This article was originally written for Türkiye Today’s weekly economy newsletter, Turkish Economy in Brief, in its Dec. 8 issue. Please make sure you are subscribed to the newsletter by clicking here.

The Turkish market is entering the final month of 2025 on an active note. Most notably, last week, the Turkish Statistical Institute (TurkStat) announced November inflation. Monthly Consumer Price Index (CPI) came in at 0.87%, below expectations. Following this development, expectations for a rate cut at the Central Bank of the Republic of Türkiye (CBRT)’s Monetary Policy Committee (MPC) meeting on Dec. 11 have increased.

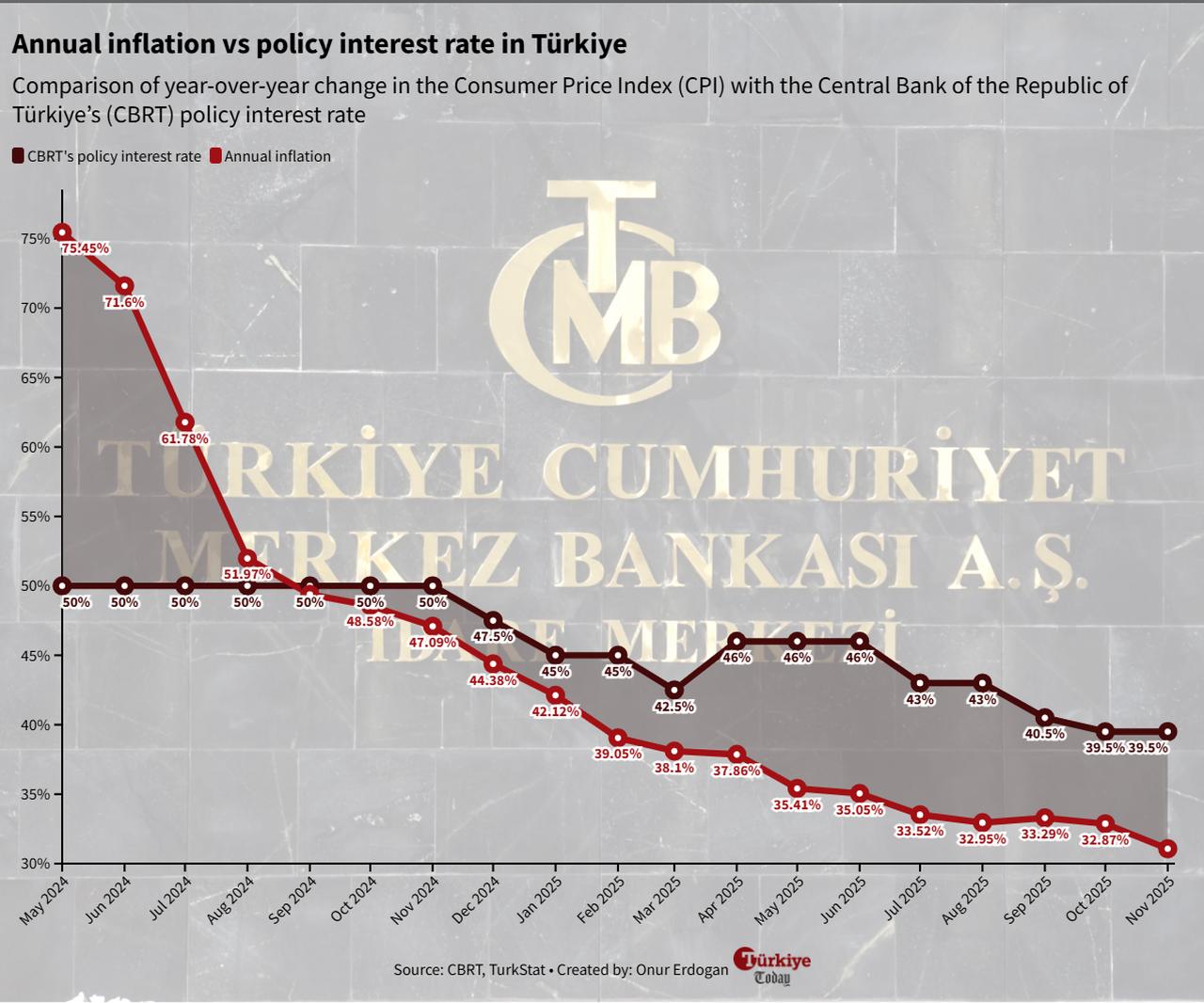

To recall the numbers: annual inflation in Türkiye fell to 31.07%, while the CBRT’s policy rate is at 39.50%. This 8.50-point gap indicates a high real yield, creating room for a rate cut.

On the other hand, one of December’s key topics is the minimum wage. It has not yet been determined, but various figures are being discussed. The prevailing estimate suggests an increase of around 20–25%. Additionally, considering the price hikes applied to administered and regulated prices at the start of each year, we are approaching a period where inflationary pressures may temporarily rise.

Therefore, the CBRT will take its decision ahead of the minimum wage adjustment and new-year price hikes. As such, a cautious rate cut is also a possibility.

Even in the case of a 200-basis point cut, the real interest rate gap would narrow only to 6.5 points, maintaining a tight monetary policy stance.

In the Market Participants Survey conducted by the CBRT in November, the policy rate was forecasted to average 38.28% for this month.

A report by Alnus Yatirim stated that the CBRT’s position was strengthened after the release of November CPI data. The analysis noted, “We think the Central Bank will cut the policy rate by 150 basis points with a cautious approach in this meeting. Meanwhile, the November CPI data improved our year-end inflation forecast. We revise our projection from 32.32% to 31.37%.”

A report from Gedik Investment pointed to rising expectations for rate cuts, noting: “Without seeing the minimum wage adjustment and critical January inflation data, we think the CBRT could maintain a cautious stance and proceed with 100–150 basis point cuts.”

Kutay Gozgor, Head of Research at Kuwait Turk Investment, said the decline in services inflation remains slow, but the outlook on the industrial side and the improvement in headline inflation provide a rational basis for a rate cut.

Forecasting a 200-basis point cut, Gozgor argued that such a step would maintain positive real interest rates and allow the degree of policy tightness to be adjusted without compromising the inflation fight.

As for market reaction: the BIST 100 Index on Borsa Istanbul ended last week up 1%, closing at 11,007 points. During the week, the index tested a high of 11,201, moving toward the highest levels in the past nine weeks. However, despite "supportive developments," it failed to break the resistance level of 11,250 seen since September.

It’s also worth noting the tensions in the Black Sea. As U.S.-backed ceasefire efforts in the Russia-Ukraine war remain unresolved, attacks on commercial vessels have rekindled geopolitical tensions. While markets had started to price in a potential ceasefire, uncertainty remains, and developments in this strategically important region must be closely monitored.