This article was originally written for Türkiye Today’s weekly economy newsletter, Turkish Economy in Brief, in its Feb. 9 issue. Please make sure you are subscribed to the newsletter by clicking here.

After the minimum wage hike at the start of 2026 and a series of price increases across different sectors, January’s inflation data was highly anticipated by the markets.

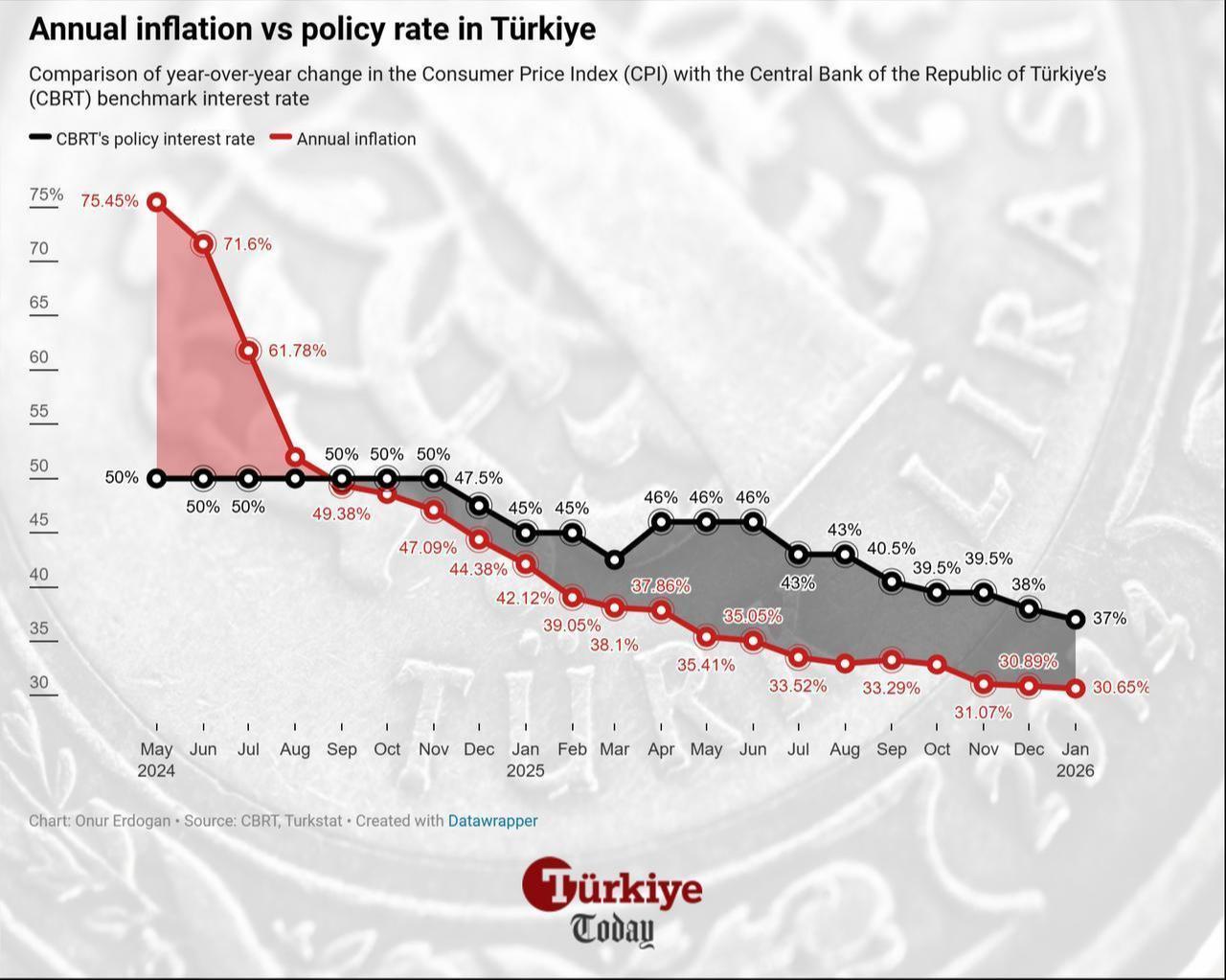

Last week, the numbers were released. According to official statistics, monthly inflation in January came in at 4.84%, while annual inflation reached 30.65%.

Markets had expected monthly inflation to be around 4.2%. The higher-than-expected figure strengthened the view that the central bank may keep its cautious stance for a while longer.

At the start of the new year, investors in Turkish markets have been positioning around a scenario of falling inflation and interest rates. That core scenario has not, but the January data added some uncertainty.

Earlier measures, like gradually tightening credit card limits, have returned to focus, along with other steps to curb inflation.

Looking at market reactions, the BIST 100 index fell 2.29% last week and closed at 13,522 points, ending a five-week rally that had been marked by consecutive record highs.

Fluctuating risk appetite in major global markets, especially in the U.S., concerns around AI and software stocks, and sharp moves in crypto and precious metals appear to have contributed to profit-taking in the BIST 100.

The index had been trading near peak levels.

Attention now turns to the Turkish central bank next week. The bank will release its first Inflation Report of the year on Feb. 12 in Istanbul. Its year-end 2026 inflation forecast range currently stands between 13% and 19%. The updated projections and the messages delivered by Governor Fatih Karahan will be closely watched by the markets.

The central bank typically does not revise its year-end forecasts in the first inflation report of the year.

After the higher January inflation reading, no revision is expected this time either. Still, the report may send a clear signal that even if the rate-cutting trend continues, it will likely proceed in more measured and controlled steps.