difficulties we are facing.”

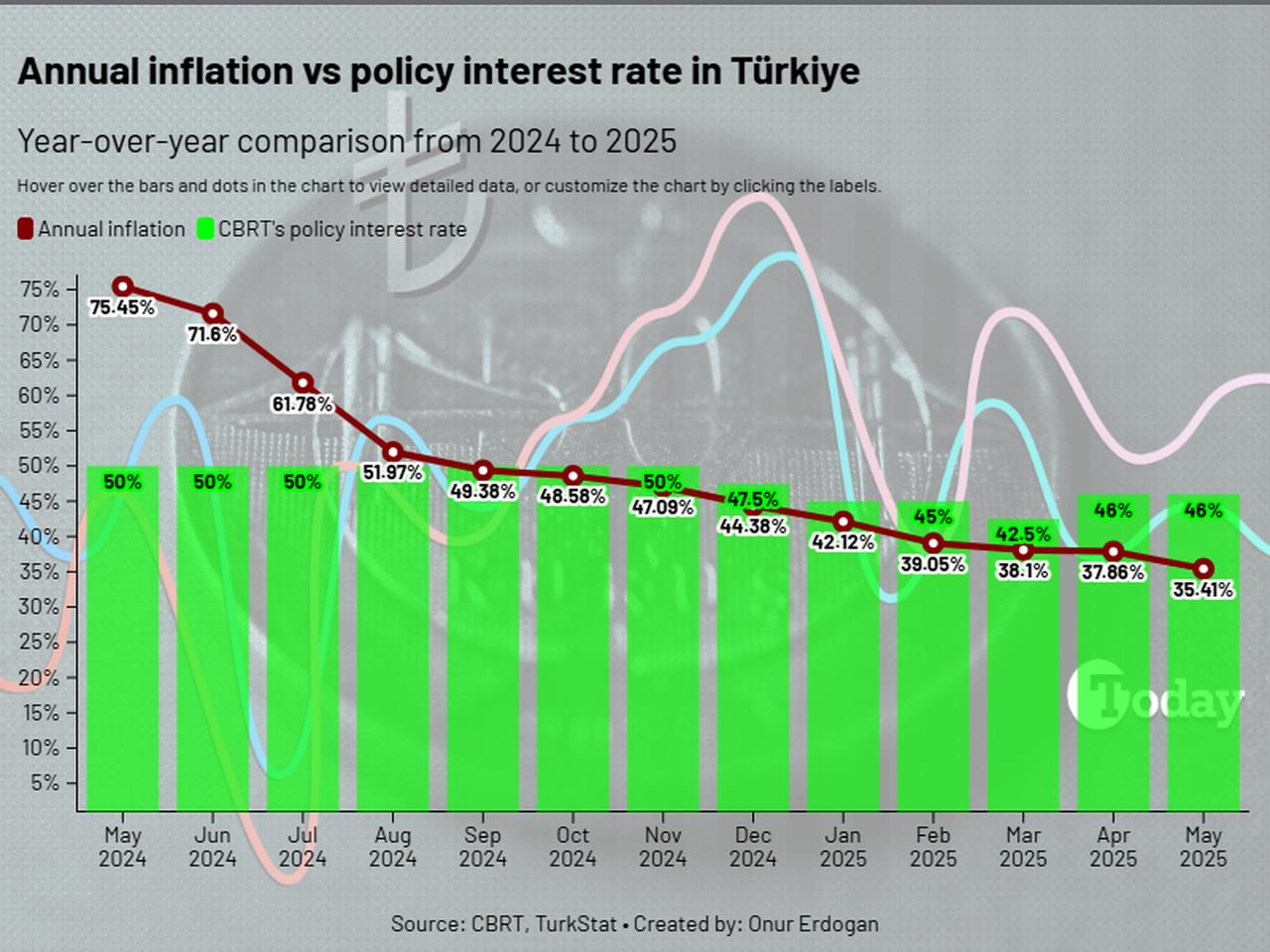

In May, Türkiye's inflation rate dropped to 35.41%, and the Turkish central bank decided to keep the policy rate at 46%.

While supporting broader efforts to lower inflation, Avdagic questioned the current reliance on monetary tightening as the primary tool, noting that it disproportionately affects the business community. “Financing costs have risen significantly, while access to credit has become increasingly difficult,” he explained.

Avdagic warned that the overvaluation of the Turkish lira is harming producers and exporters while benefiting importers. “Last year, the exchange rate appreciated by around 18% to 19%, while inflation reached 45% and wages rose by about 50%,” he said. “That created a 30% to 35% gap that the business world had to navigate. It’s extremely difficult to operate under such a wide divergence between inflation and exchange rates in any country.”

As of the week ending June 13, the weighted average commercial loans in Türkiye were at 63.95%.

The ICOC president highlighted that both investment and export contributions to growth have turned negative, describing these figures as “serious warnings” for the coming period. “We must maintain Türkiye’s competitiveness at a reasonable level by increasing production,” he urged.

According to the Turkish Statistical Institute (TurkStat), Türkiye's economy grew by 2% in the first quarter of 2025, down from 3.2% in the previous quarter. Exports of goods and services fell by 0.01% year-over-year in volume terms, while imports rose by 3% during the same period.

While total exports have seen limited growth, Avdagic noted a clear contraction in many sub-sectors, especially labor-intensive industries. “Two-thirds of Türkiye’s sectors have reported a decline in exports,” he said. “We have become a financially expensive country. Our costs are higher than many of our global competitors, and our capacity to invest is weakening. All of these factors make sustainable exports harder to achieve.”

To address the situation, he repeated three critical proposals: “In the short term, we must reduce financing costs, expand credit access, and maintain the correlation between exchange rates and inflation.”

Commenting on President Recep Tayyip Erdogan’s recent announcement to increase the “Investment-Linked Advance Credit” program to ₺500 billion ($12.58 billion) for medium- and high-tech sectors, Avdagic called the decision “very important and valuable.”

He explained that the program offers interest rates between 15% and 30%, depending on the investor profile, and called for swift and investor-friendly implementation. “It’s crucial to match this package with potential investors quickly and efficiently,” he said.

Avdagic noted that the share of high-tech products in Türkiye’s total exports has been shrinking for the past two years. “We must increase both the number of investors and production capacity in medium- and high-tech products,” he added. “This should be done in the short and medium term if we want to raise their share in total exports.”

Avdagic emphasized the need for Türkiye to consistently grow exports faster than imports to correct a long-standing structural imbalance. “We need to break the 150-year pattern of exporting less than we import,” he said. “We are clearly in a period where imports have become more attractive, and exports have become more challenging. This requires urgent steps to facilitate both goods and services exports.”

He also stressed the need to take the current geopolitical risks into account. “In light of the ongoing war in Ukraine, escalating tensions between Israel and Iran, and the humanitarian crisis in Gaza, Türkiye must maintain its economic stability,” he said. “This makes it even more important to take into consideration the expectations of the business community.”

Avdagic concluded by underscoring the importance of Türkiye continuing its proactive role in Syria. “Türkiye must become Syria’s key partner—not only in political terms, but also in the country’s economic recovery,” he said. “This requires constant support, regular policy updates, and impact assessments. All institutions must act in a coordinated and proactive way to ensure this.”