Türkiye’s central bank raised its medium-term inflation forecast path while keeping its official year-end targets unchanged in its first Inflation Report of 2026, Governor Fatih Karahan announced on Thursday, citing updated risk factors and recent price data behind the revised ranges.

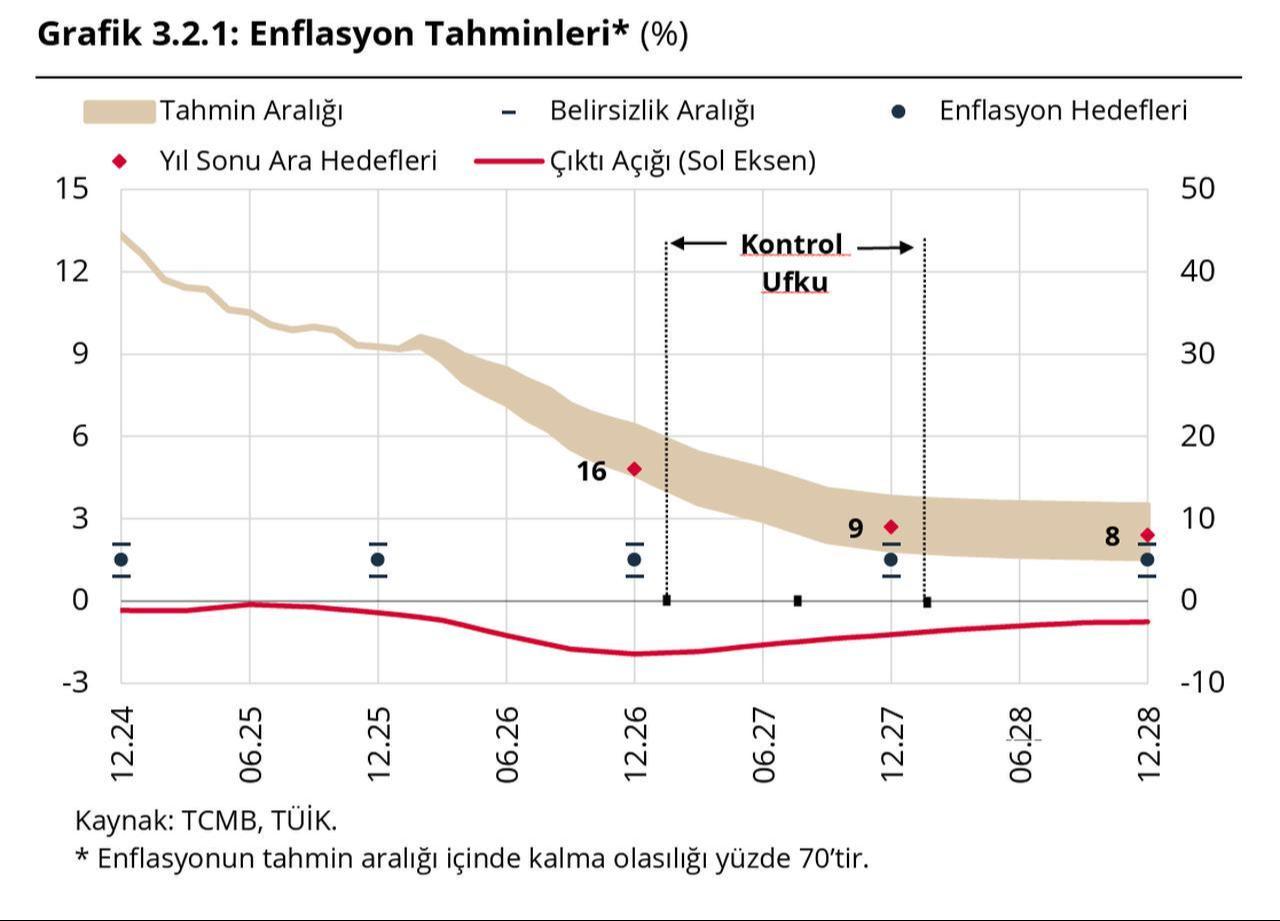

Karahan said the bank moved its inflation projection bands higher to 15%–21% for 2026, up from the previous 13%–19% range, and set the 2027 forecast band at 6%–12%, while maintaining the same year-end targets of 16% for 2026 and 9% for 2027. After declining to 8% in 2028, inflation is projected to stabilize around 5% in the medium term.

"We revised the inflation forecast range upward due to a combination of risks," Karahan said, pointing to a recent acceleration in prices, with January inflation at 4.84% month-on-month, which brought the annual rate down to 30.65%.

Karahan added that the forecast band revision reflected clearer risk factors, updated assumptions on import and commodity prices, and a higher weight of services in the consumer price index basket under the Turkish Statistical Institute’s revised calculation method.

The bank reported that annual consumer inflation continued to ease, falling 2.2 percentage points from the previous reporting period as of January, although monthly momentum picked up due to food and services-related pricing behavior.

Food prices showed sharp, weather-driven swings, with vegetable prices reversing earlier declines, according to the report, which added that part of the upward pressure is expected to ease in the second quarter as supply conditions normalize.

Karahan also said food price pressures are expected to continue in February, adding that preliminary data indicates the annual inflation rate may edge up at a limited pace during the month. He stressed that it is important to see March and April data before making a firmer assessment of the trend.

The central bank chief said headline volatility should not be overinterpreted when driven by specific components. "When we look at the underlying breakdown, we do not think the inflation outlook is that negative. If adverse readings come from highly volatile items such as food, there is no need to panic," he asserted.

He also signaled caution on the pace of additional rate moves, noting that current conditions do not justify larger near-term steps. "Given the current inflation outlook, our targets, demand conditions and expectations, we assess that the threshold for increasing the step size in the short term is relatively high," Karahan said.

In its previous meeting, the Monetary Policy Committee (MPC) extended the easing cycle that began in July but struck a cautious tone, delivering a 100 basis point rate cut that lowered the policy rate to 37%, below market expectations of a 150 basis point reduction.

"We will maintain our tight monetary policy stance until price stability is achieved," he reiterated, adding that the bank is ready to act if the inflation outlook worsens.

The next Monetary Policy Committee (MPC) meeting will be held on Mar. 12.