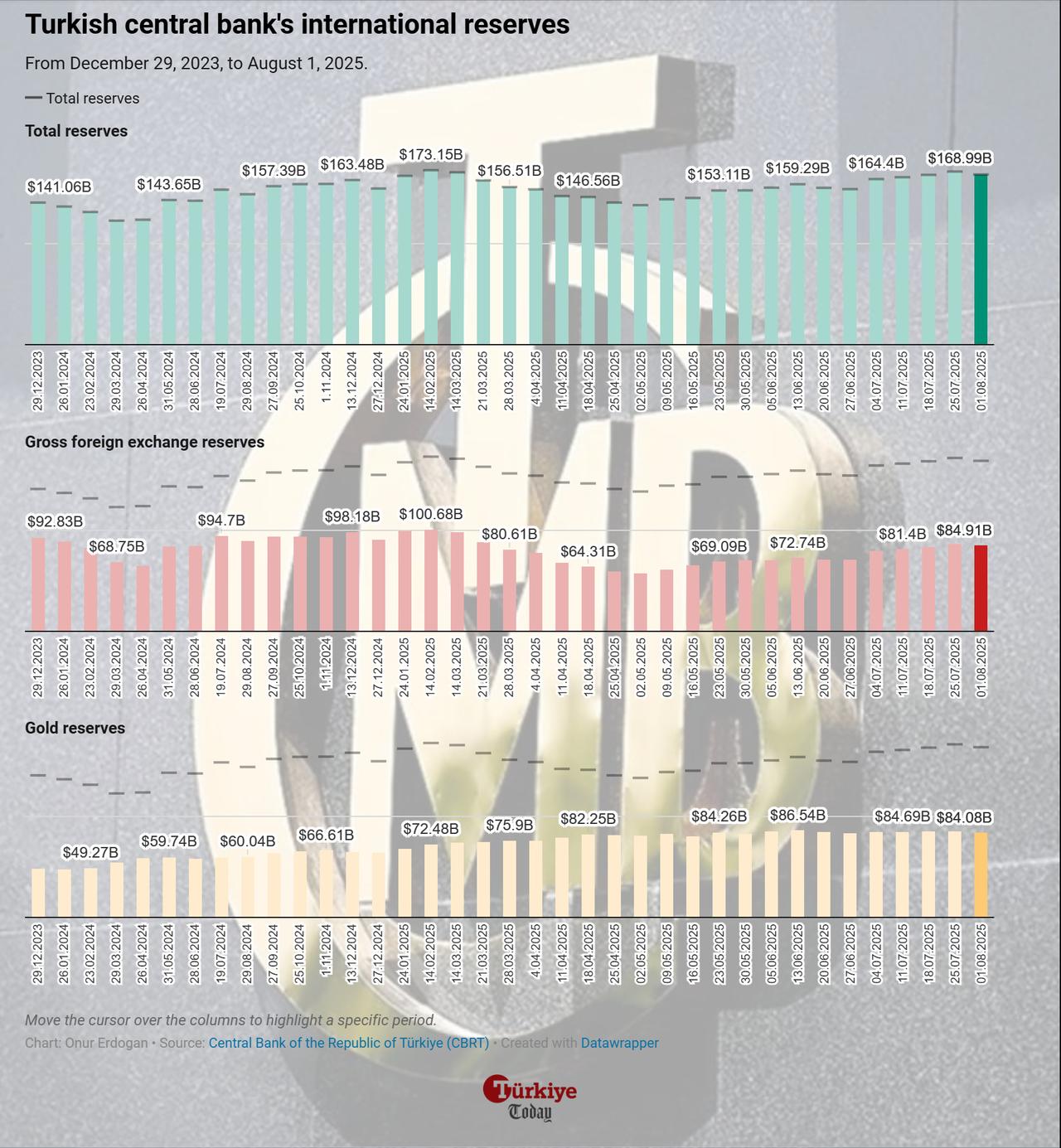

Türkiye’s total central bank reserves fell by nearly $2.9 billion in the week ending August 1, declining to $168.99 billion after rising for five consecutive weeks, according to the Central Bank of the Republic of Türkiye (CBRT).

In the previous week, total reserves stood at $171.85 billion.

The drop reflected a decrease in both foreign exchange and gold reserves. Gross foreign exchange reserves fell by $1.72 billion to $84.91 billion, while gold reserves decreased by $1.14 billion to $84.08 billion.

Net reserves excluding currency swaps also declined, from $46.7 billion to $45.6 billion during the same period.

Despite the decline in reserves, foreign investors continued to buy equities for a sixth straight week, though they posted net sales in domestic bonds. In the week ending August 1, non-resident investors purchased $135.5 million worth of equities, $8.8 million in government domestic debt securities (GDDS), and $61.2 million in non-government sector bonds.

The total stock of equities held by non-residents rose from $32.92 billion to $33.27 billion during the period.

Meanwhile, GDDS holdings dipped slightly from $14.31 billion to $14.28 billion, while non-government sector bond holdings climbed from $778.5 million to $836.9 million.

The banking sector’s total deposits decreased by ₺248.14 billion ($6.1 billion) during the week, falling from ₺24.74 trillion ($609.16 billion) to ₺24.49 trillion.

Lira-denominated deposits declined by 1% to ₺13.58 trillion, while foreign currency deposits dropped 1.4% to ₺7.77 trillion for the first time in three weeks. The total foreign currency deposits in the banking system amounted to $231.03 billion, of which $192.26 billion belonged to domestic residents.

When adjusted for exchange rate fluctuations, domestic residents’ foreign currency holdings declined by $1.83 billion during the week.

On the lending side, consumer credit continued to expand. Domestic residents’ consumer loans rose by 2.5% to ₺4.82 trillion. This figure includes ₺594.7 billion in housing loans, ₺56.25 billion in vehicle loans, ₺1.78 trillion in personal loans, and ₺2.38 trillion in credit card debt.

The overall loan volume in the banking sector, including the CBRT, increased by ₺137.49 billion, reaching ₺19.48 trillion as of August 1.