Türkiye's disinflation process remains on track, with both short-term indicators and the broader economic outlook pointing to continued moderation in price growth, Central Bank of the Republic of Türkiye (CBRT) Governor Fatih Karahan said on Friday.

Speaking at the High Advisory Council meeting of the Turkish Industry and Business Association (TUSIAD) in Ankara, a day after the latest Monetary Policy Committee (MPC) meeting, Karahan reaffirmed the central bank’s commitment to maintaining a tight monetary policy until lasting price stability is achieved.

"Our top priority is price stability," he said, adding that "the progress we have made toward this objective is meaningful." He stressed that this policy stance would be sustained to ensure the permanence of recent disinflation trends.

Central bank policymakers decided on Thursday to go with another rate cut at the last MPC meeting of the year, lowering the policy rate by 150 basis points to 38%. Thus, the total amount that the current easing cycle has delivered since it was ushered in July reached 800 basis points.

The decision came following November's far better-than-expected inflation figures, which came in the lowest since mid-2023 on a monthly basis at 0.87%, bringing the headline inflation down to 31.07%.

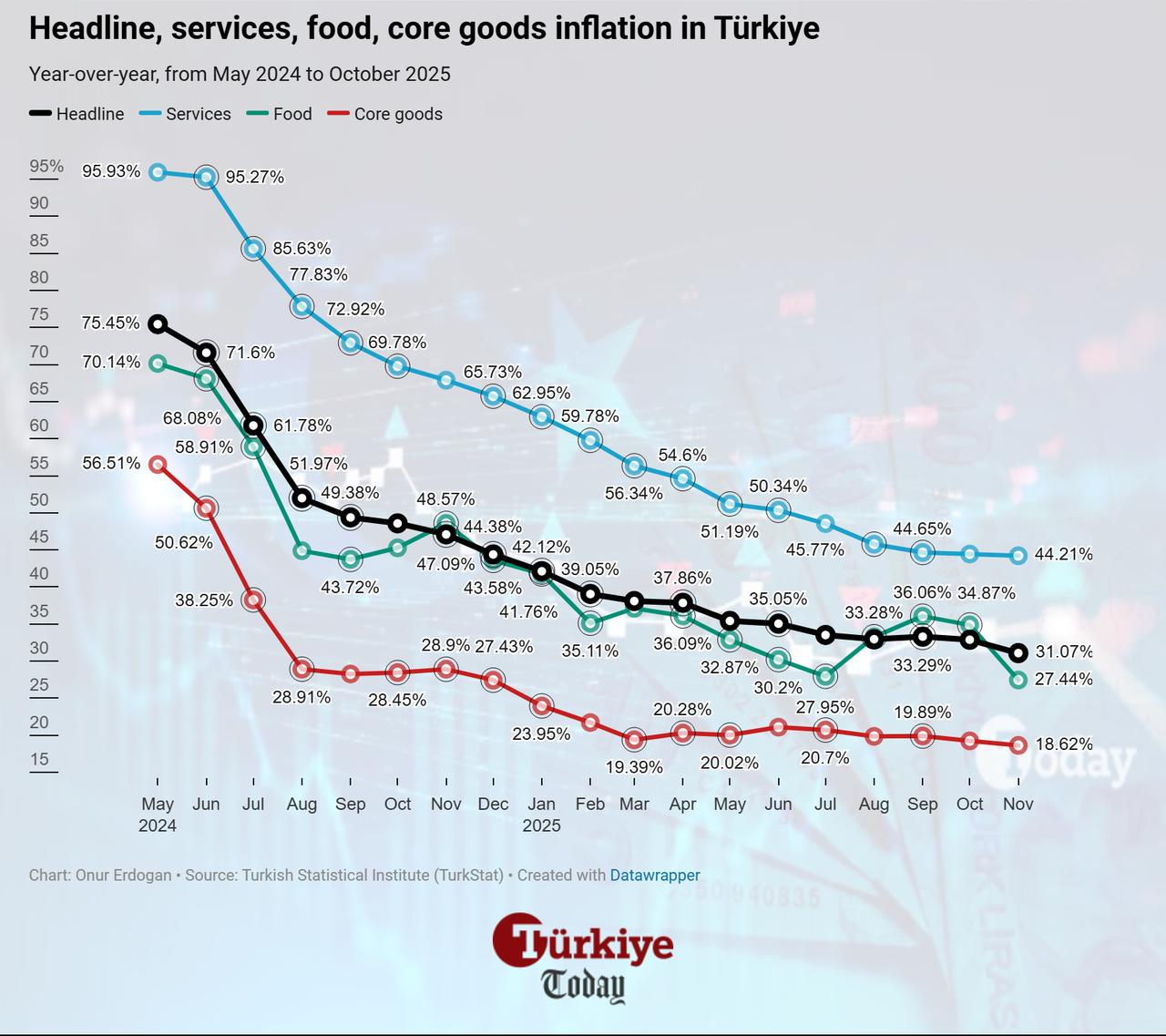

Regarding the outlook, Karahan outlined a sharp decline in headline inflation, which fell from 64% in late 2023 and attributed the drop to three driving factors, including rebalancing in domestic demand, normalization in pricing behavior, and improved inflation expectations.

By category, Karahan highlighted that core goods inflation fell below 19%, while food prices dropped to 27% despite persistent volatility. Services inflation, although still elevated at 44%, declined from its May 2024 peak. From that point onward, inflation in core goods fell by 38 percentage points, in food by 43 points, and in services by 52 points.

Cost-side pressures also showed signs of easing, he emphasized, noting that producer price inflation dropped by 30 percentage points since May 2024, reaching 27% in November. In the services sector, producer inflation fell from 85% in May to 35%, marking a 50-point decline.

Karahan said that this downward trend in input costs was beginning to ease inflationary pressures more broadly. "Recent data show that cost-driven inflation pressures have subsided," he assessed.

While short-term market rates remain closely tied to the central bank’s benchmark policy rate, Karahan stressed that long-term lending rates are more influenced by inflation expectations and uncertainty. He explained that institutions issuing long-term credit price risk based on future inflation rather than the central policy rate alone, so shifts in the policy rate may not immediately translate to market borrowing costs.

Nevertheless, Karahan projected that as inflation continues to decline and confidence in price stability strengthens, credit maturities would likely lengthen over time.

Karahan reaffirmed the bank’s data-driven and cautious approach to future rate decisions, stating that each move would depend on the evolving inflation outlook. He noted that the policy stance would be tightened further if there is a "clear deviation" from interim inflation targets.

"Price stability is a prerequisite for sustainable growth and shared prosperity," he said. "We will do whatever is necessary to ensure this."