Consumer price growth in Türkiye came in better than expected in November, with monthly inflation slowing to 0.87%, the lowest since May 2023, and the annual rate falling to 31.07%, the Turkish Statistical Institute (TurkStat) reported on Wednesday.

Market participants had expected a 1.59% monthly increase, according to the Central Bank of the Republic of Türkiye’s (CBRT) latest survey, pointing to a decline in the annual rate to 32.02%.

The more-than-expected slowdown in inflation, now at its lowest level since November 2021, is likely to boost rate cut expectations, previously centered around 100 basis points before the inflation reading, as it gives policymakers some relief in deciding the pace of monetary easing.

Among 143 main expenditure items tracked in the Consumer Prices Index (CPI), prices fell in 28, remained unchanged in seven, and increased in 108 categories in November.

The three main spending groups with the highest weights in Türkiye’s consumer price index saw varied movements in November.

Food and non-alcoholic beverages posted a monthly decline of 0.69%, while still recording an annual increase of 27.44%. Transport costs rose 1.78% month-on-month, bringing the year-on-year rise to 29.23%, and housing prices increased 1.70% on the month, with a 49.92% annual gain.

Among the expenditure groups, recreation and culture recorded the highest increase in November at 3.33%, followed by alcoholic beverages and housing. Food prices, which had been the main driver of inflationary pressures in previous months and a key factor slowing the disinflation path, fell by 0.69% during the month, bringing the annual rate down to 27.44%.

Meanwhile, the domestic producer price index (D-PPI) rose 0.84% month-on-month, lifting the annual rate to 27.23%. Prices in mining and quarrying came in at 1.77% monthly, bringing the annual rate to 32.6%; in manufacturing, 1.17% monthly, with an annual rate of 27.04%; in electricity and gas production and distribution, prices fell 3.1% on the month, while the annual rate stood at 24.92%; and in water supply, prices rose 2.02% monthly, lifting the annual rate to 57.62%.

Commenting on the figures in his post on X, Treasury and Finance Minister Mehmet Simsek stressed that monthly inflation had slowed to its lowest level in two and a half years, adding that the government expects this moderation to continue into December.

He pointed to the normalization of food prices, previously well above trend during August to October, as a key contributor to the easing in price pressures.

Simsek also laid out key drivers expected to support the disinflation process over the medium term, particularly by 2026, reaffirming commitment to tight monetary and fiscal policy, improved financial stability, moderate global commodity prices, and rule-based pricing frameworks—especially in education.

"We will continue to implement our program, which prioritizes price stability, with determination," Simsek said.

He emphasized that tax adjustments and administered price increases would be aligned with inflation targets and fiscal capacity, while ongoing supply-side reforms in food, housing, and energy are expected to reinforce the disinflation process.

Meanwhile, local brokerage firms pointed to expanded monetary policy space for the central bank and a likely continuation of positive momentum in equity markets, particularly in banking, construction, and industrial stocks.

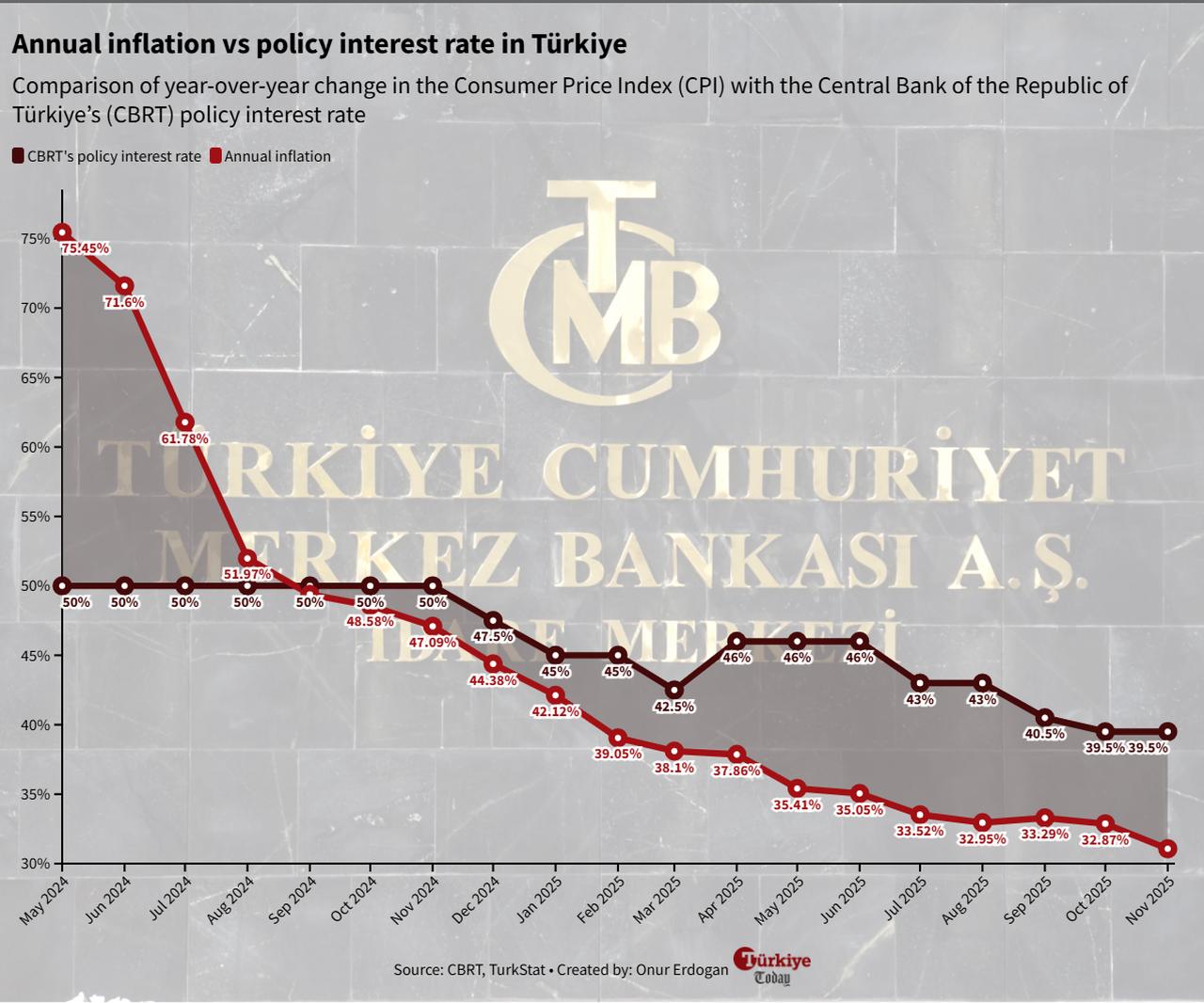

With November’s inflation figures, the gap between the Central Bank of the Republic of Türkiye’s (CBRT) policy rate and headline inflation widened to approximately 8.5 percentage points, boosting expectations for a larger rate cut at the next Monetary Policy Committee (MPC) meeting on Dec. 11, where policymakers will decide on the continuation of the easing cycle that began in July. In October, the central bank reduced the size of the rate cut to 100 basis points due to an uptick in the annual inflation rate in September.

Alnus Yatirim described the inflation data as supportive for Turkish lira assets and anticipated positive pricing in specific sectors if no external or domestic shocks emerge before the next monetary policy meeting. "If the CBRT cuts rates by at least 150 basis points next Thursday, the recovery attempt in equities may remain effective in the short term unless new headwinds appear," it added.

Kuveyt Turk's brokerage arm said the inflation outcome came in well below both their internal and market-wide expectations, which increases the central bank’s policy flexibility ahead of its December 11 rate decision. "In this context, we expect the CBRT to cut the policy rate by 200 basis points to 37.5% at the meeting," the firm said.

Trive Yatirim took a more definitive stance, suggesting that a rate cut in December is now all but certain given the inflation surprise, and said expectations have shifted toward a larger 200 basis point move. "With the monthly CPI figure coming in well below forecasts, it’s safe to say that a December rate cut by the CBRT is now confirmed," Trive said.

"Previously, the consensus was leaning toward a 150 bp cut, but a revision to 200 bp now appears reasonable. A cycle of low inflation, a satisfactory disinflation process, and continued rate cuts could mark a return to an upward cycle in equities."