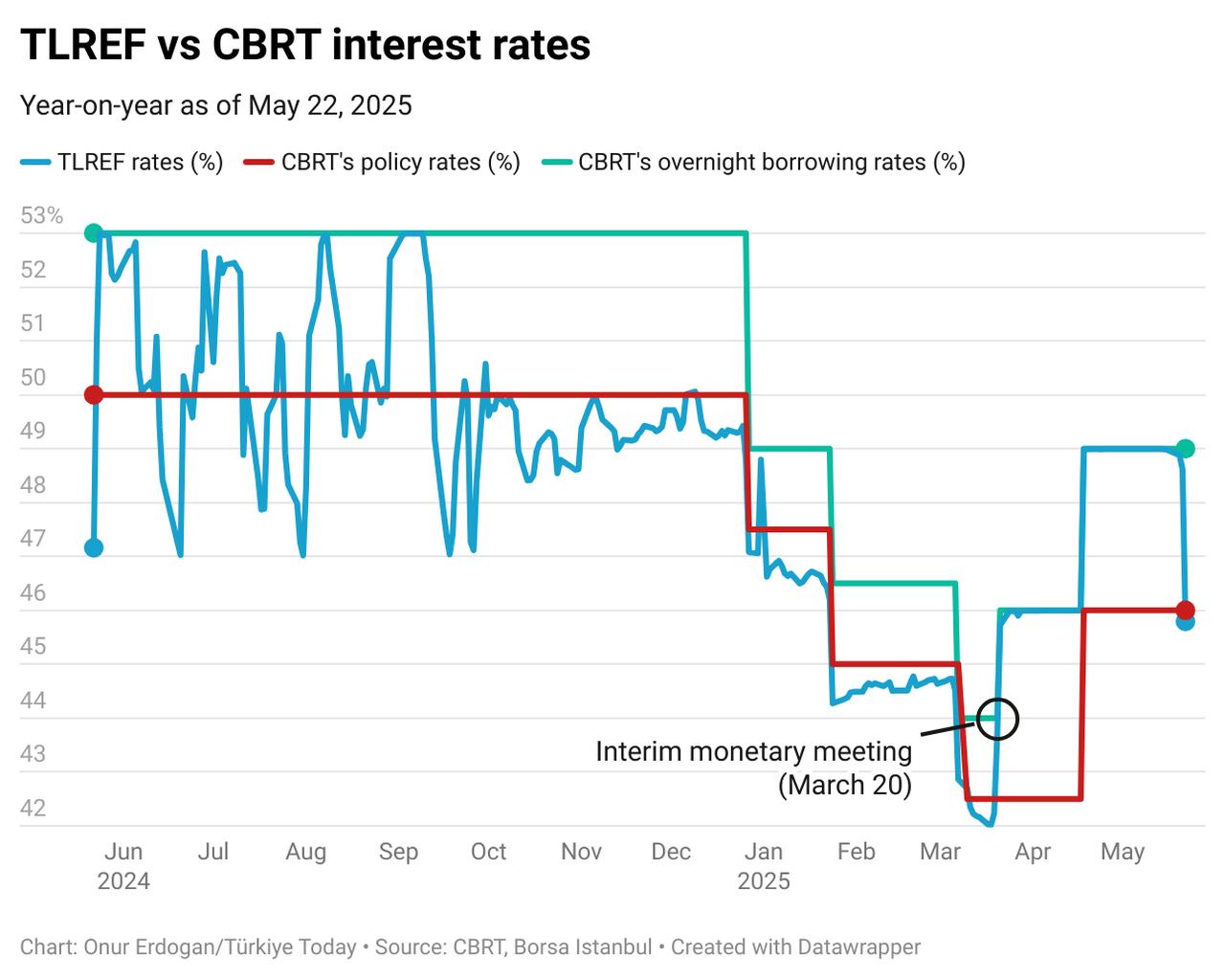

The Turkish lira overnight reference rate (TLREF), a key benchmark for short-term funding in Türkiye’s financial markets, declined sharply on Thursday following significant liquidity injections by the central bank. The rate dropped to 45.8%—down from 48.62% the previous day—marking its steepest single-day fall in recent weeks and the first time it has dipped below 46% since mid-April.

TLREF, or the Turkish lira overnight reference rate, serves as a benchmark for pricing a wide range of financial instruments in Türkiye, including bank loans, corporate bonds, and derivatives. It is comparable to global equivalents such as SOFR in the United States or ESTR in the eurozone and reflects prevailing short-term funding costs in the local money market.

As such, movements in TLREF offer valuable insight into liquidity conditions and monetary policy implementation. A lower TLREF generally indicates more abundant lira liquidity, reduced borrowing costs, and, potentially, a more accommodative environment for credit expansion for businesses.

The sharp decline in TLREF this week follows a notable increase in Turkish lira liquidity, triggered by recent foreign currency purchases by the Central Bank of the Republic of Türkiye (CBRT).

According to the central bank’s latest international reserves report, the CBRT’s net foreign exchange position improved by $2.8 billion as of May 16—driven in part by rising gold prices but primarily by direct market interventions. Total reserves climbed to $145.7 billion, up 0.9% from the previous week, while gold reserves fell to $80.3 billion.

By buying foreign currency and injecting lira into the market, the CBRT increased liquidity and made short-term funding more accessible. This additional supply helped push TLREF downward, reversing the elevated levels that had persisted since April 18, when the rate had hovered around 48.99% under the central bank’s tight monetary stance.

Currently, the upper limit of Türkiye’s interest rate corridor—the central bank’s overnight lending rate—stands at 49%. Until this week, TLREF had remained closely aligned with that ceiling. The recent drop in TLREF suggests a loosening of local funding conditions, though it may prove temporary, as the central bank continues to manage both liquidity and exchange rate stability.

At its upcoming Monetary Policy Committee (MPC) meeting, the CBRT is expected to keep the policy rate unchanged but may opt for indirect easing by shifting funding toward the 46% weekly repo rate—effectively delivering a three-point cut. While the impact on credit costs is expected to be more gradual, market observers increasingly believe the CBRT may soon signal a formal rate cut if credit access for the real sector continues to tighten. Mounting financing difficulties have heightened expectations that the bank will not remain on the sidelines much longer.

Meanwhile, during the presentation of the second inflation report of 2025 on Thursday, Governor Fatih Karahan emphasized that the tight monetary stance would remain in place until single-digit inflation is achieved. Karahan also stated that the bank has maintained its inflation forecast at 24% for 2025 and 12% for 2026.

The policy interest rate was raised to 46% following a surprise 350 basis-point hike in April, while Türkiye’s inflation eased to 37.86%, marking the 11th consecutive month of slowdown, though at a diminishing pace. The CBRT’s next MPC meeting is scheduled for June 19.