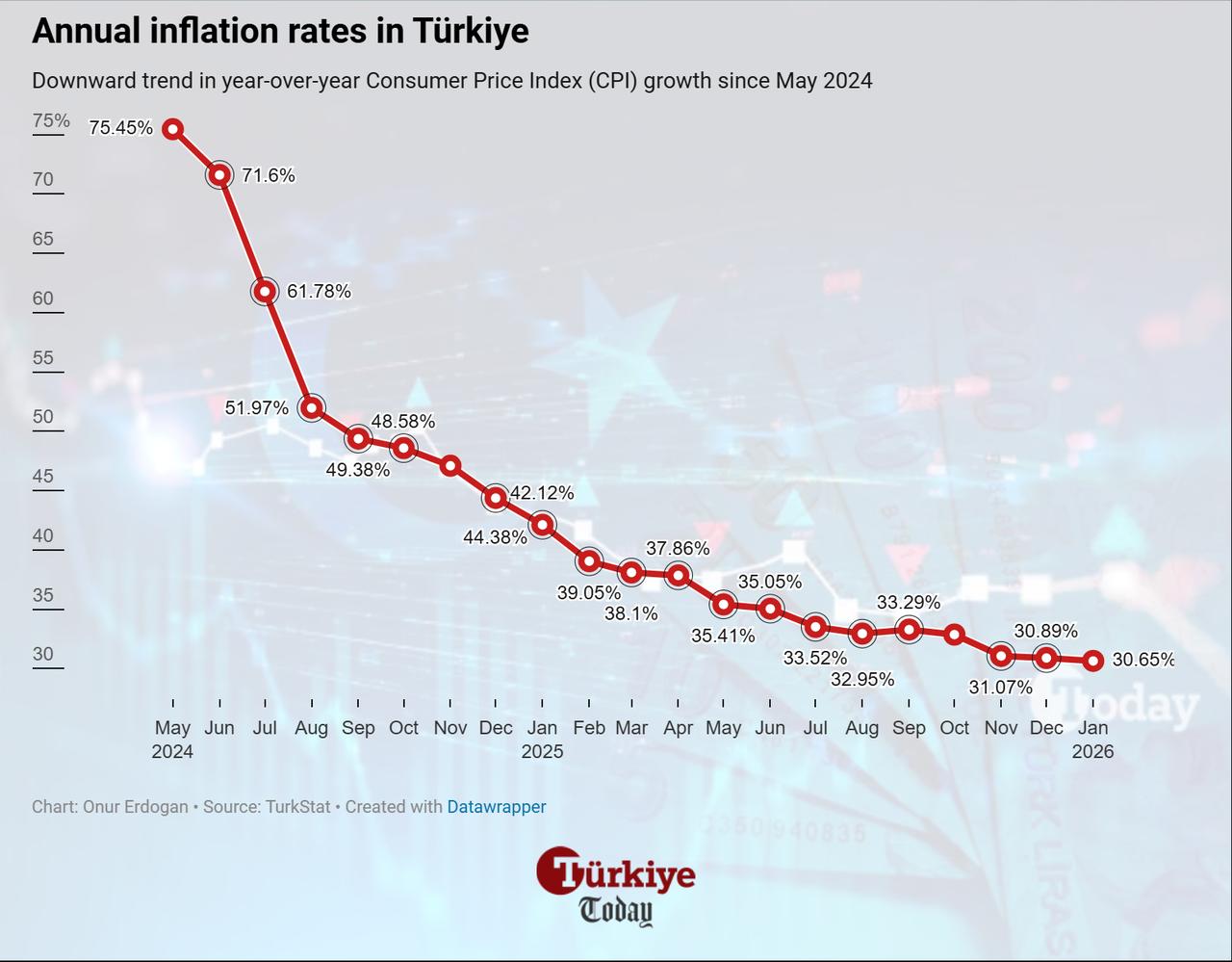

Türkiye’s monthly inflation was recorded at 4.84% in January, driven by new year cost hikes and rising food prices, while the annual rate eased to 30.65%.

Although the annual rate extended its four-month downtrend, the figure still beat expectations at 4.2% monthly and 29.9% year-on-year, data from the Turkish Statistical Institute (TurkStat) showed on Tuesday.

The figures build on subdued prints from November and December, both below 1% monthly, which gave central bank policymakers more room to continue their easing cycle.

In January, Türkiye’s top spending categories, food, transport, and housing, rose 6.59%, 5.29%, and 4.43% month-on-month, bringing annual rates to 31.69%, 29.39%, and 45.36%.

Other notable increases came from services, with health, insurance, and education rising 14.85%, 10.82%, and 6.61%, respectively, partly due to New Year wage adjustments.

Clothing and footwear was the only group to decline, falling 4.66% from the previous month.

Core inflation, which excludes food, energy, alcohol, tobacco, and gold, stood at 4.55% monthly and 29.80% annually.

The data also reflects the first release under a new methodology, with Türkiye shifting the CPI base year to 2025=100 and updating the inflation basket for 2026.

On the producer side, the domestic producer price index (D-PPI) rose 2.67% in January, pushing the annual rate to 27.17%, with the steepest monthly gains recorded in other manufactured goods at 9.23%, metal ores at 7.8%, and printing services at 7.32%.

While the bond market reacted mildly to the data, with Türkiye’s 2-year treasury yields rising to 34.65%, the benchmark BIST 100 index defied the pressure, climbing over 2% intraday to reach a new record of 13,926.55 points.

Despite exceeding market expectations due to seasonal price fluctuations, the figures appear broadly aligned with the Central Bank of the Republic of Türkiye’s (CBRT) projections.

During an investor meeting in early January, CBRT Governor Fatih Karahan said preliminary data suggested potential volatility in January and February, mainly driven by seasonal factors in food supply, indicating a cautious stance in the ongoing rate-cut cycle.

Following Karahan’s remarks, policymakers delivered a 100 basis point cut at the Monetary Policy Committee (MPC) meeting, below market expectations of 150 basis points, bringing the policy rate to 37%.

In the summary of the meeting, the central bank emphasized that while the disinflation process was on track, it noted that consumer price growth remained influenced by seasonal and supply-side factors, particularly in food and services, which had firmed in January even as the underlying inflation trend showed limited upward pressure.

Assessing the release, Treasury and Finance Minister Mehmet Simsek said January inflation was mainly driven by food prices, well above long-term averages due to adverse weather conditions, and other seasonal factors. "We will continue our disinflation policies with determination, supported by supply-side measures," he stated.

The economy board set the end-2026 inflation target at 16% in the Medium Term Program, while the central bank’s latest inflation report assigned a 70% probability to the rate landing between 13% and 19%.