The Central Bank of the Republic of Türkiye (CBRT) has clarified that it has no plans to issue new Turkish lira banknotes with higher denominations and that no such move is under consideration, even though the recent period of high inflation has eroded the value of existing notes.

In an official written response to Türkiye Today, the CBRT stated that the issuance of any new banknote denomination is determined based on macroeconomic and financial analyses as well as technical evaluations.

The bank added that changes in the composition of banknotes in circulation and developments in non-cash payment instruments and methods in Türkiye are being closely monitored within this framework.

"At present, the Bank has no ongoing work toward issuing a new banknote denomination," it concluded.

Türkiye currently has six Turkish lira banknote denominations in use—₺5, ₺10, ₺20, ₺50, ₺100, and the highest, ₺200 ($4.78).

The Turkish central bank’s dismissal of new Turkish lira denominations comes amid the currency’s steep deterioration in recent years, particularly since November 2019, when double-digit inflation began and has continued uninterrupted through September 2025.

As of September 2025, inflation has eroded 87% of the Turkish lira’s value, while consumer prices have risen by 670.1% since November 2019.

This essentially means that at least ₺1,540 is now needed to purchase the same basket of goods that cost ₺200 at the time — or that more than seven ₺200 banknotes are now required to cover the same expenses.

According to the Confederation of Turkish Trade Unions (Turk-Is), the amount required to cover monthly basic food needs rose to ₺27,090 in September—equivalent to more than 135 ₺200 banknotes, compared to just 10 in November 2019.

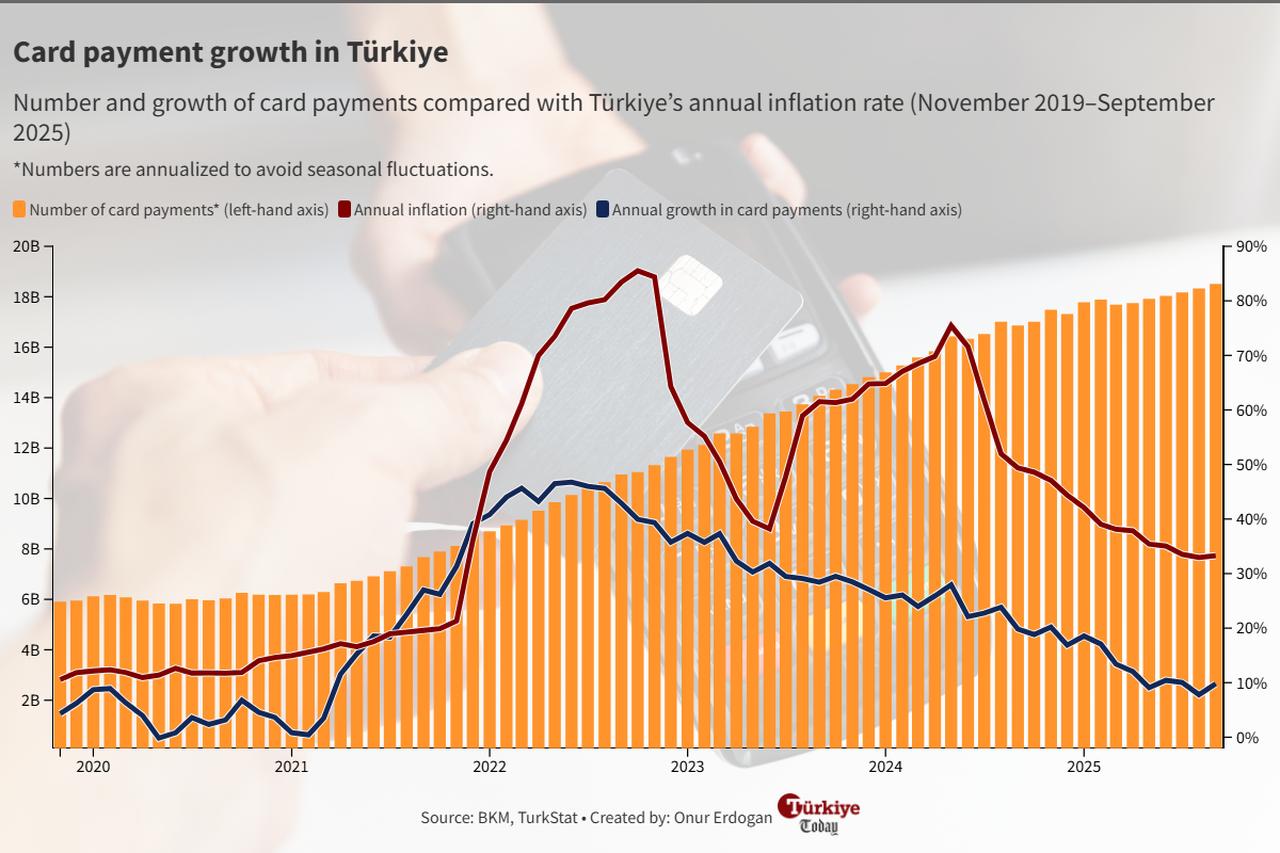

The situation has made it increasingly difficult to sustain daily transactions through physical cash, which has been reflected in the rising frequency of credit and debit card use among citizens. According to Türkiye’s Interbank Card Center, the total number of payments made by debit and credit cards reached 18.5 billion on an annualized basis in September, up 213% from 5.91 billion recorded in November 2019. The total value of transactions also surged by 2,076% to ₺20.2 trillion ($495.0 billion) from ₺928.24 billion ($161.7 billion).

The number of debit and credit cards likewise expanded by 76.9% to 354.61 million from 200.5 million, meaning that each person aged 15 and over now holds an average of about five cards.

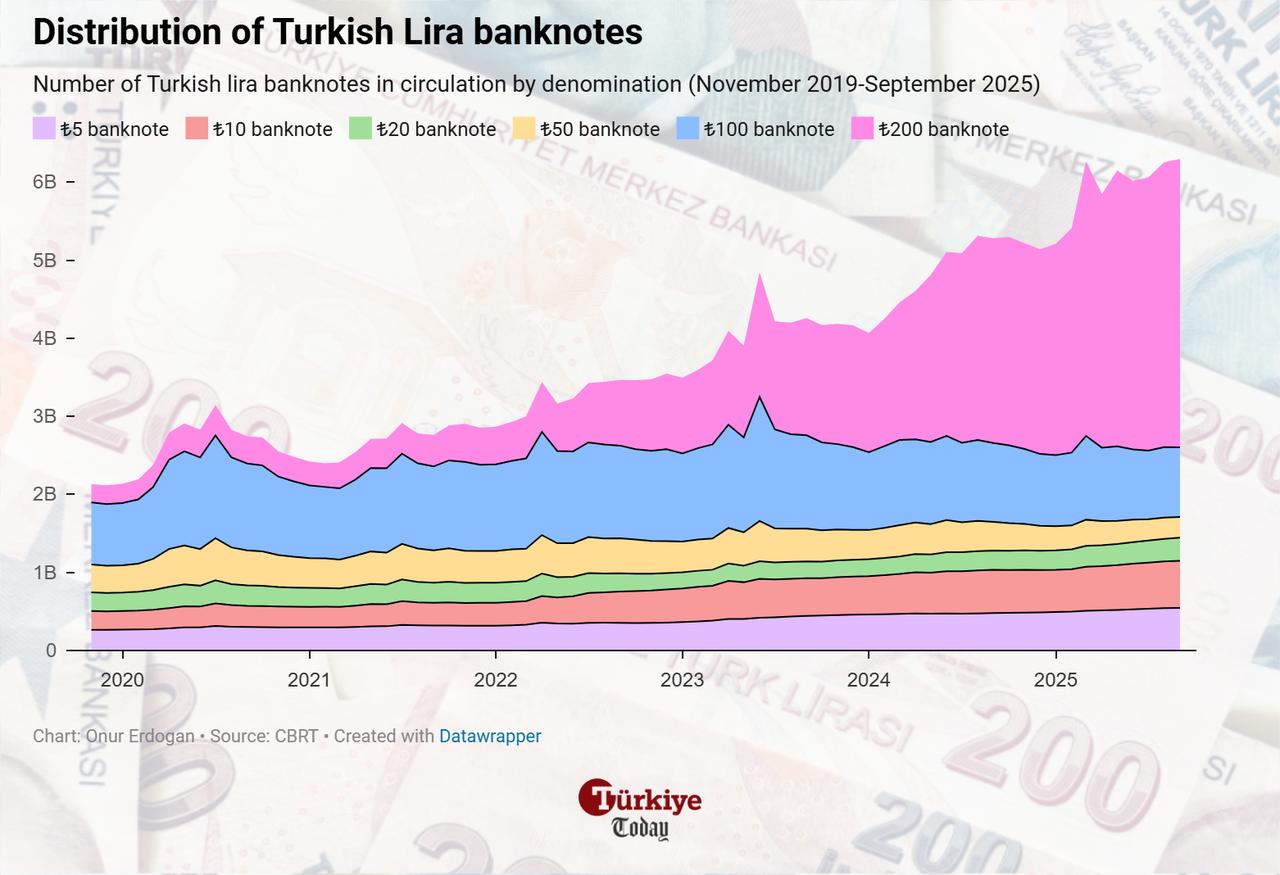

The impact of the lira’s deterioration and the growing need for higher-value banknotes are also reflected in the composition of Turkish currency in circulation.

The ₺200 note, which accounted for only 10.9% of all Turkish lira banknotes in circulation in November 2019, has increased its share to 58.7% as of September 2025, becoming both the most valuable and the most widely circulated denomination.

According to data from the Central Bank of the Republic of Türkiye (CBRT), as of September 2025, a total of 6.29 billion Turkish lira banknotes are in circulation, of which 3.69 billion are ₺200 notes—the only denomination exceeding one billion units.

Since November 2019, the total number of banknotes in circulation has increased by 195.5%, driven mainly by the expansion of ₺200 notes, whose volume has surged by 1,490%, while other denominations have remained nearly unchanged.

The ₺100 note, the second-highest denomination, follows ₺200 in circulation with 891.08 million units, marking an increase of only 12% over the same period.

Among the lower-denomination banknotes, the ₺10 and ₺5 notes have the largest shares, with 603.46 million and 546.69 million units, respectively, representing increases of 151.8% and 104.9% and accounting for 9.5% and 8.6% of total banknotes in circulation.

In contrast, the ₺50 note is the only mid-denomination bill to have declined in volume, falling by 25.4% to 265.72 million units and now representing just 4.2% of total circulation.

Türkiye has maintained the same Turkish lira denominations since 2005, when a major currency reform removed six zeros, converting ₺1 million to ₺1 after decades of chronic inflation had eased to single-digit levels, lifting the Turkish lira from its status as one of the least valuable currencies in the world.

The overhaul also simplified the banknote structure, reducing the number of denominations from 15 to 5, and was designed to restore confidence in the national currency and facilitate financial transactions, strengthening Türkiye’s transition to a more stable monetary framework under the name "New Turkish Lira."

In 2009, a Cabinet decision removed the word "New" from Turkish lira banknotes and introduced new designs, while the ₺1 banknote was replaced by a coin and a new ₺200 note was added instead.

Since then, the composition of the denominations has remained unchanged.

Debates over the need for higher-denomination banknotes have intensified in recent years against this backdrop, with many arguing that soaring prices have sharply eroded the purchasing power of existing notes, making everyday cash transactions cumbersome and increasingly impractical for both consumers and the financial system.

In 2021, particularly after inflation hit a record 85.5% in October, many economists predicted that the Turkish central bank would issue new banknotes denominated in ₺500 and ₺1,000.

However, then–Central Bank Governor Sahap Kavcioglu dismissed speculation that preparations were underway to issue new banknotes.

Similarly, after a return to orthodox policies in 2023, questions were raised to the new Central Bank Governor Hafize Gaye Erkan, who echoed the same view, arguing that developments between 2009 and 2021 were consistent with projections and confirmed the accuracy of the current denomination structure.

After Erkan, current Central Bank Governor Fatih Karahan also rejected such speculation in 2024, citing the development of digital and card payment systems and stating that there are no ongoing preparations for new banknote denominations.

In recent years, the Treasury and Finance Ministry has intensified its campaign against unregistered cash transactions through tighter financial monitoring and the expansion of digital payment infrastructure.

Promoting card and electronic payments—now used for the majority of retail transactions—is viewed as a key tool to increase transparency and tax compliance.

According to Ernst & Young’s 2025 report, Türkiye’s shadow economy, also referred to as the unregistered economy, accounted for 16.1% of its gross domestic product (GDP), or about $179 billion, while the government’s fiscal losses were estimated at between $33 billion and $44 billion.

Issuing larger banknotes, policymakers apparently believe, could undermine these efforts by encouraging cash-based activity and weakening oversight.

Higher-denomination banknotes are also seen as a factor that could fuel public perceptions of persistent inflation and undermine confidence in the currency’s value, according to former CBRT economist Ugur Gurses.

In a blog post challenging Erkan’s remarks, Gurses noted that during the previous inflationary period between 1970 and 2004, Türkiye ended up issuing banknotes with multiple zeros and million-valued bills out of necessity, as there were 15 different denominations in circulation before the 2005 currency reform.

"The cycle of ‘money is losing value; let’s shop before prices rise’ is still remembered by an older generation," Gurses wrote, however, adding that there is a need for higher-denomination banknotes to reflect the realities of the Turkish lira’s current value.

Since the founding of the Republic in 1923, Türkiye has issued nine emission groups of Turkish lira banknotes with varying denominations, most notably in response to needs arising after periods of high inflation.

Over the decades, the designs and denominations have changed several times, yet the cycle of high inflation has continued to haunt the country despite occasional interruptions.