President Recep Tayyip Erdogan announced on Wednesday that Türkiye has increased the limit of its investment-focused credit scheme by 70%, raising it to ₺500 billion (approximately $12.65 billion as of June 18) from ₺300 billion. The initiative aims to support manufacturers, exporters, and producers amid ongoing economic adjustments.

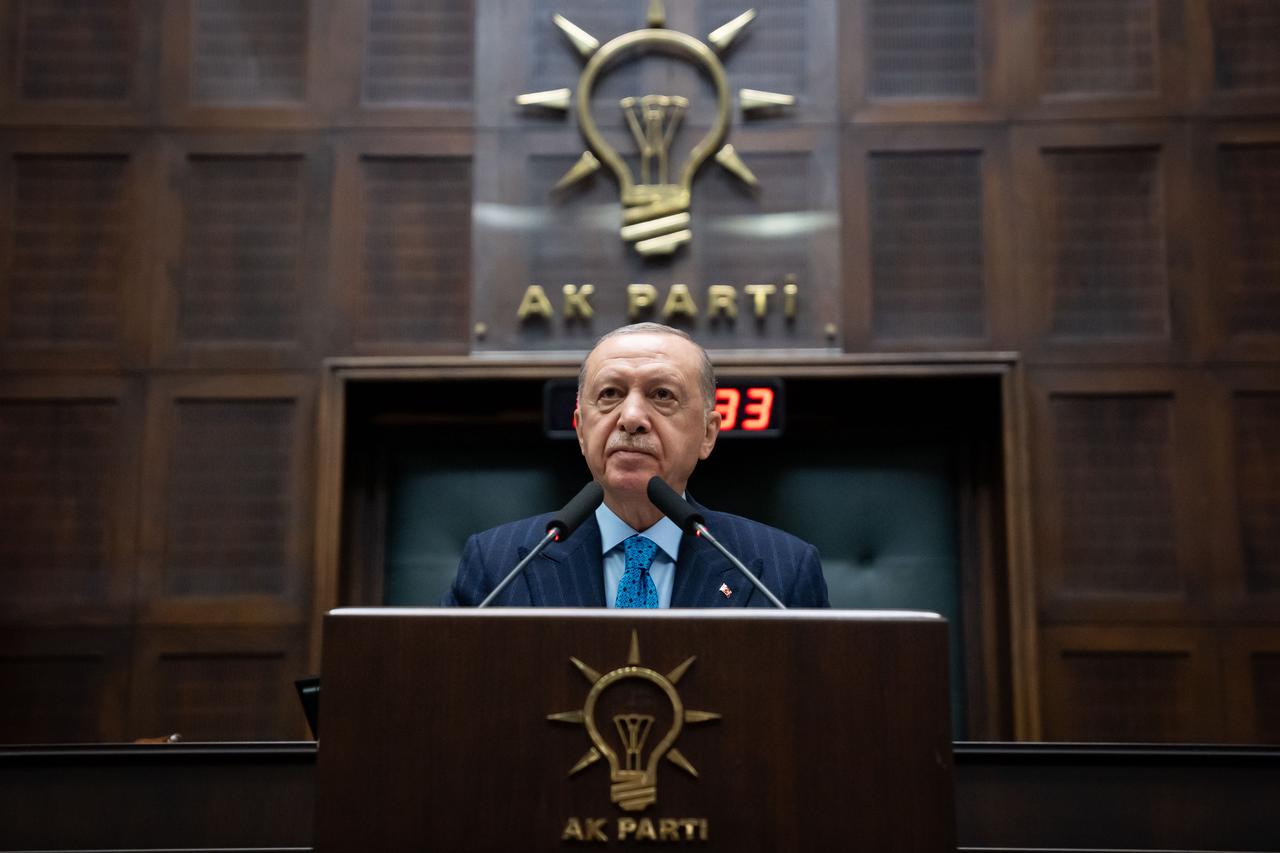

Erdogan’s remarks came during the Justice and Development Party's (AK Party) weekly parliamentary meeting, just one day before the Turkish central bank's monetary policy meeting on Thursday at 2 p.m. local time (GMT+3), where the policy rate is expected to remain unchanged at 46%.

Operated through intermediary banks, the Investment Commitment Advance Loan (YTAK) program was introduced by the Central Bank of the Republic of Türkiye (CBRT) in 2023 to finance investment projects with strategic or technological value. Eligible projects must involve a minimum investment of ₺1 billion and are evaluated based on technology and strategy criteria.

The scheme offers loans with maturities of up to 10 years, including a two-year grace period. In its initial phase, the CBRT allocated ₺300 billion over three years, with an annual ceiling of ₺100 billion.

The program plays a vital role for Turkish businesses facing tight liquidity conditions, as the average interest rate on commercial banking loans reached 64.88% as of June 6.

Similarly, in his earlier remarks on May 23, during his return from Hungary, Erdogan announced plans to reactivate the Credit Guarantee Fund (CGF) to support businesses, particularly small and medium-sized exporters (SMEs). Aligned with this plan, the Treasury and Finance Ministry is preparing to roll out a ₺30 billion loan package specifically targeting manufacturing SMEs.

Addressing broader economic goals, Erdogan reaffirmed the government’s commitment to controlling inflation, expressing confidence that these efforts would enhance citizens’ purchasing power and living standards. "As we gain ground in the fight against inflation, we will raise the purchasing power and living standards of all 86 million people," he said.

Türkiye's inflation dropped to 35.41% in May, far better than the market expectations, official figures showed.

He also stressed the importance of reducing the current account deficit and ensuring price stability, adding that the government will boost support for investments aligned with these priorities.